Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 25 key reads for Tuesday…

- Devils blank Rangers in Game 7, advance past rivals (espn)

- In China, It’s Time to Splurge Again, and the Luxury Industry Is Relieved (nytimes)

- Fed expected to raise interest rates again this week — perhaps for the last time this cycle (marketwatch)

- China dominates global IPO market as Wall Street fails to rebound (ft)

- First Republic Deal Is a Coup for Jamie Dimon and JPMorgan (barrons)

- Here are the 6 factors that suggest the stock market bottomed last October and will continue to rally from here (businessinsider)

- Beijing likely to ‘keep market support coming’ as China’s home sales tank (scmp)

- China Tourists Overwhelm Attractions as Travel Explodes After Covid (bloomberg)

- Marriott’s Revenue Jumps 34%. It’s Not Seeing a Slowdown in Travel Demand. (barrons)

- Pfizer Stock Jumps After Sales Beat. There’s More Good News From Earnings. (barrons)

- Molson Coors adjusted profit jumps 82% (marketwatch)

- Yellen Sets June 1 as New Debt Limit Deadline (barrons)

- Casinos Are Still a Good Bet, Surging Macau Data Show (barrons)

- Tesla Raises EV Prices by $250. Why It’s a Brilliant Move. (barrons)

- Ford Earnings Are Coming. What’s Needed to Get the Stock Out of Its Doldrums. (barrons)

- FDIC recommends raising deposit insurance limit for business accounts after bankfailures (marketwatch)

- “Alibaba now trades at its steepest-ever discount to net asset value, according to Goldman’s estimates.” (bloomberg)

- Federal Reserve Meeting: Will ‘Dovish Hike’ Spark S&P 500 Rally? (investors)

- Why the human genome could be healthcare’s holy grail (yahoo)

- Investors warn of First Republic aftershocks at gloomy Milken gathering (ft)

- How Jamie Dimon swooped on the remains of First Republic (ft)

- Fed in stride to pole-vault 5% policy rate, then perhaps catch its breath (reuters)

- Stocks could soon retest all-time highs as markets react to possible ‘thesis-changing’ final rate hike from the Fed, Fundstrat says (businessinsider)

- 3 Failed Banks This Year Were Bigger Than 25 That Crumbled in 2008 (nytimes)

- The Inside Story of Buffett’s Big Japan Bet, Over Glasses of Coke at Four Seasons (bloomberg)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 22 key reads for Monday…

- Why the stock market is smarter than any of us – including the bears (nypost)

- JPMorgan Chase takes over First Republic after U.S. seizure of ailing bank (cnbc)

- China’s Travel Rush Over Holiday Sees Tourism and Spending Soar (bloomberg)

- Iveric Bio Agrees to $5.9 Billion Bid From Astellas. Buyers Are Hunting Biopharma Bargains. (barrons)

- The Fed Has Few Good Options. The Risk of a Misstep Is Growing. (barrons)

- GM Stock Rises After Morgan Stanley Says Buy (barrons)

- Li Auto Stock Rises After Record EV Deliveries (barrons)

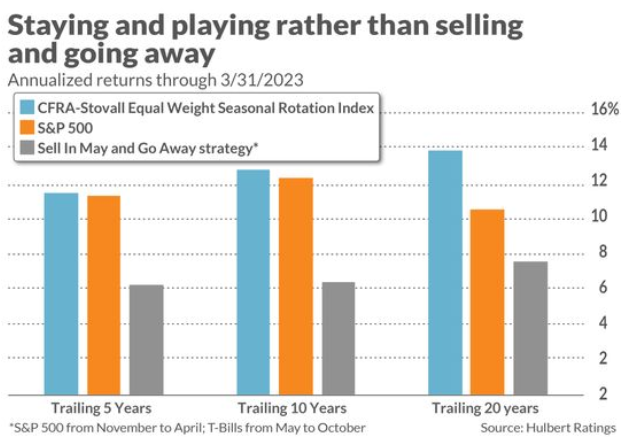

- Opinion: Sell in May? Not so fast. ‘Stay and play’ this summer in safer stock-market sectors. (marketwatch)

- Stock-market investors want the Fed to answer this crucial question when it meets this week (marketwatch)

- Watch for a Fed pause, a debt-ceiling battle and a volatile summer. Shelter in these stocks, says strategist. (marketwatch)

- Norwegian Cruise Line Sails Past Estimates. The Stock Is Up. (barrons)

- 10 Tough Questions for Warren Buffett Heading Into Berkshire’s Annual Meeting (barrons)

- The Building Boom Is Prolonging Market Pain (wsj)

- Here’s What Treasury, Fed Might Do in a Debt Ceiling Crisis (wsj)

- Fed Set to Raise Interest Rates and Debate a Pause (wsj)

- The Air Has Come Out of the Dollar (wsj)

- Hedge Funds Bet Dollar to Erase Hike-Cycle Gains as Fed Peaks (bloomberg)

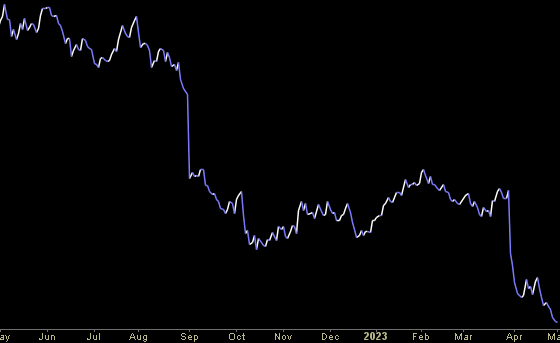

- Trader ‘Exhaustion’ Drags April ETF Volume to Lowest Since 2020 (bloomberg)

- The Slow Dance Between Markets and Central Banks (bloomberg)

- The Chip Sector Has a New Sport: Finding the Bottom (bloomberg)

- The Dollar’s Demise May Come Gradually, But Not Suddenly (bloomberg)

- Macau Casino Revenue Jumps Again in April on China Tourism Boom (bloomberg)

Tom Hayes – Quoted in Reuters article – 5/1/2023

Thanks to Manya Saini, Siddarth S, Reshma Rockie George and Arpan Varghese for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Reuters Article

Tom Hayes – Quoted in Reuters article – 5/1/2023

Thanks to Saeed Azhar, Nupur Anand, Tatiana Bautzer & Manya Saini for including me in their article on Reuters today. You can find it here: