Data Source: Finviz

Be in the know. 20 key reads for Friday…

- CSRC: Delisting Risk of US-listed CN Firms Subsides Hugely (aastocks)

- Alibaba Cloud wins deal with coal giant in bid to woo state-owned firms (scmp)

- BABA Dumps 70M SENSETIME Shrs on Mon to Pocket Over $150M (aastocks)

- S&P 500 Starts a New Bull Market as Big Tech Lifts Stocks (wsj)

- CSRC vice-chairman sees more foreign fund flows into A shares despite concerns (scmp)

- Amazon’s stock could be a sleepy AI play, according to UBS (marketwatch)

- Small-cap stocks just experienced their most explosive rally ever by this measure (marketwatch)

- China Central Bank Governor Reiterates Stable Policy Stance (bloomberg)

- Asos turnaround pace frustrates fast-fashion firm’s investors (sky)

- Tesla Stock Leaps On GM Charging Deal. Analyst Calls Move ‘Game, Set, Match’ For Market Control. (investors)

- Biogen Takes Alzheimer’s Drug to FDA Advisers (barrons)

- Less Haggling, More Upselling: How EVs Will Change How You Buy a Car (wsj)

- Boeing Is Rising Again as Travel Rebound Lifts Aviation Stocks (barrons)

- China Stocks Mixed After Weak Inflation Data. Hopes Rise for More Stimulus. (barrons)

- NYC mogul John Catsimatidis offers to buy CNN — and run it for just $1 per year (nypost)

- China Deflation Risk Prompts PBOC Governor to Downplay Fears (bloomberg)

- ‘Buying the dip’ is making a major stock-market comeback in 2023 as strategy heads for 3rd-best year ever (marketwatch)

- Used car prices drop for second straight month (foxbusiness)

- Wall Street has a new favourite phrase and it’s utterly nauseating (ft)

- com Beats as Chinese Travelers Pack Their Bags, Markets React to Major Policy Makers’ Speeches in Shanghai (chinalastnight)

Where is money flowing today?

Be in the know. 22 key reads for Thursday…

- Hedge funds lose $18bn betting against tech stock rally (ft)

- China’s big banks cut deposit rates, signaling monetary easing ahead (cnbc)

- China Auto Sales Jump 55% Year Over Year (zerohedge)

- China’s services activity picks up in May on improved demand (reuters)

- CICC Predicts CN Annual GDP Growth at Near 6%; Real Estate Investment Growth May Turn Positive (aastocks)

- Google to crack down on office attendance, asks remote workers to reconsider (cnbc)

- Semtech Stock Soars. It’s Not Just a Surprise Profit That’s Lifting Hopes. (barrons)

- Forget the Naysayers. Why the Stock Market Can Keep Rising. (barrons)

- A ‘perfect business.’ Why investors may want to follow the Saudis into golf, says this strategist. (marketwatch)

- Martha Stewart says she’s opposed to remote work: ‘Should America go down the drain?’ (marketwatch)

- As tech companies take over the market again, don’t forget these bargain dividend stocks (marketwatch)

- S. jobless claims leap to nearly two-year high of 261,000 (marketwatch)

- S. and China Prepare for Possible Blinken Visit to Beijing (wsj)

- Amazon Plans Ad Tier for Prime Video Streaming Service (wsj)

- A $1 Trillion Borrowing Binge Looms After Debt Limit Standoff (nytimes)

- Why the World Can’t Quit Its Addiction to Chinese Goods (bloomberg)

- China’s big banks cut deposit rates, signaling monetary easing ahead (cnbc)

- Warren Buffett has made predictions about crypto, table tennis, and even his own death. Here are 12 forecasts and how they’ve turned out. (businessinsider)

- Investors should buy the dip as the stock market will keep climbing amid a trifecta of bearish voices, Fundstrat says (businessinsider)

- China’s securities regulator touts long-term value investing to soothe investors. CSRC will also continue to encourage sales of stock-focused funds, possibly with tax breaks and favourable accounting rules as incentives. (scmp)

- Political Relationship Green Shoots Lift Markets (chinalastnight)

- Copper Slump Will Give Way to Record Buying Spree, Citi Says (yahoo)

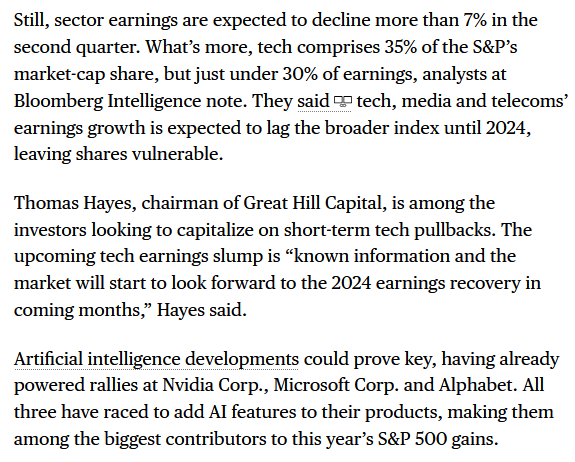

Tom Hayes – Quoted in Bloomberg article – 5/13/2023

Thanks to Farah Elbahrawy for including me in her article on Bloomberg. You can find it here:

