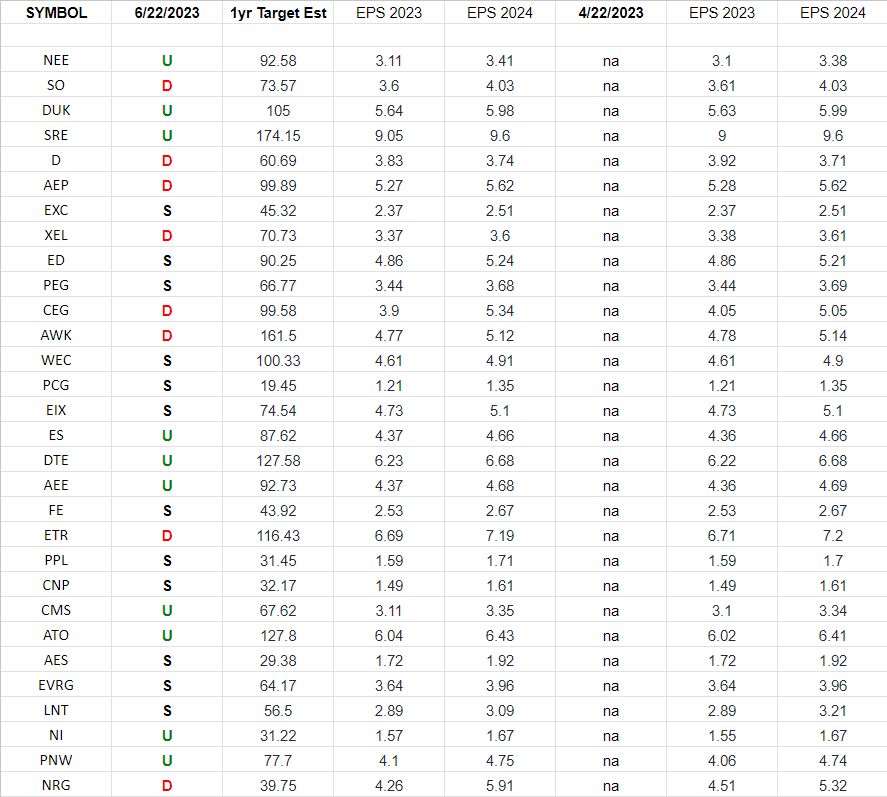

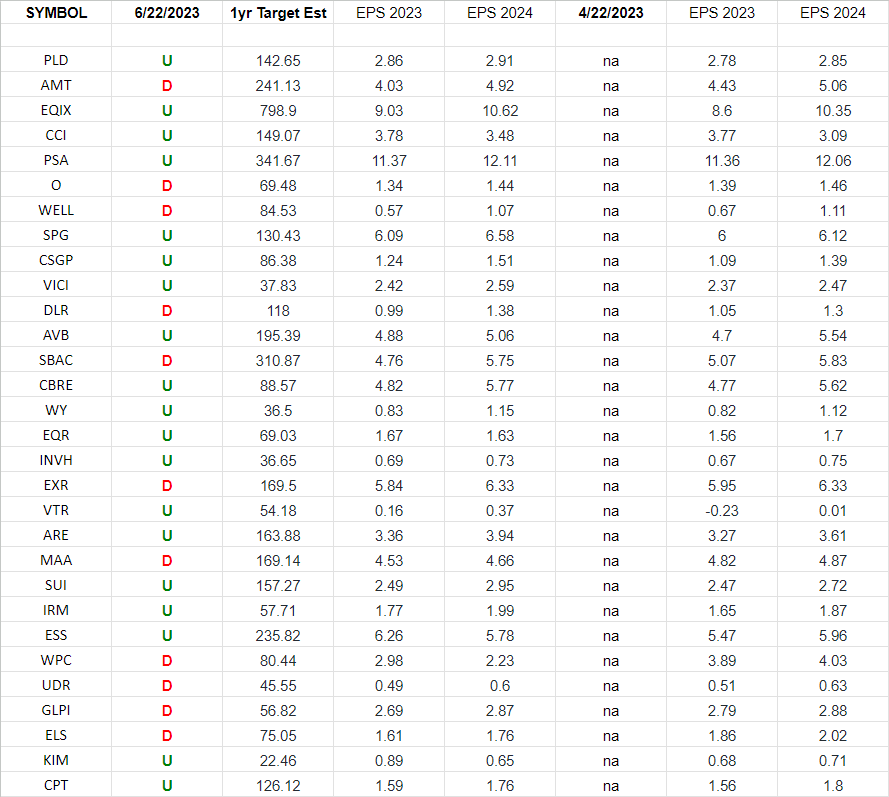

Data Source: Finviz

Utilities Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Utilities Sector ETF (XLU) top weighted stocks.

