Be in the know. 17 key reads for President’s Day…

- PayPal stock trades near its cheapest valuation in history, and one Wall Street analyst sees triple-digit upside for shareholders. (fool)

- China’s Premier Urges ‘Forceful’ Action to Boost Confidence (bloomberg)

- China State Banks Earmark $8 Billion for Property Projects. Authorities are stepping up support for housing market. (bloomberg)

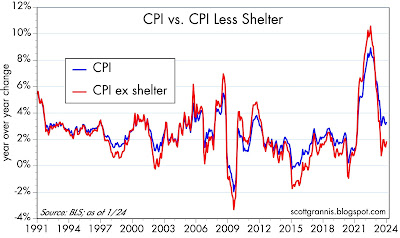

- The CPI overshoot is a statistical artifact (scottgrannis)

- Year of the Dragon Starts With Roar for the Tourism Industry, says Alibaba’s Fliggy (alizila)

- Any stimulus signs emerging ahead of the key annual meetings in March, where the leadership announces the economic growth target and development goals, will thus be closely watched.(bloomberg)

- Stock Bulls Turn to Europe for Cheap Alternative to Magnificent Riches (bloomberg)

- Tourism to Hong Kong and Macau also surged, as did trips to places such as Singapore where Chinese travelers were able to enjoy relaxed visa rules. (bloomberg)

- China’s National Team Is Back at Work as Stock Trading Resumes (bloomberg)

- China’s Hainan Cuts Down Payment for First-Home Buyers (bloomberg)

- China’s JD.com in Early-Stage Talks to Buy UK Retailer Currys (bloomberg)

- What’s really happening with the Evergrande liquidation (npr)

- The great dollar store backlash (thehustle)

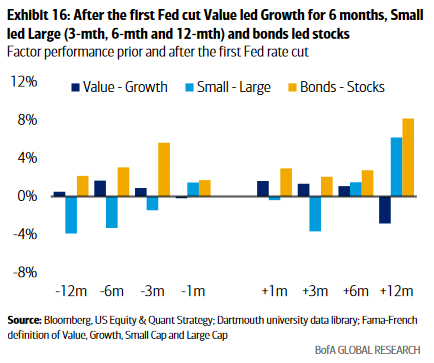

- Jerome Powell plans to cut interest rates despite persistent inflation (nypost)

- Market’s Bullishness On Euro Against Dollar Looks Misplaced (zerohedge)

- Goldman Sachs raises S&P 500 price target on earnings strength (streetinsider)

- Some regional electric grids ‘in trouble’ over the next few years, says Skylar’s Bill Perkins (cnbc)

Quote of the Day…

Be in the know. 10 key reads for Sunday…

- Robb Report’s 2024 Car of the Year: The 10 Contenders (robbreport)

- Masters in Business: Bill Dudley (bloomberg)

- Up 7 of Last 12 After Presidents’ Day but Still Weak Long Term (almanac trader)

- Natural Gas Crashes Into Historic 25-Year Price Support (kimblechartingsolutions)

- Michigan Consumer Sentiment Essentially Unchanged in February (advisorperspectives)

- Producer Price Index: Wholesale Inflation Inches Down to 0.9% in January (advisorperspectives)

- Weekly Leading Economic Index (advisorperspectives)

- Banner week for billionaire investor Carl Icahn – a total of four board seats at JetBlue and American Electric Power will go to deputies as Icahn celebrates his 88th birthday (fortune)

- Big Shale means ‘consolidate or get eaten,’ Wall Street is all in, and one of the ‘last original wildcatters’ will become America’s richest oilman (fortune)

- We Drove The Ferrari Roma Spider Through Italy’s Sardinian Mountains (maxim)

Be in the know. 15 key reads for Saturday…

- A US productivity boom may explain how inflation slowed amid a strong economy (cnn)

- This Tech Stock Is a Bargain Waiting to Be Found. Just Bring a Calculator. (barrons)

