On Tuesday, I joined Liz Claman on Fox Business – the Claman Countdown – to discuss inflation. For those of you wondering what our new “auto-parts supplier” position was in the last few weeks, I broke it on Liz’s show (below). Thanks to Liz and Ellie Terrett for having me on:

Here were my Show Notes ahead of the segment:

YELLEN (BAD NEWS):

- Inflation at “unacceptable levels.” Expects it to remain.

- “Putin’s war in Ukraine is having impacts on energy and food prices globally.”

- Energy and gasoline prices would be higher without SPR release 1M bbl/day through Fall.

- MUST BOOST PRODUCTION OF RENEWABLE ENERGY.

- SAYS OIL PRODUCERS HAVE INCENTIVES NOW TO INCREASE PRODUCTION.

GOOD NEWS:

CHIPS

- ABOUT A THIRD OF U.S. INFLATION IS AS A RESULT OF NEW AND USED CARS, ALL DUE TO THE SHORTAGE OF SEMICONDUCTORS.

- Morgan Stanley (Adam Jonas) Note: 1) the long-lasting global auto chip shortage is edging closer to resolution. 2) TSM (which accounts for ~50% of global auto MCU production) has seen significant improvements through 1Q with wafer foundry auto semi output up approximately 60% YoY.

- This should result in lower used vehicle prices since “Used vehicle prices are still up over 60% vs. 2 years ago and only 6% off of all time high. Recovering new car supply/inventory can be a release valve for unprecedented new and used car price inflation.”

- Beaten-down Auto-Suppliers will be greatest beneficiaries (avg. light vehicle [car/SUV] age 12.1 yrs): BWA, MGA, CPS

OIL (will take time, BUT…):

- Oil is in BACKWARDATION: Cash $122.11, Nov ’23 $93.82, Nov ’24 $82.75

- Rig Count 727 vs. 244 pandemic low (792 pre-pandemic). Production coming back.

- Many Commodities Rolling Over: Wheat, Live Cattle, Cocoa, Lumber, Copper, Soybean Meal, Gold, Palladium prices dropping in recent weeks and mos.

- $20-$30/bbl war premium goes away with any resolution.

Other Inflation Factors:

- Biden Admin may drop tariffs on China Imports.

- Avg. hourly earnings came in lower than expected Fri.

- Labor Force Participation rate ticked up (more supply).

- Discounting on (categories) inventory build from companies like Target will be dis-inflationary.

- Retailers from WMT to Gap face a glut of inventory as shoppers skip categories that were popular during the pandemic. (Sweats and hoodies OUT, party dresses and high heels IN).

Friday

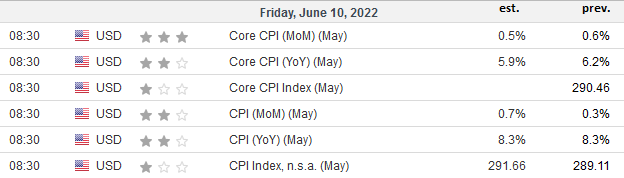

“PEAK INFLATION” NARRATIVE

- Starting to gain more traction with last month’s reads, but Friday will be key.

- Numbers may benefit (lower) from high “base effects” as May 2021 was highest m-o-m inflation jump. Should benefit Friday’s read.

- Any Summer Rally hinges on Friday’s numbers.

- Inflation Breakevens down from 3.59% to 3.05% in 2.5 mo. “Dovish Pivot” possible in Fall.

