On Tuesday I joined Charles Payne on Fox Business to discuss 3 turnaround stocks we own and why we own them. Thanks to Charles, Kayla Arestivo and Nick Palazzo for having me on:

Monday I joined Julie Hyman on Yahoo! Finance to discuss one stock we own at these levels and one we want to avoid. Thanks to Julie and Sydnee Fried for having me on:

Watch in HD directly on Yahoo! Finance

Last night I joined Phil Yin on CGTN America to discuss the Fed Decision and implications for the Stock Market moving forward. Thanks to Phil and Mona Zughbi for having me on:

And finally, I joined Maria Katarina on CNBC “Closing Bell” Indonesia this morning to discuss the Fed’s Dovish Pivot and implications moving forward. Thanks to Maria and Fitria Anggrayni for having me on:

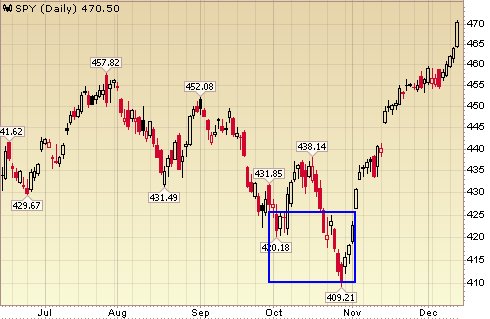

Here’s what the stock market looked like in October (blue box):

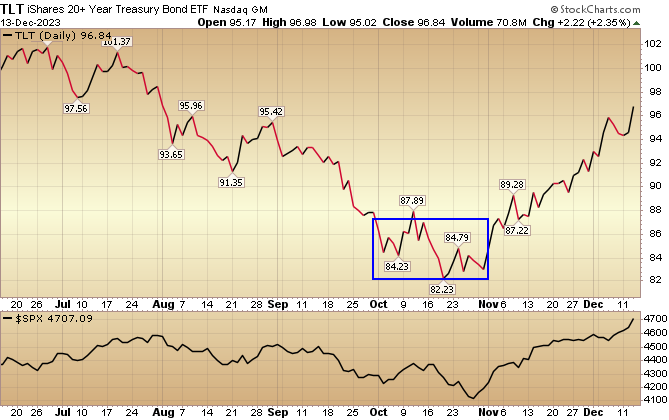

Here’s what the bond market looked like in October (blue box):

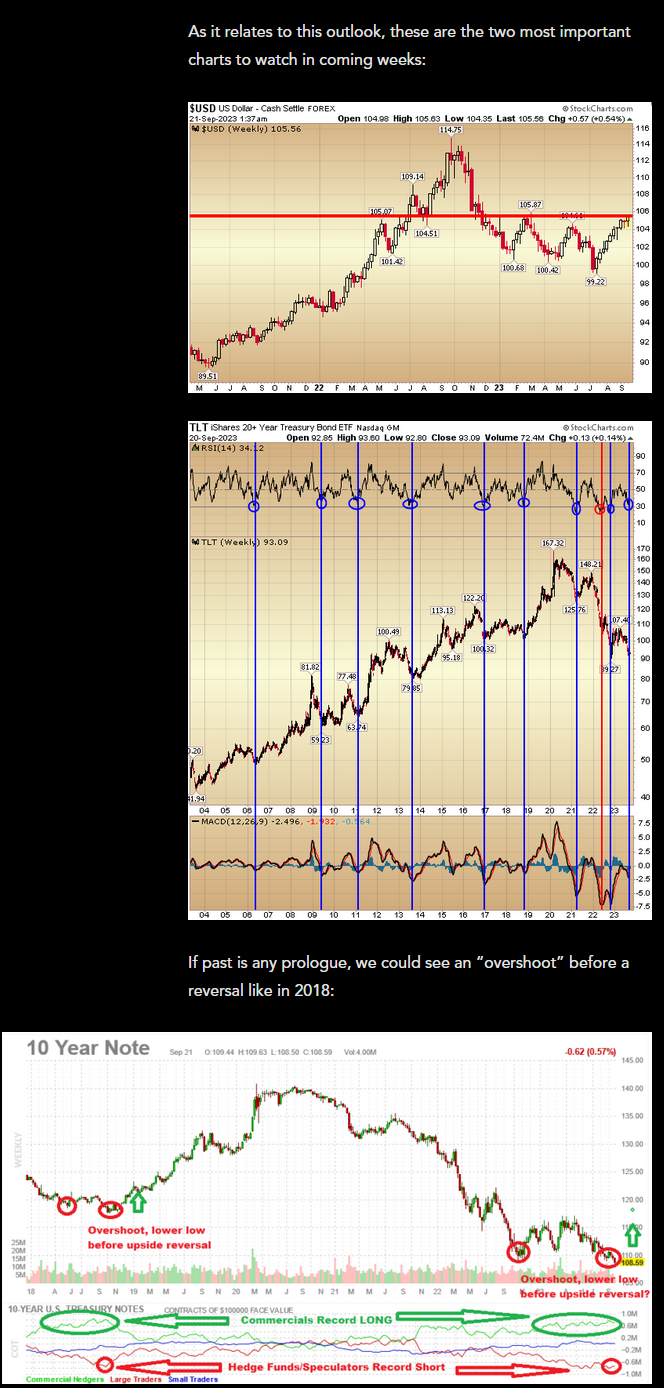

Here’s what the US Dollar looked like in October (blue box):