Click Here to View The Full Article on Bloomberg

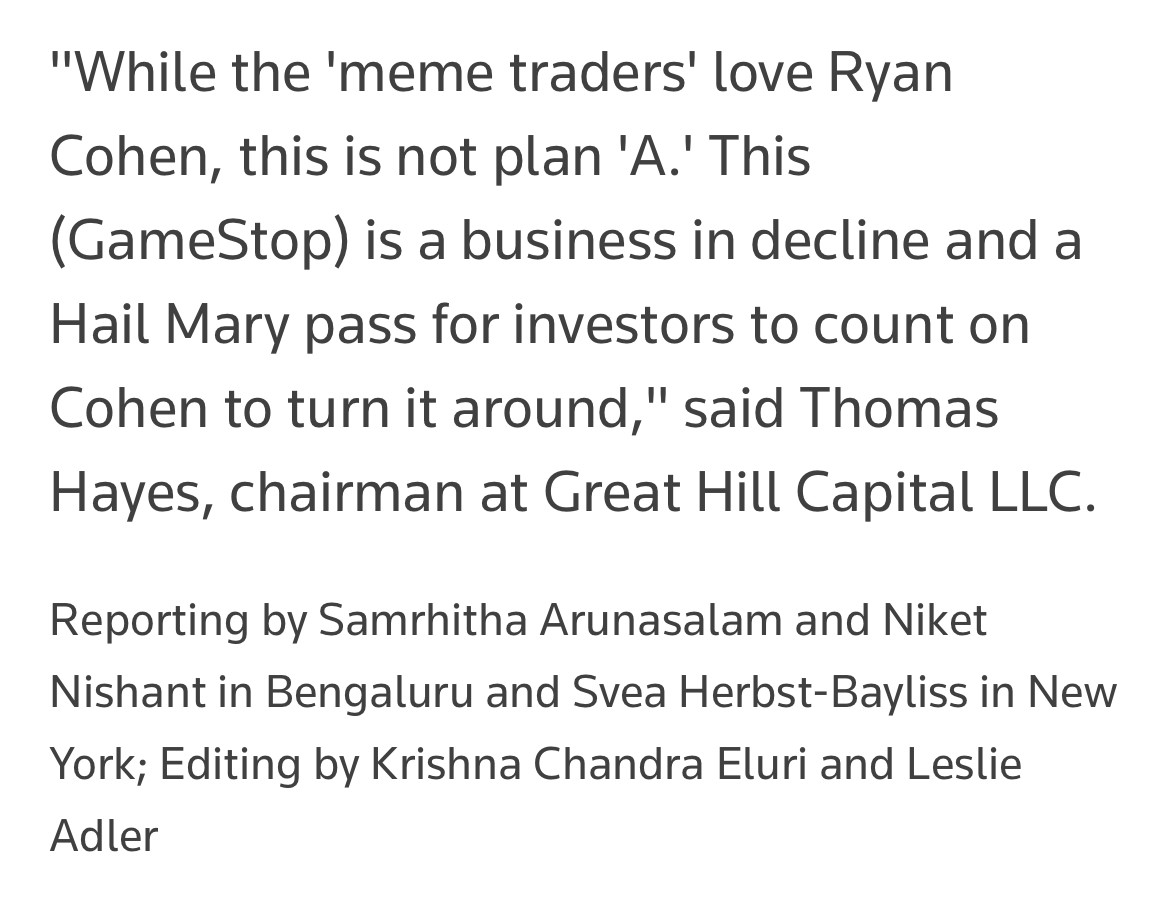

Tom Hayes – Quoted in Reuters article – 6/7/2023

Thanks to Samritha Arunasalam and Svea Herbst-Bayliss for including me in their article on Reuters. You can find it here:

Click Here to View The Full Reuters Article

“The One That Got Away” Stock Market (and Sentiment Results)…

It was very lonely being a bull last fall when the S&P 500 was in the 3600s to 3700s. A few smart hosts kept an open mind (at those subdued levels) when we were pounding the table to buy equities (see circled dates below).