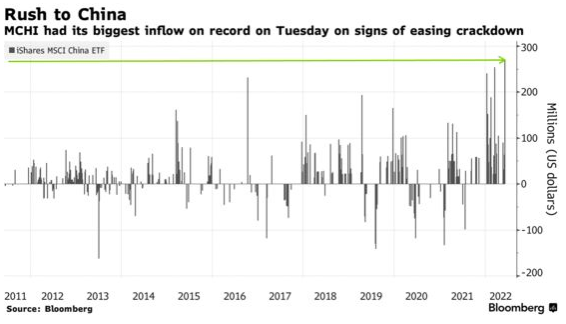

China

“Opinion Follows Tend…”

Now onto the shorter term view for the General Market:

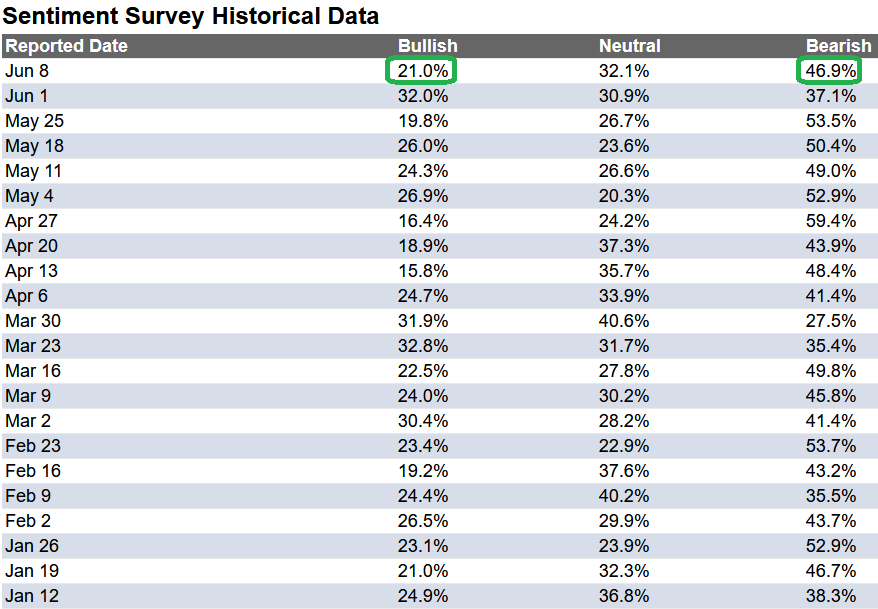

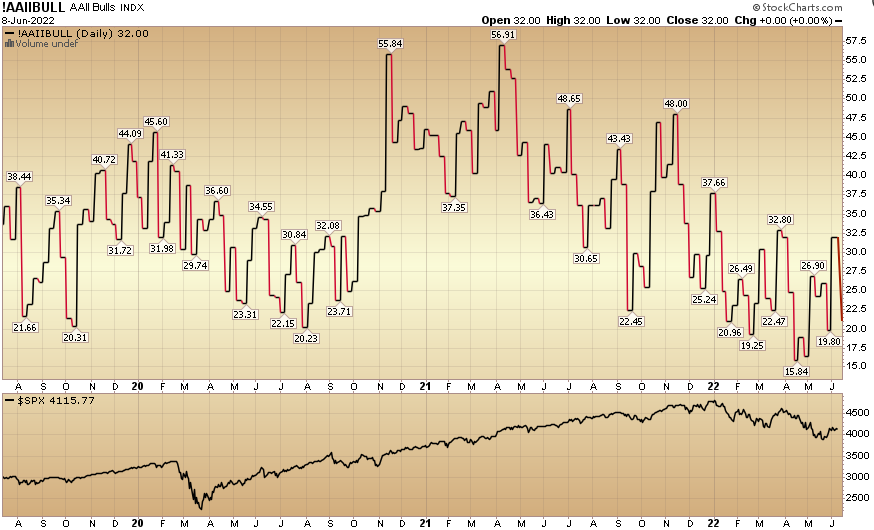

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) collapsed to 21% this week from 32% last week. Bearish Percent jumped to 46.9% from 37.1%. Retail investors are extremely fearful once again. These are ideal conditions for the market to climb the “wall of worry.”