- Fed’s Bostic Argues for Patience on Rate Cuts. Here’s His Case. (barrons)

- Consumer Sentiment Stalls in February (barrons)

- Want your stock picks to beat index funds? Look at companies with one key metric. (marketwatch)

- Small-cap stocks haven’t been this volatile in nearly a year. What it means for the long-suffering sector. (marketwatch)

- Finding Stocks to Buy Is Getting Harder. 6 Shorts to Consider, From an Analyst. (barrons)

- The Stock Market Is Melting Up. Prepare for a Short-Term Correction. (barrons)

- JPMorgan and State Street quit climate group as BlackRock scales back (ft)

- Intel in Talks for More Than $10 Billion in Chips Act Incentives (bloomberg)

- How Uber Beat the Skeptics and Became Profitable (bloomberg)

- Odd Lots Newsletter: Who Cares When the Rate Cuts Start? (bloomberg)

- Top Investors Share the Toughest Lessons They Had to Learn (bloomberg)

- 4 Warren Buffett Stocks to Buy Now (morningstar)

- This 30% Undervalued Stock Is a Buy After a 7% Dividend Increase (morningstar)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 226

Article referenced in VideoCast above:

“Goolsbee Saves The Day!” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 226

Article referenced in podcast above:

“Goolsbee Saves The Day!” Stock Market (and Sentiment Results)…

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 15 key reads for Friday…

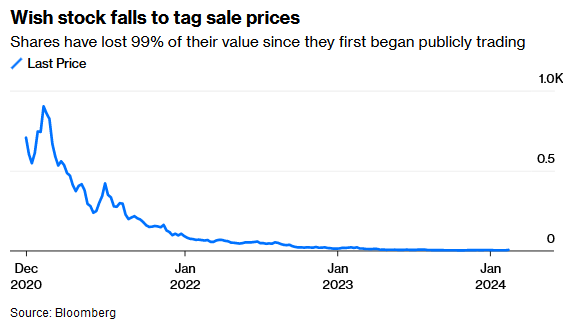

- Temu Is ‘Shopping Like a Billionaire’ for Ads. What Could Go Wrong? A lot. The recent relatively cheap sale of Wish, which also spared no expense when it came to marketing, proves it. (bloomberg)

- Improved Cash Flow Highlights Cooper Standard’s Fourth Quarter and Full Year 2023 Results (cooperstandard)

- Chinese New Year travel and consumption data continues to come in strong, with a strong increase in hotel bookings of +60% year-over-year, according to the Ministry of Commerce. Meanwhile, Meituan reported a +36% YoY increase and +155% versus 2019 in “daily consumption growth.” E-Commerce spending appears to be coming in strong, though Hainan Island, China’s Hawaii, does not have enough planes to get people home. Macau and Hong Kong visitor numbers look strong too. (chinalastnight)

- Overseas Chinese tourists back as Alipay transactions up 7 per cent from 2019 (scmp)

- ‘The Big Short’s’ Michael Burry Doubled Down on Alibaba Stock and JD.com. Should You? (barrons)

- China steps up ‘whitelist’ mechanism for property sector – media (reuters)

- UK shoppers pick up their spending, signaling quick end to recession (reuters)

- China Holiday Travel Surge Hints at Consumer Spending Pickup (bloomberg)

- Banks Are Piling Back Into Everything From Mortgage Debt to CLOs (bloomberg)

- Macau Sees Record Lunar New Year Visitors in Boost for Casinos (bloomberg)

- UK Energy Bills Set to Drop 15% in Boon for Taming Inflation (bloomberg)

- Goldman Strategists See Stronger US Consumers Boosting Luxury Stocks (bloomberg)

- Coca-Cola Boosts Its Dividend Again (barrons)

- What the Top Hedge Funds Are Buying: an Inside Peek (barrons)

- CN Govt Plans to Buy Distressed Private Property Projects, then Sell or Rent them Out after Conversion – Report (aastocks)