REIT Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Real Estate (REIT) Sector ETF (IYR) top 30 weighted stocks. Continue reading “REIT Earnings Estimates/Revisions”

Be in the know. 15 key reads for Thursday…

- Rolls-Royce and 4 Other Picks From a Top International Value Investor (barrons)

- Insiders Snap Up Stock in Auto-Parts Retailers (barrons)

- How Nike Shows the Next Big Risk for the Stock Market (barrons)

- More News Is Coming on Lilly, Novo Nordisk’s New Weight-Loss Drugs (barrons)

- This Bud’s for investors. Buy the stock even if Bud Light sales never recover, says analyst. (marketwatch)

- Goolsbee says Fed has to ‘do more sniffing’ on inflation before raising rates again (marketwatch)

- Fed should leave interest rates unchanged for the rest of the year, Bostic says (marketwatch)

- Intel Stock Drops Despite Plan for Cost Savings. This Is Why. (barrons)

- Biden Calls Xi a Dictator, Jeopardizing U.S.-China Thaw (wsj)

- Here Are the Key Takeaways From Powell’s Testimony Before US House (bloomberg)

- Olive Garden parent earnings beat estimates, fueled by strong LongHorn Steakhouse sales (cnbc)

- Mark Zuckerberg accepts challenge to cage fight with Elon Musk (foxbusiness)

- 3 reasons why the stock market could hit a record high by the end of the year (businessinsider)

- China approves 89 new video games in June, keeping a steady pace for the year (scmp)

- EVs Rise on Policy Support As Investors Yearn For More (chinalastnight)

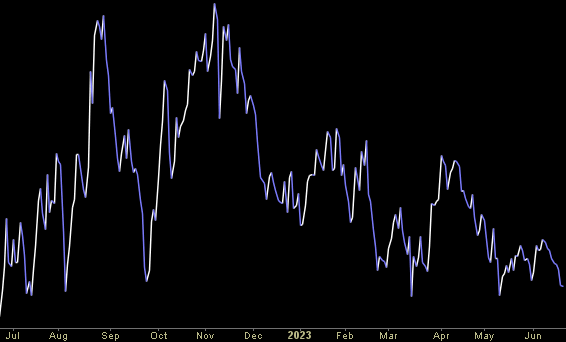

“Somethin’s Tellin’ Me This Ain’t Over Yet” Stock Market (and Sentiment Results)…

Morgan Wallen’s “Last Night” became the country star’s first No. 1 on the Billboard Hot 100 songs chart dated March 18, 2023. The song chronicles an “on again, off again” relationship that reminds me of the stop and start nature of the “China Trade” recovery since the lows in October: Continue reading ““Somethin’s Tellin’ Me This Ain’t Over Yet” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 19 key reads for Wednesday…

- China Stimulus Calls Mount From State Media, Top Advisers (bloomberg)

- Alibaba founders Jack Ma, Joe Tsai appear in Hangzhou in show of confidence amid corporate reshuffling

- Powell Heads to the Hill. Cue Tough Talk. (barrons)

- Jack Ma Ally Joe Tsai to Take Helm of Alibaba (wsj)

- 15 Biotech Stocks Wall Street Analysts Say Are Too Cheap (barrons)

- Amazon’s Stock Price Target Is Lifted on Expected AI-Driven Gains (barrons)

- 3M’s Dividend Dilemma (barrons)

- SoftBank’s Masayoshi Son Had His Cry. Now He’s in Love Again—With ChatGPT. (wsj)

- One-Percenters Keep Shopping at the Dollar Store (wsj)

- China Cuts Borrowing Rates Again in Bid to Juice Recovery (wsj)

- Fed’s Powell Says Interest-Rate Pause Is Expected to Be Temporary (wsj)

- KKR’s McVey Says Investors Too Cautious, Sees Stronger US Growth (bloomberg)

- BofA client data shows biggest equity inflows since October (streetinsider)

- China unveils $72 bln tax break for EVs, other green cars to spur demand (reuters)

- Intel to sell 20% stake in Austrian chip company (yahoo)

- Bill Gates’ venture firm, with backing from Jeff Bezos and Jack Ma, just minted a $1 billion A.I. unicorn that uses machine learning for mining rare earth metals crucial for EVs (yahoo)

- China furious after Biden calls Xi a ‘dictator’ (ft)

- The bull run in emerging market currencies can extend (ft)

- Taobao ‘618’ Livestream Viewers Scale Up 43% (aastocks)