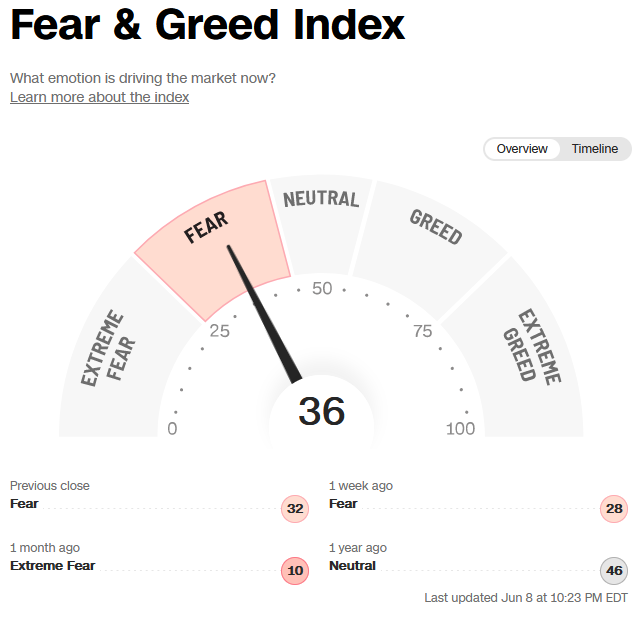

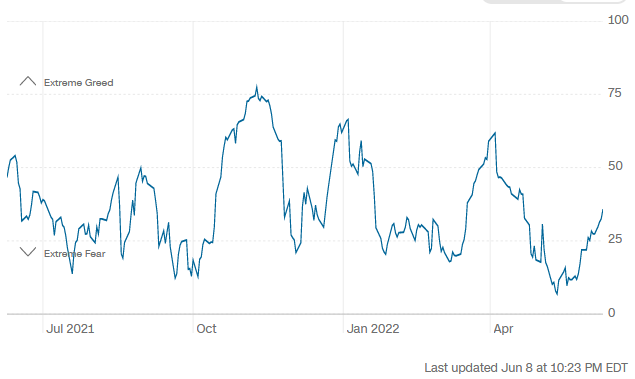

The CNN “Fear and Greed” rose from 26 last week to 36 this week. Sentiment is thawing in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

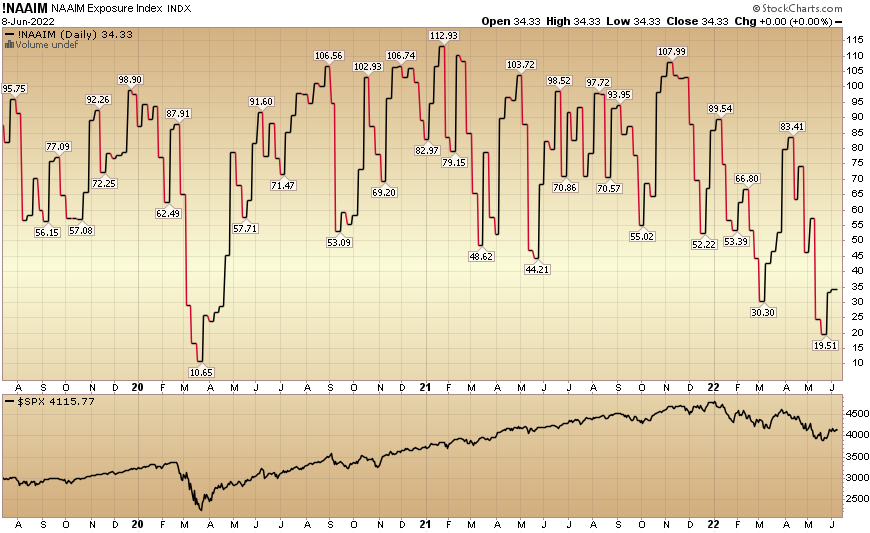

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 34.33% this week from 33.19% equity exposure last week. If Friday’s inflation numbers are decent, flat-footed managers will have to panic-buy into equities to play catch-up.

Our podcast|videocast will be out on Thursday or Friday this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.