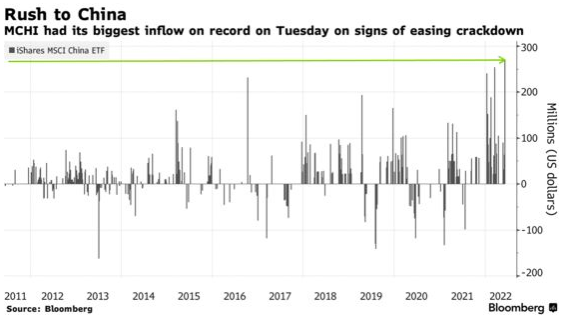

- A $7.2 Billion China ETF Just Added the Most Cash Since 2011 (bloomberg)

- Alibaba Stock Rallies as the Regulatory Picture Brightens. Is This Time Really Different? (barrons)

- China’s Stocks Are Cheap. Why It Could Be Time to Bargain Hunt. (barrons)

- New Obesity Drugs From Lilly and Novo Nordisk Generate Excitement (barron)

- Corporate America Is Making Deals Again. What That Means for the Stock Market. (barrons)

- The ECB Will Hike Rates in July. What It Means for the Global Economy. (barrons)

- Lumber Prices Are Falling With a Thud. (barrons)

- Avoiding Recession May Require Moving the Inflation Goal Post (barrons)

- China Weighs Reviving Jack Ma’s Ant IPO as Crackdown Eases (bloomberg)

- Alibaba’s cloud business unit brings new services to global NFT market (scmp)

- JPMorgan Strategists Say Equities Are Flashing a Bullish Signal (bloomberg)

- All About Mohammed bin Salman, the Prince at the Center of US-Saudi Reset (bloomberg)

- Ethereum just completed a successful dress rehearsal for its most important upgrade (cnbc)

- This chart explains why the US will avoid a recession, according to JPMorgan strategists (businessinsider)

- Hong Kong Internet Stocks Fly on Significant Volume Increase (chinalastnight)

Be in the know. 15 key reads for Thursday…