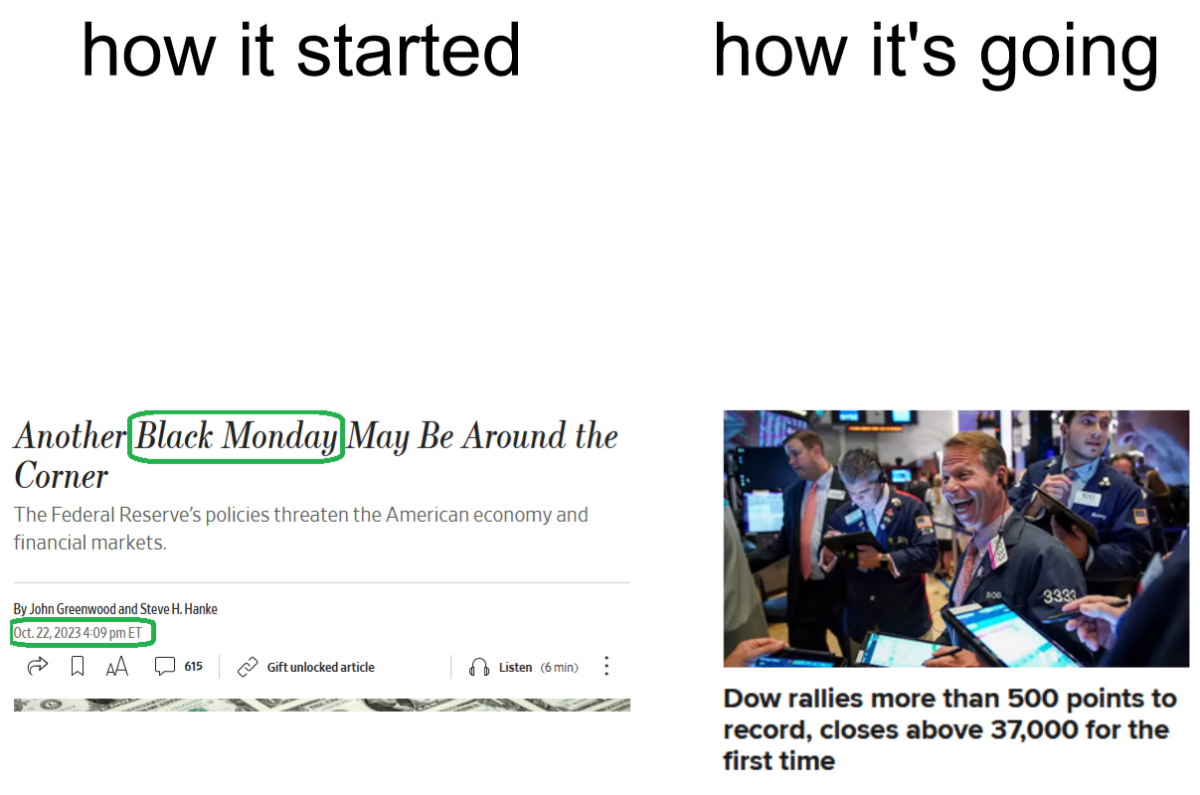

Here’s what we were doing and publishing when all of the bears were out in full force:

