- Apple Is Seeing a ‘Demand Rebound’ in China. Why It Matters. (barrons)

- China’s Top Online Travel Agent, Trip.com, Is Ready for Liftoff (wsj)

- International Stocks Lure Investors Seeking Bargains (wsj)

- Dear Fed, ‘Speak Loudly Because Your Stick Isn’t That Big Anymore’ (zerohedge)

- Powell Faces the House. Expect the Hawk Again. (barrons)

- THE WARREN QUESTION THAT INVESTORS HAVE TO TAKE SERIOUSLY (Joe Weisenthal)

- ADP Reports Wage Growth Slowing Despite Job Gains (zerohedge)

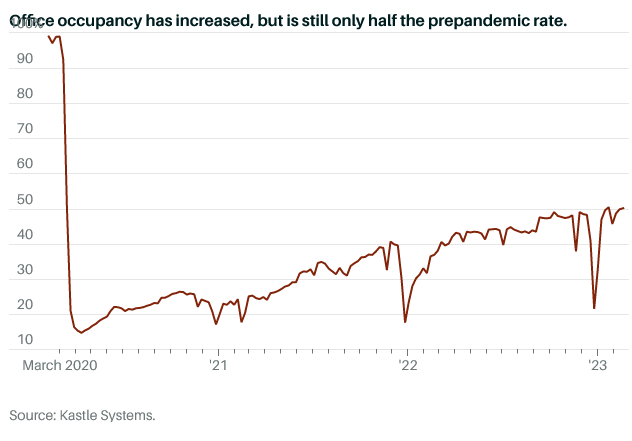

- Hybrid Work Is the New Norm. So Are Half-Full Buildings (barrons)

- Why financials may become the ‘new crowded’ sector after looming classification changes in stock market (marketwatch)

- ‘There’s a light at the end of the tunnel,’ despite high rents and inflation, says this economist (marketwatch)

- Jerome Powell Says Fed Is Prepared to Speed Up Interest-Rate Rises (wsj)

- Bars, Hotels and Restaurants Become the Economy’s Fastest-Growing Employers (wsj)

- U.S. to Ease Covid Testing Requirements for Travelers From China (wsj)

- Traders Burned by Stock Losses Are Pouring Billions Into Credit (bloomberg)

- They Swore the Ferrari Purosangue Would Never Exist. It Does, and It Howls (bloomberg)

- Consumers Hit A Brick Wall: January Credit Growth Craters As Interest Rates Soar (zerohedge)

- PayPal (PYPL) negative investor sentiment could lead to an opportunity – Oppenheimer (streetinsider)

- Amazon (AMZN) and Google (GOOGL) top Internet stocks to own in 2023 – Goldman (streetinsider)

- Trip.com Financial Results Provide Important Insight into China’s Reopening (chinalastnight)

- Intel Wants $5 Billion More Subsidies From Germany for New Chip Plant (bloomberg)

Be in the know. 20 key reads for Wednesday…