- China’s Mega Banks Cut Deposit Rates Further to Boost Growth (bloomberg)

- China Said to Approve First Boeing 787 Delivery Since 2021 (bloomberg)

- Why So Many People Got This Year’s Economy Wrong (bloomberg)

- Small-Cap Stocks Are Taking Off. Forget Big Tech. (barrons)

- Carnival’s stock surges after results beat expectations and outlook was upbeat, as cruise demand keeps strengthening (marketwatch)

- Gilead Stock Could Finally Have a Breakout Year. Here’s Why. (barrons)

- 6 Cheap Healthcare Stock Picks With Room to Grow in 2024 (barrons)

- US, China Militaries Restore Dialogue After a Dangerous Rupture (wsj)

- Meet the New Economy, Same as the Old Economy (wsj)

- US Initial Jobless Claims Tick Up, Remain Near Historic Lows (bloomberg)

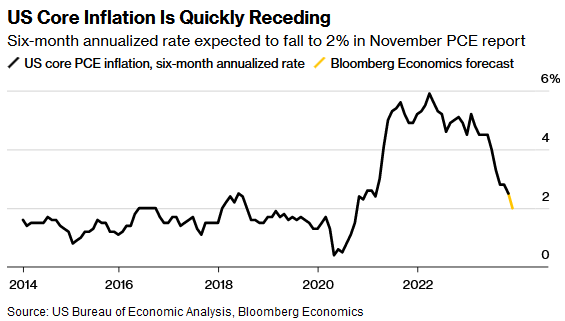

- US Inflation Report to Show Fed’s Battle Is Now All But Complete (bloomberg)

- Final Q3 GDP, Personal Consumption Revised Sharply Lower As Core PCE Slumped To 2.0% (zerohedge)

- Morgan Stanley’s Adam Jonas bullish on GM and Ford into 2024 (streetinsider)

- Why Matsusaka wagyu is the most expensive beef in the world (businessinsider)

- China stock market bulls aren’t just being contrarian (scmp)

- BABA Further Cuts Stake in XPENG by 50M Class A Shrs (aastocks)

- This Stock Market Indicator Has Been 83% Accurate Since 1984. It’s Signaling a Big Move in the S&P 500 Right Now. (fool)

Be in the know. 17 key reads for Thursday…