1) September 21 –

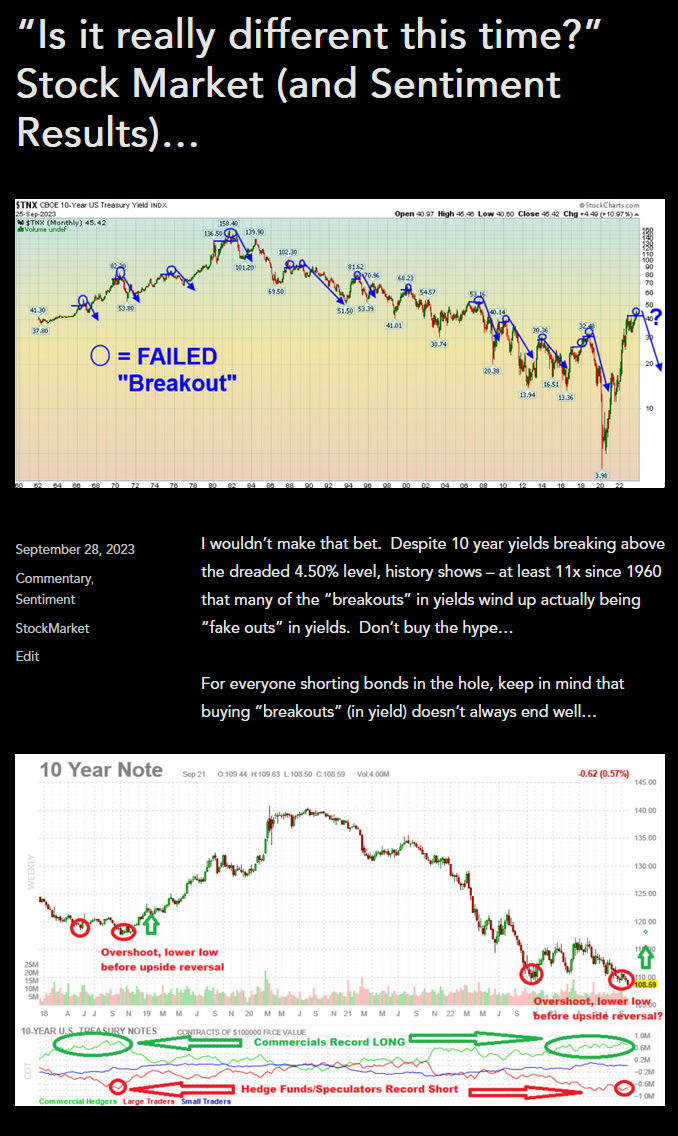

2) September 28 –

“Is it really different this time?” Stock Market (and Sentiment Results)…

3) October 4-

4) October 12-

5) October 19-