Continue reading ““The One That Got Away” Stock Market (and Sentiment Results)…”

Hedge Fund Tips (PCN) – Position Completion Notification

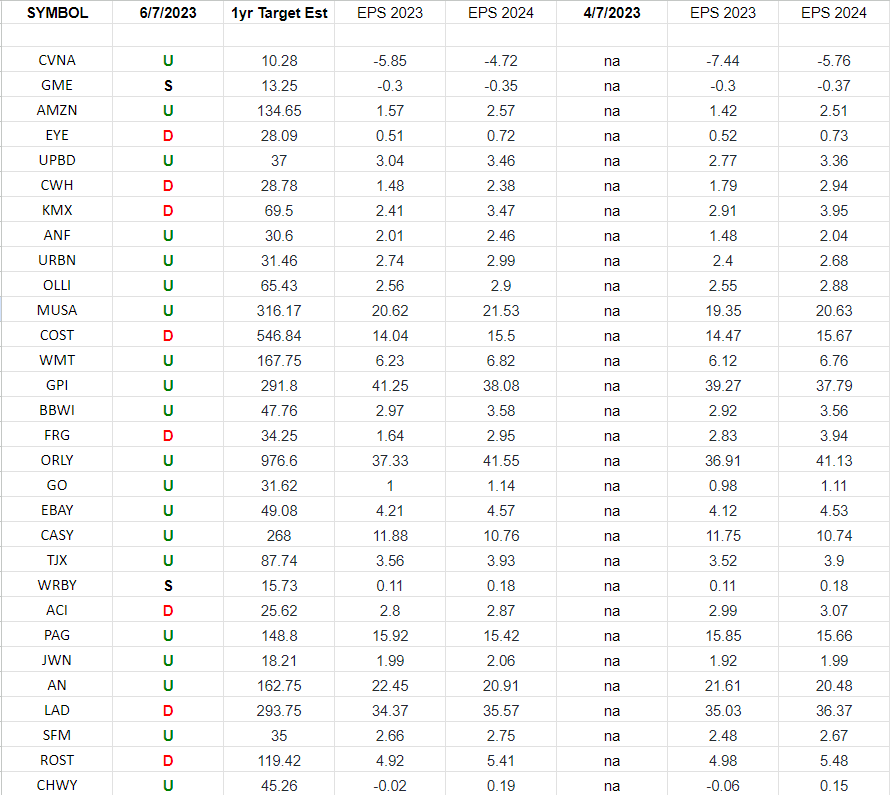

Retail Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”

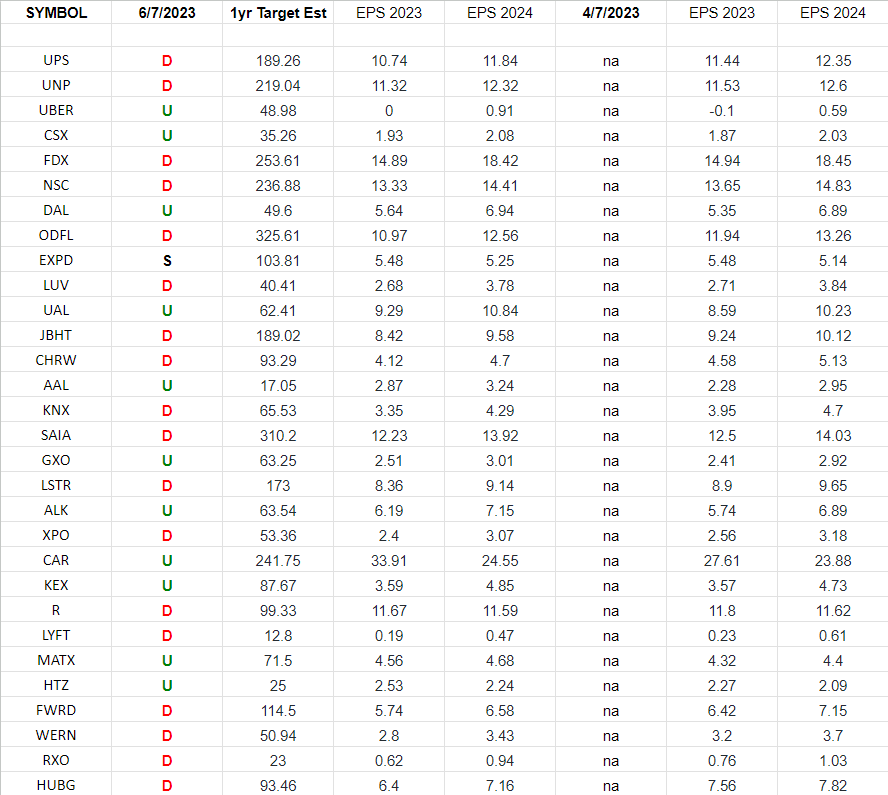

Transports Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) holdings. Continue reading “Transports Earnings Estimates/Revisions”