- Move Over, Aristocrats. Meet the Dividend Kings. (Barron’s)

- 5 Ultra-Safe Dividend Stocks to Buy Now as a Market Correction May Have Started (24/7 Wall Street)

- Look for Health Stocks to Stop Lagging, Start Leading (Wall Street Journal)

- Emerging-Market Investors Are Immune to New Covid Threat—for Now (Barron’s)

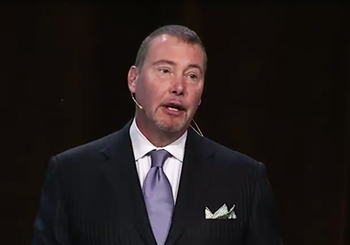

- Bond King Jeff Gundlach says there is a simple reason Treasury yields are so low even as inflation surges (MarketWatch)

- There’s a New Growth Area in Tech. Pay Attention to These Stocks. (Barron’s)

- Intel Is in Talks to Buy GlobalFoundries for $30 Billion: Report (Barron’s)

- A Chip Peak Like No Other (Wall Street Journal)

- Wall Street Opens Back Up to Oil and Gas—but Not for Drilling (Wall Street Journal)

- Fed’s Powell Concedes Anxiety About Higher Inflation but Resists Policy Shift (Wall Street Journal)

- TSMC Expects Auto-Chip Shortage to Abate This Quarter (Wall Street Journal)

- The U.S. Housing Market Is Losing Some of Its ‘Frenzy,’ as More Homes List for Sale (Wall Street Journal)

- As U.S. Home Prices Surge, American Buyers Set Their Sights on Europe (Wall Street Journal)

- As U.S. Home Prices Surge, American Buyers Set Their Sights on Europe (Wall Street Journal)

- The Reassuring Data on the Delta Variant (Wall Street Journal)

- Gain in U.S. Retail Sales Underscores Solid, Steady Consumer (Bloomberg)

- Citigroup Is Closing in on Peers in One Key Way (Wall Street Journal)

Be in the know. 17 key reads for Friday…