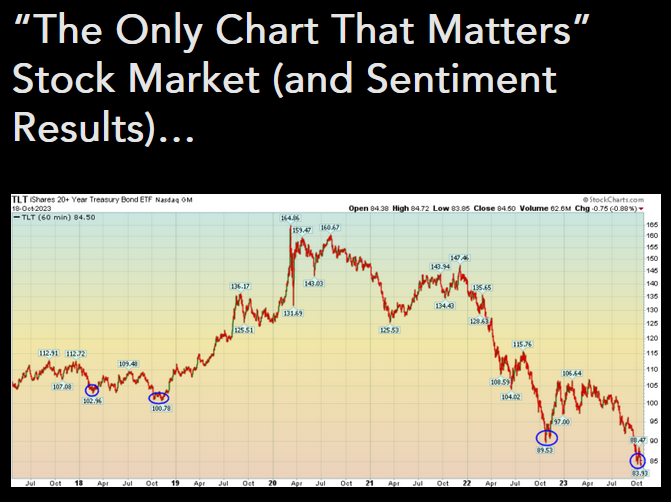

“The Only Chart That Matters” Stock Market (and Sentiment Results)…

6) October 26-

7) October 31 –

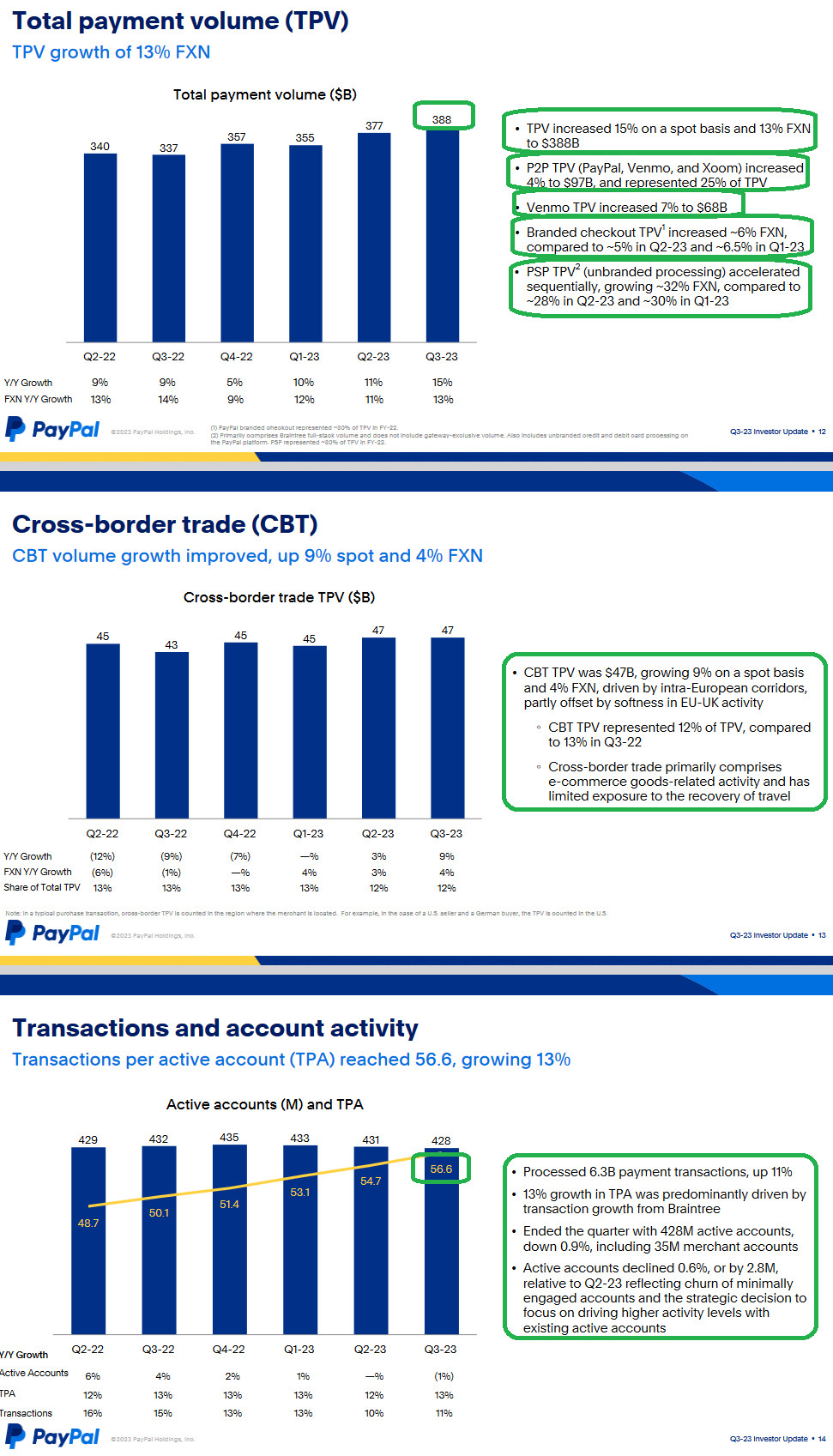

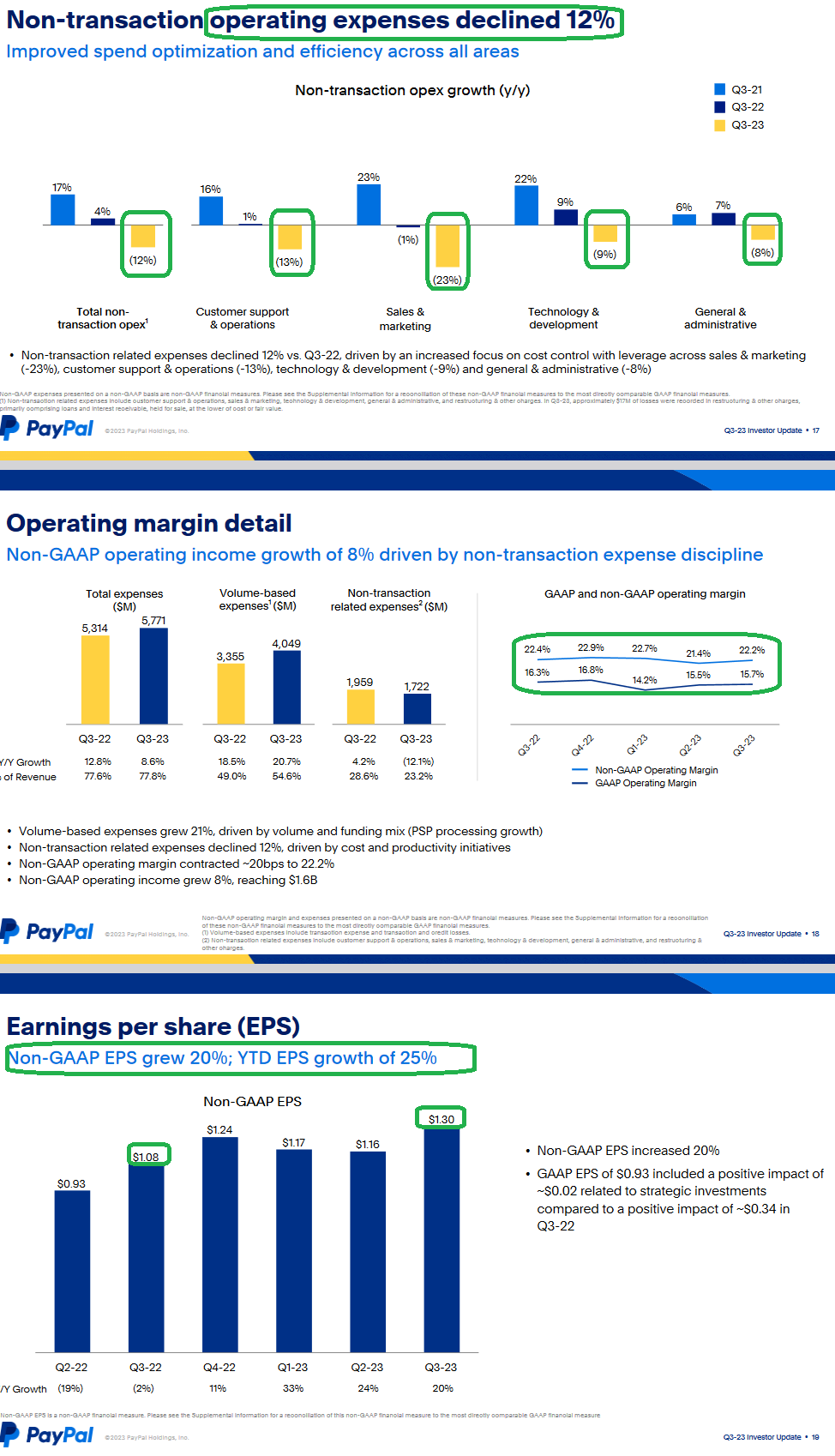

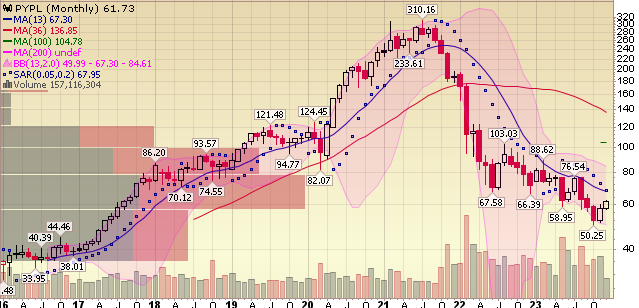

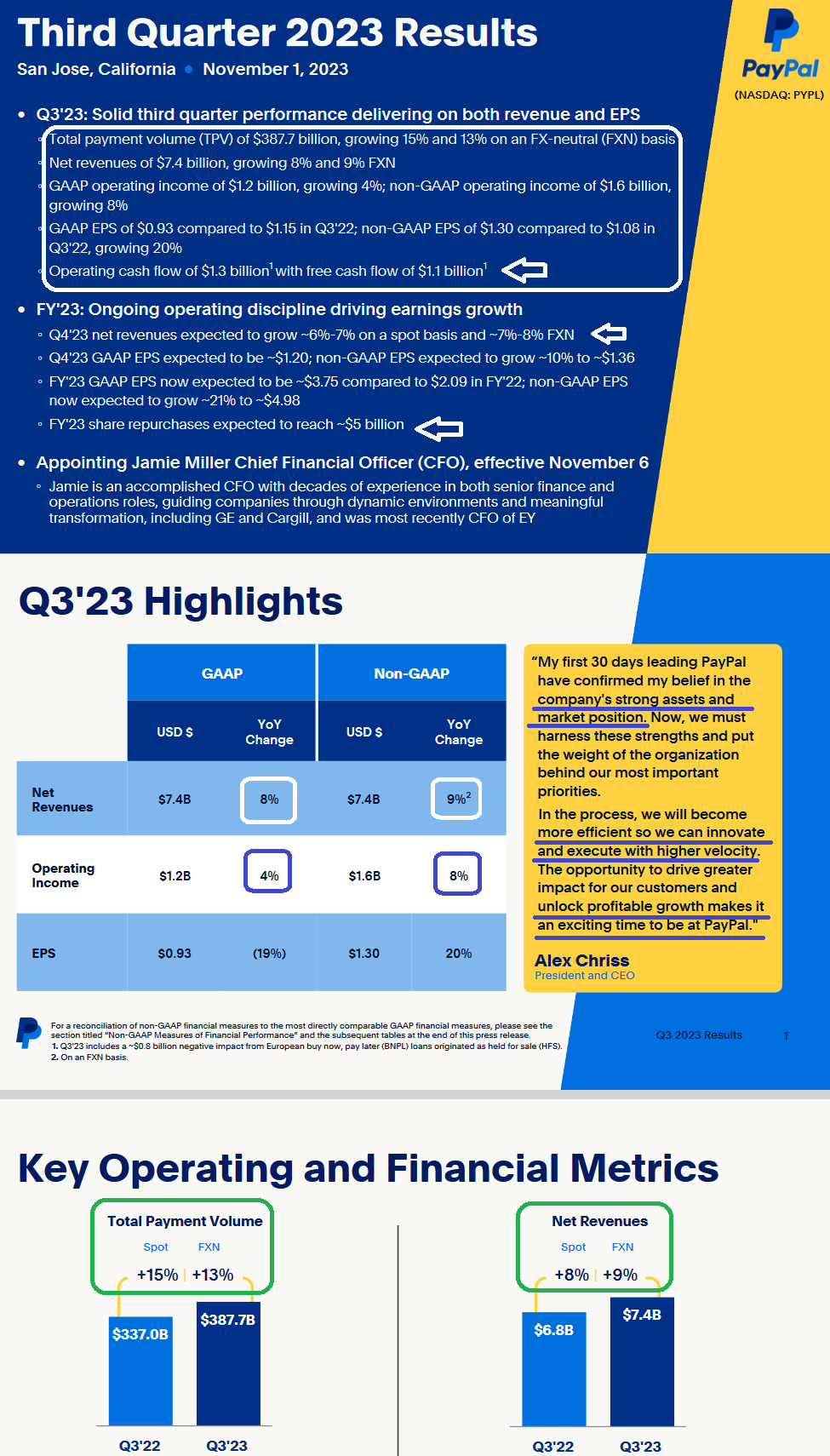

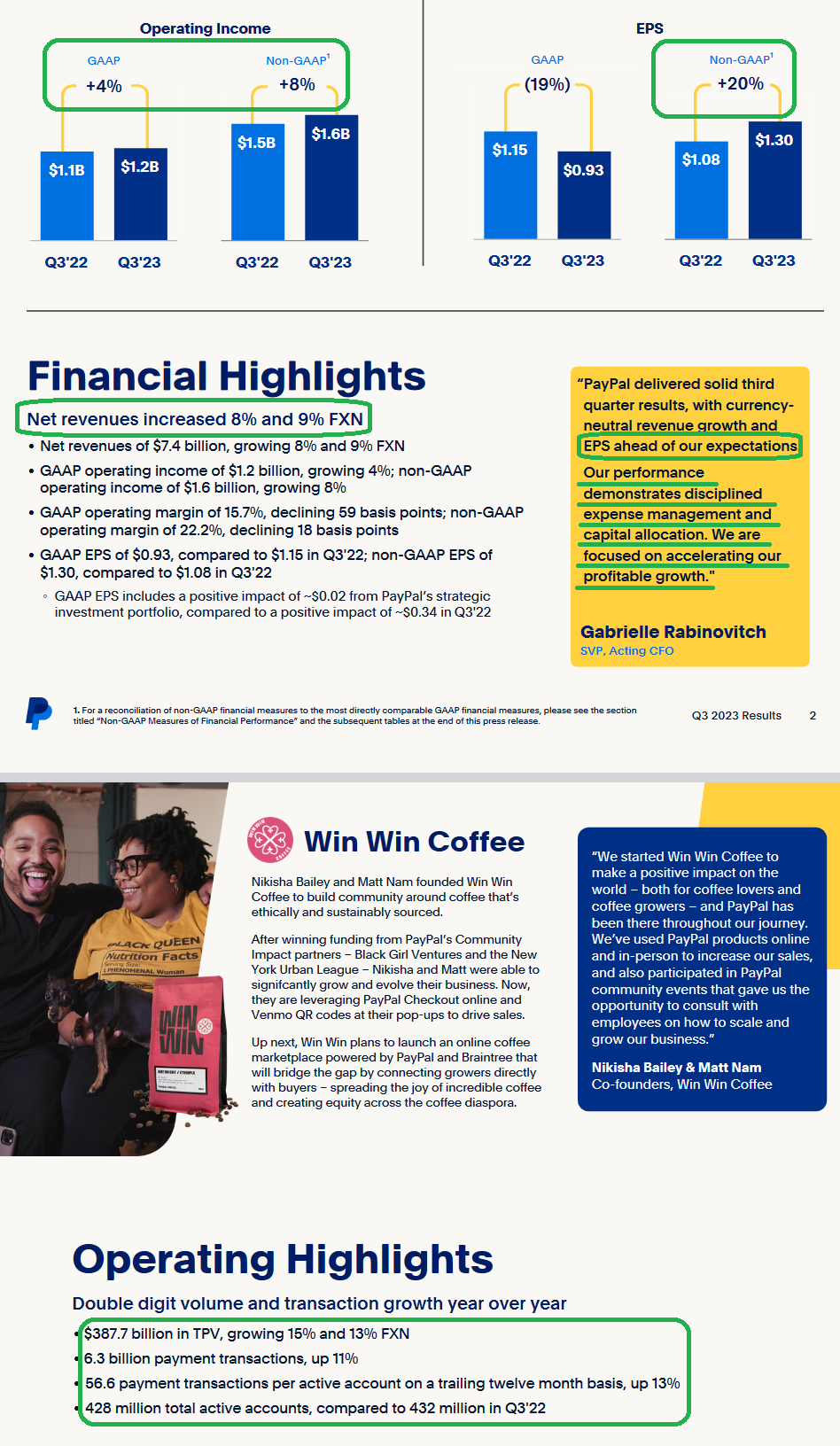

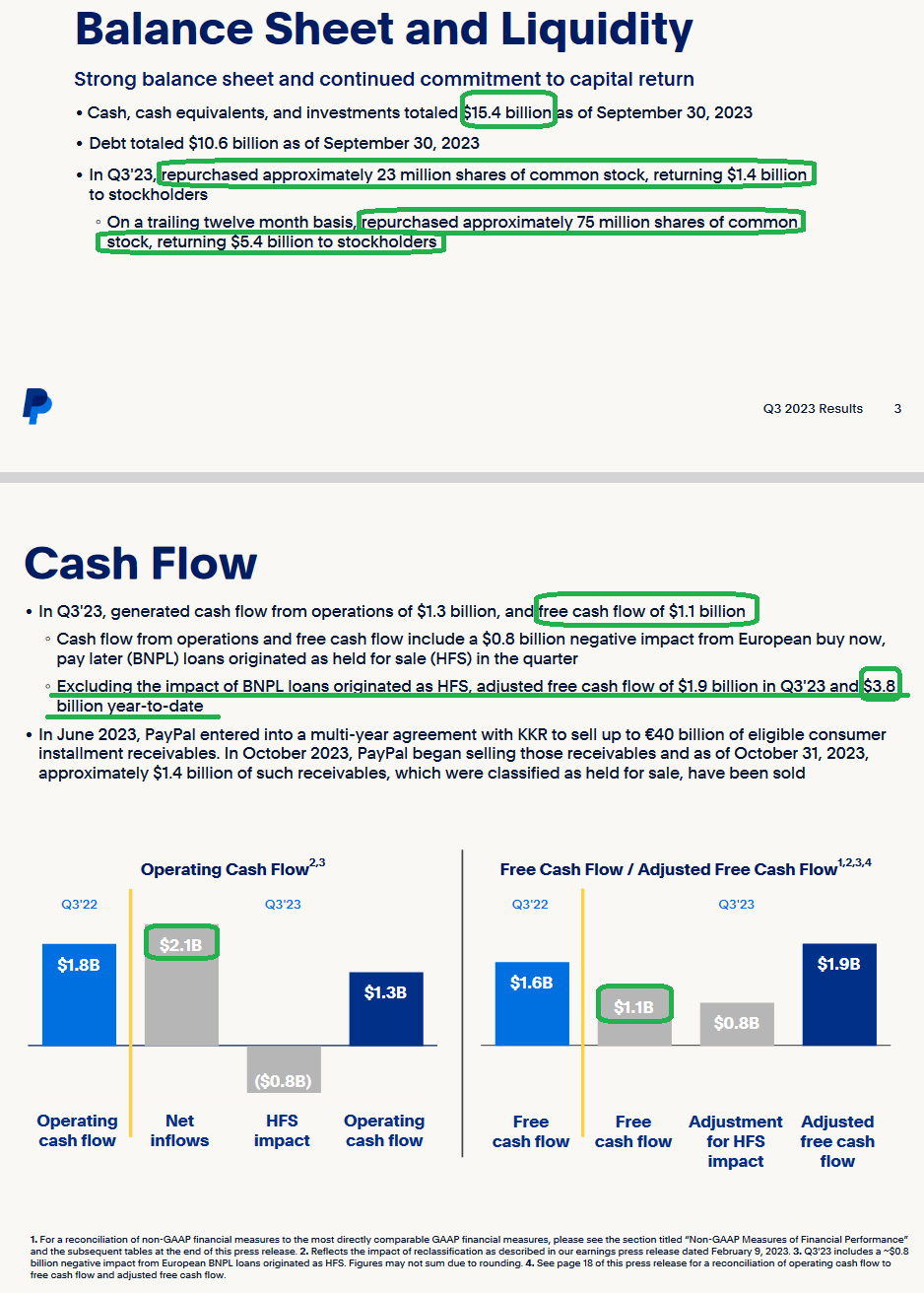

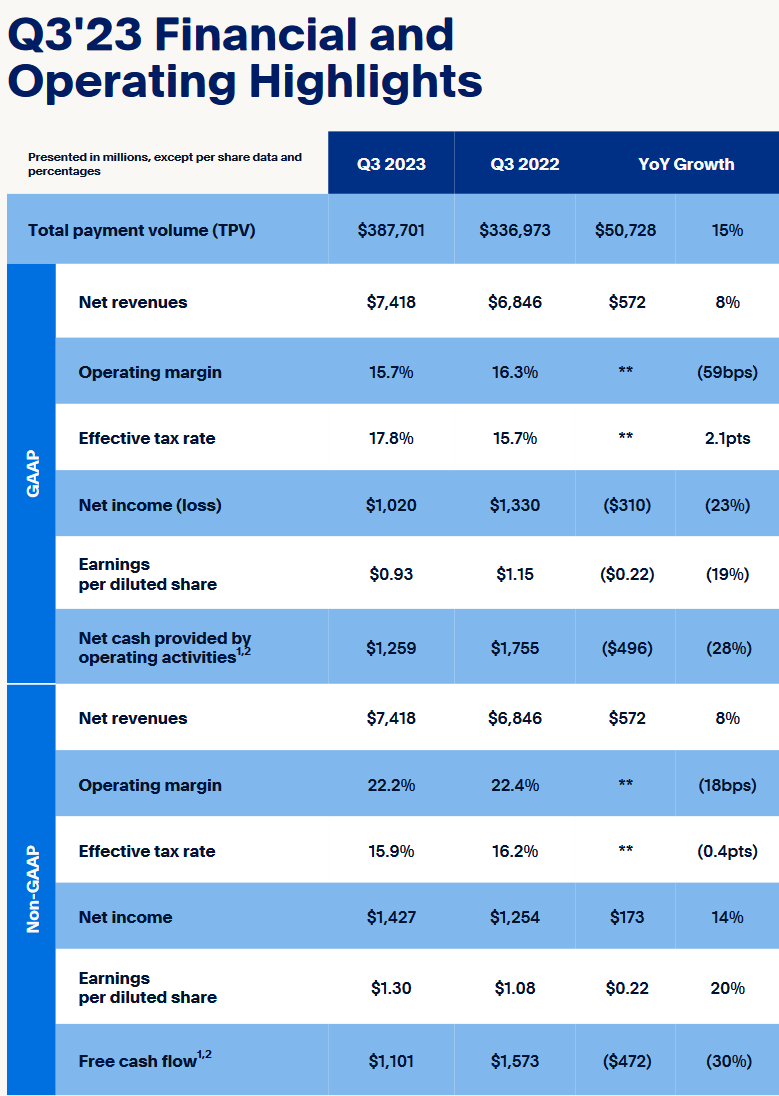

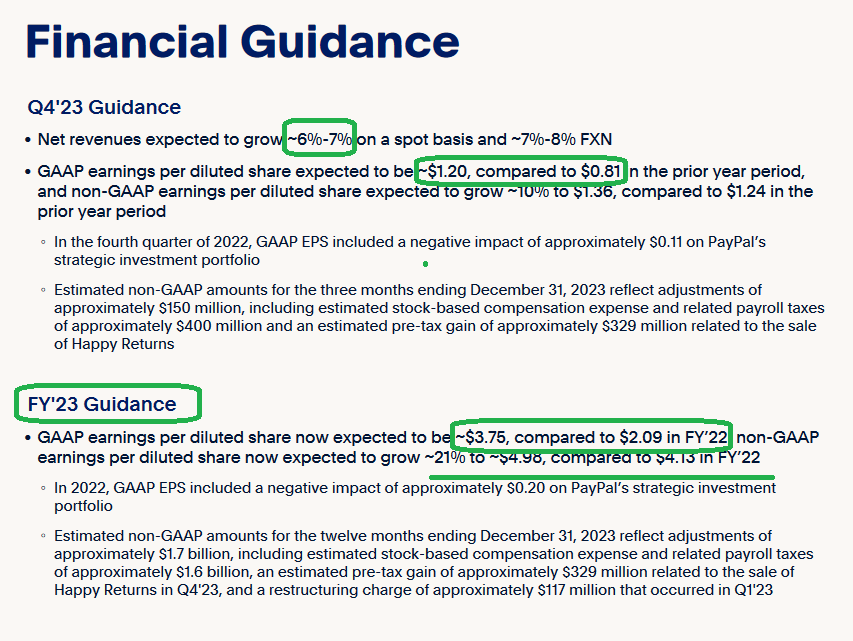

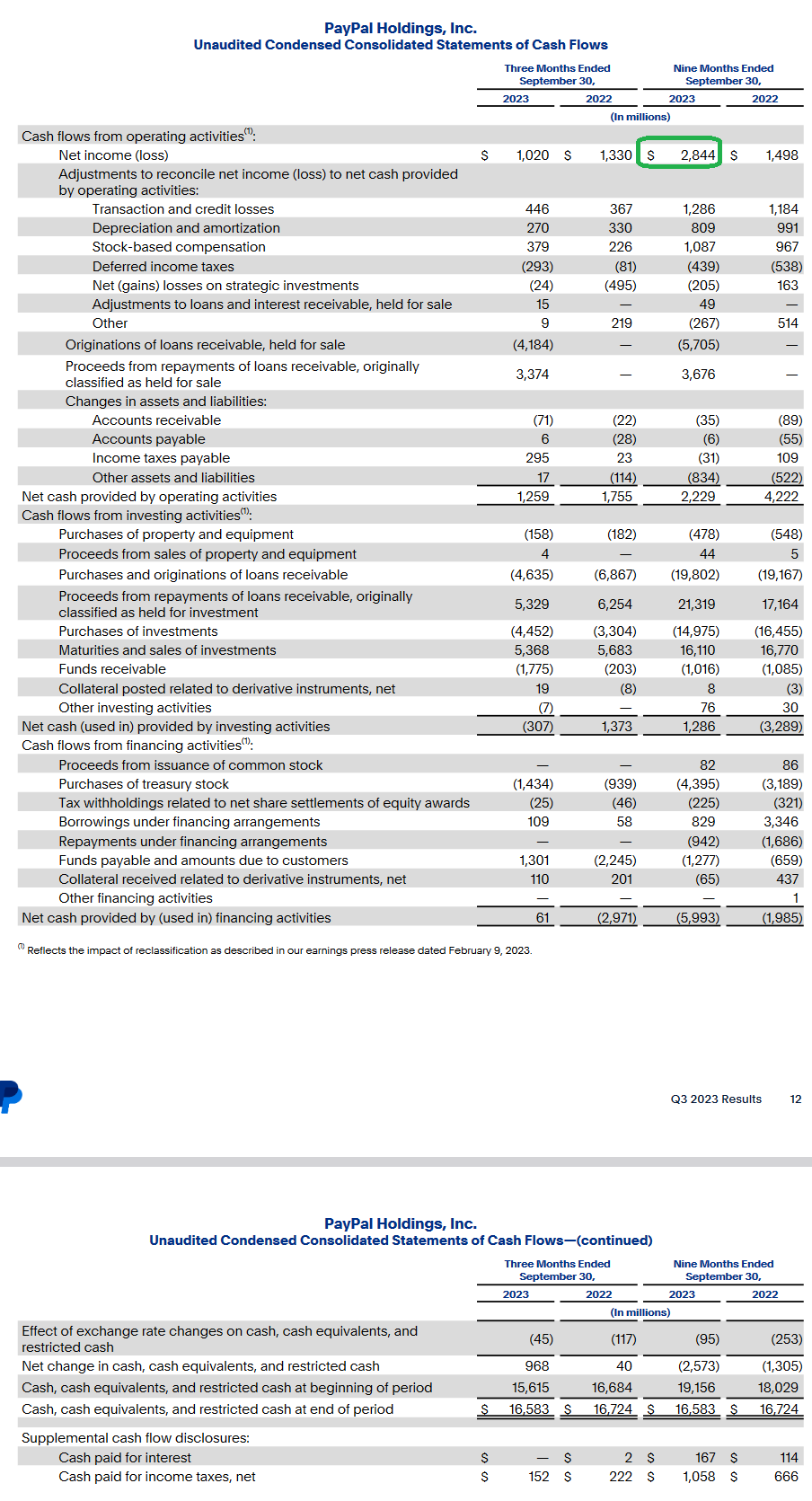

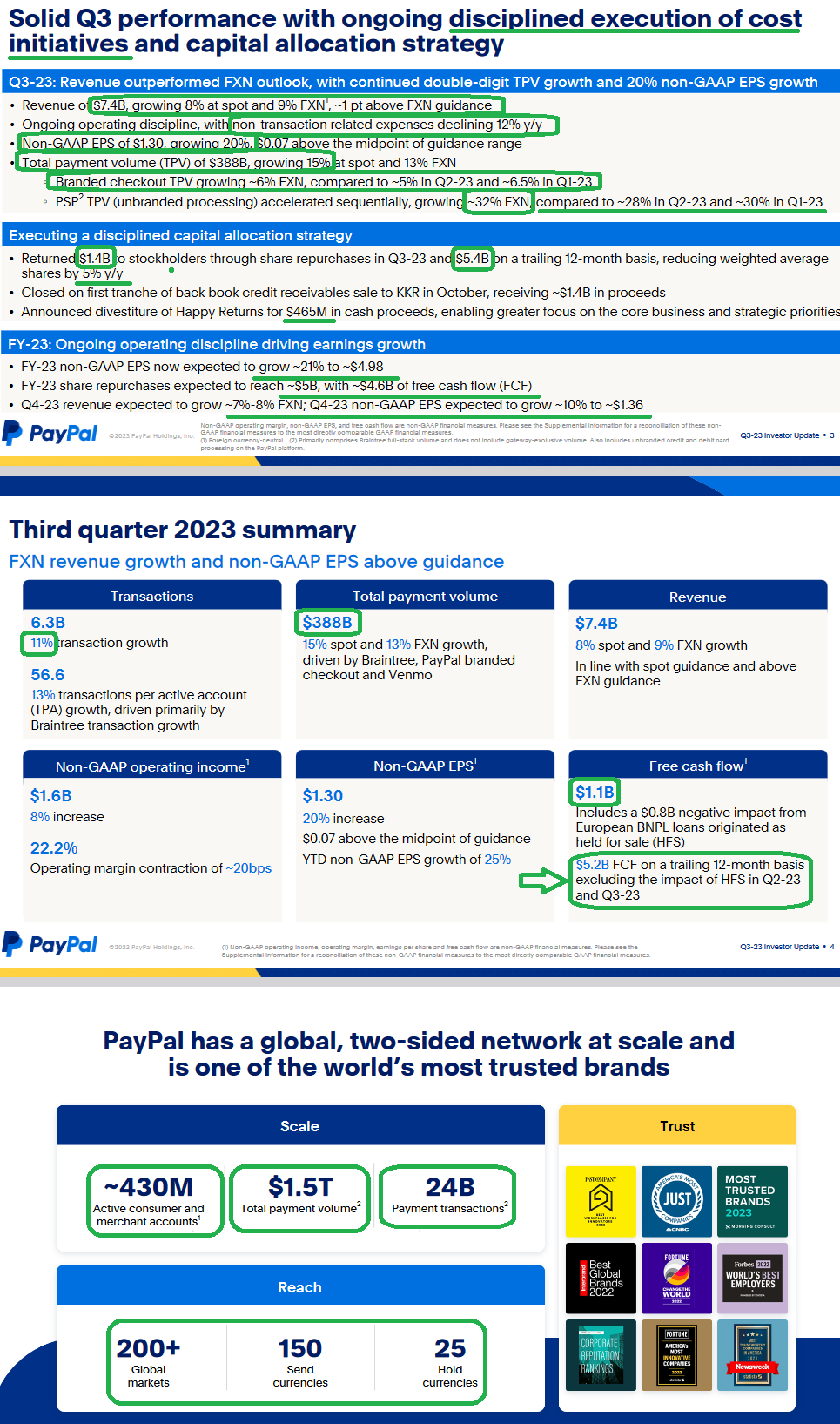

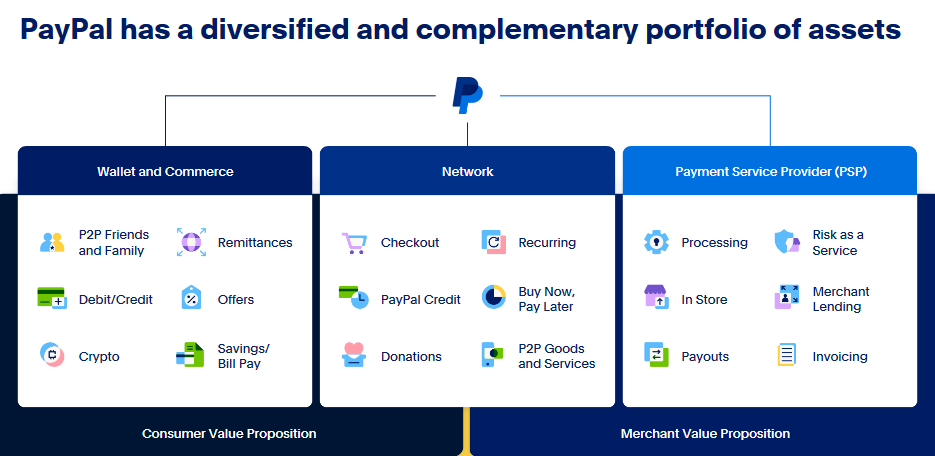

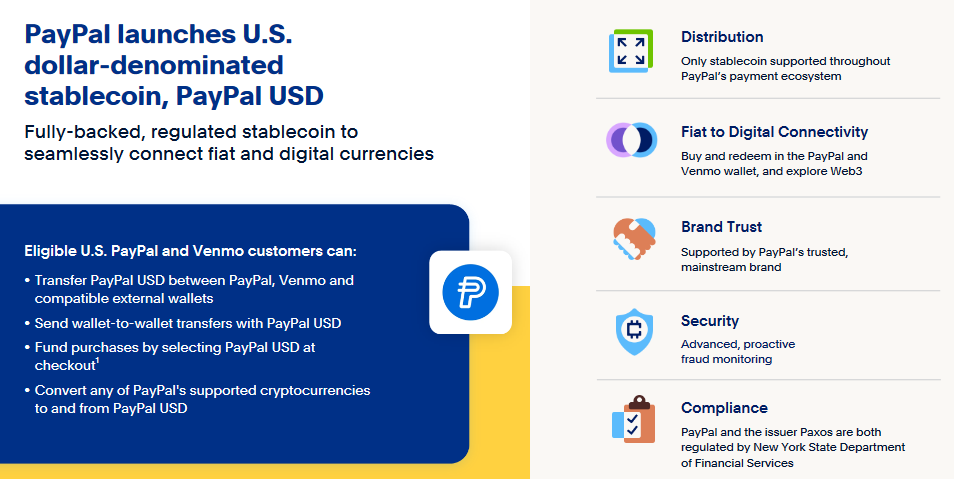

PayPal Update

Also in the final article above, I laid out out case for why we own PayPal. It was trading at $51.40 that day. They have since reported results so I want to update the thesis:

Remember Vornado at ~$15?

Here’s a clip from April 20:

Here’s what happened next:

Now onto the shorter term view for the General Market:

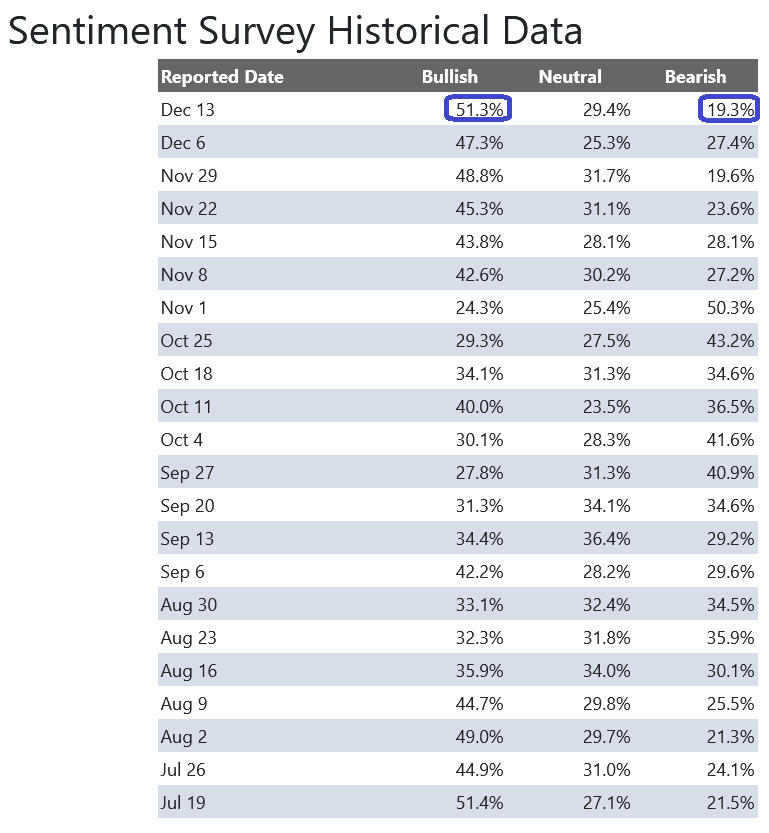

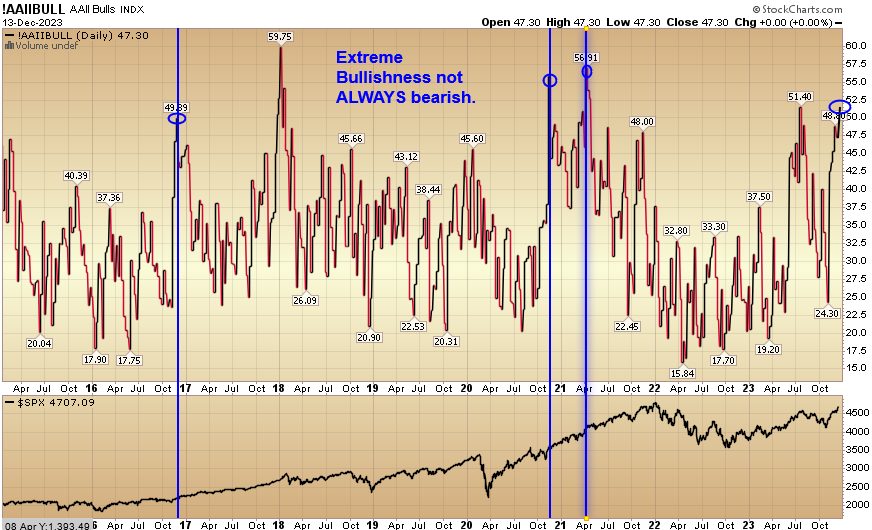

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) moved up to 51.3% from 47.3% the previous week. Bearish Percent dropped to 19.3% from 27.4%. Retail investors are bullish. This level can stay elevated during major moves (see below).

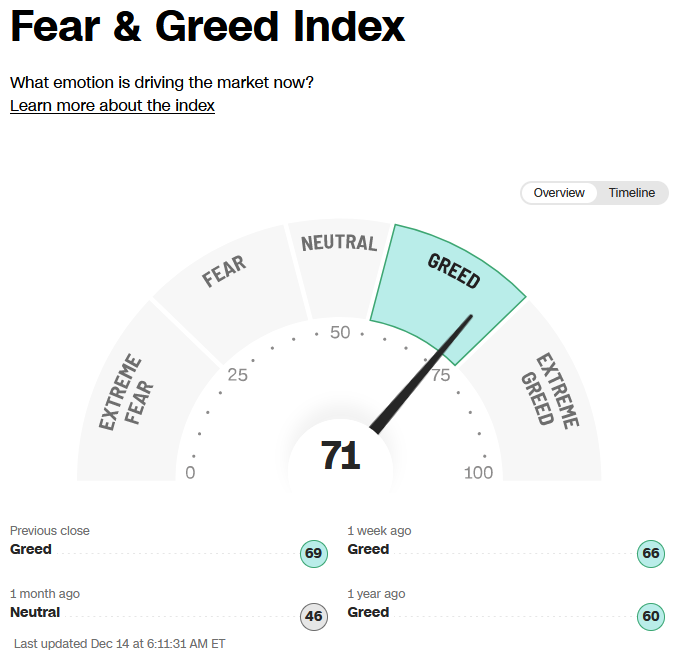

The CNN “Fear and Greed” moved up from 63 last week to 71 this week. By this metric, investors are giddy, but not yet euphoric. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” moved up from 63 last week to 71 this week. By this metric, investors are giddy, but not yet euphoric. You can learn how this indicator is calculated and how it works here: (Video Explanation)

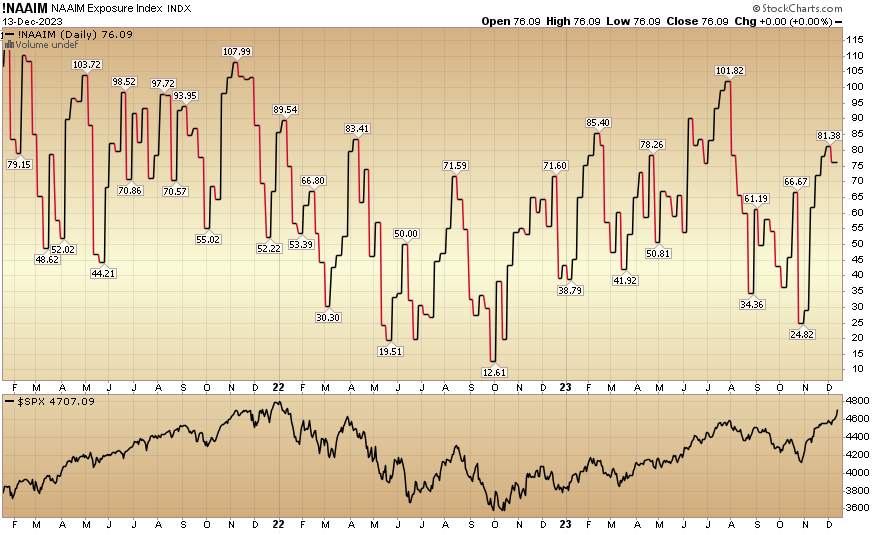

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved down to 76.09% this week from 81.38% equity exposure last week ago. The year end chase is not over:

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved down to 76.09% this week from 81.38% equity exposure last week ago. The year end chase is not over:

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms