Where is money flowing today?

Be in the know. 15 key reads for Wednesday…

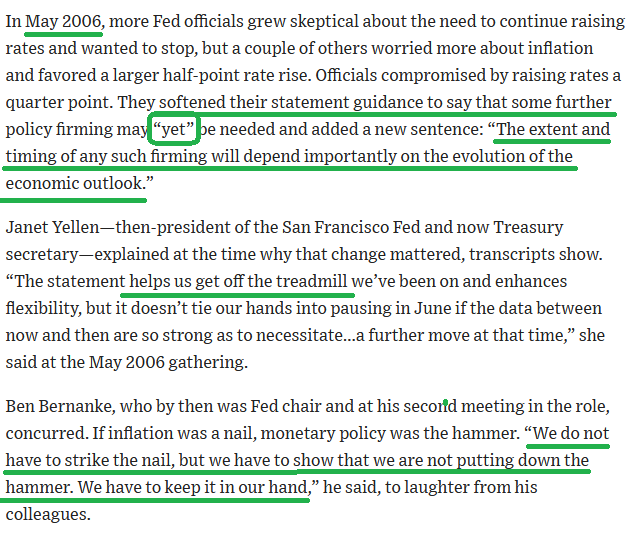

- What a Fed Debate 17 Years Ago Reveals About Its Rate Deliberations Now (wsj)

- They Could Be Winners. (barrons)

- Here’s What the Federal Reserve Should Do (bloomberg)

- Warren Buffett’s ‘Secret Sauce’ Involves One of Investing’s Most Basic Strategies (wsj)

- China’s AI industry barely slowed by US chip export rules (reuters)

- To Control Inflation, the Fed Needs to Relearn Monetarism (barrons)

- Ford Reported Blowout First-Quarter Numbers. Here’s What Wall Street Thinks. (barrons)

- GM, Ford, and Stellantis Posted Strong Numbers. (barrons)

- Porsche confirms guidance after reporting higher profit (marketwatch)

- Fed may pause ‘for an extended period of time’ after interest-rate hike today, BlackRock’s Rick Rieder says (marketwatch)

- Eli Lilly Stock Jumps on Positive Alzheimer’s Drug Phase 3 Trial Data (barrons)

- Immunogen stock more than doubles on heavy volume after positive trial data ovarian cancer treatment (marketwatch)

- Fed Holds an Ace to Calm Banking Turmoil. Why It’s Not Playing It. (barrons)

- Job Openings Near Two-Year Low as Layoffs Jump (wsj)

- His 1960 Corvette Is At Home in a Public Brooklyn Garage (wsj)

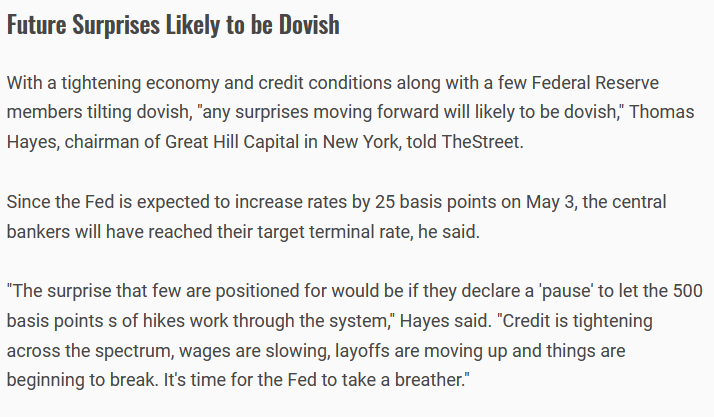

Tom Hayes – Quoted in TheStreet article – 5/2/2023

Thanks to Ellen Chang for including me in her article on TheStreet.com. You can find it here:

Click Here to View The Full Article on TheStreet.com

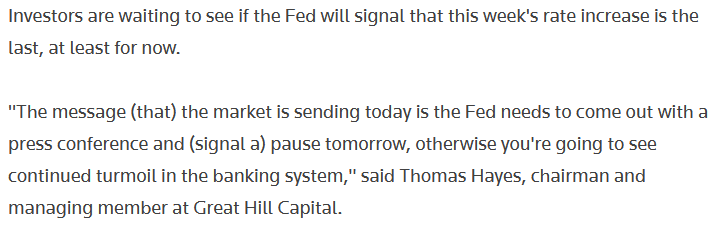

Tom Hayes – Quoted in Reuters article – 5/2/2023

Thanks to Ankika Biswas and Sruthi Shankar for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Reuters Article

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 25 key reads for Tuesday…

- Devils blank Rangers in Game 7, advance past rivals (espn)

- In China, It’s Time to Splurge Again, and the Luxury Industry Is Relieved (nytimes)

- Fed expected to raise interest rates again this week — perhaps for the last time this cycle (marketwatch)

- China dominates global IPO market as Wall Street fails to rebound (ft)

- First Republic Deal Is a Coup for Jamie Dimon and JPMorgan (barrons)

- Here are the 6 factors that suggest the stock market bottomed last October and will continue to rally from here (businessinsider)

- Beijing likely to ‘keep market support coming’ as China’s home sales tank (scmp)

- China Tourists Overwhelm Attractions as Travel Explodes After Covid (bloomberg)

- Marriott’s Revenue Jumps 34%. It’s Not Seeing a Slowdown in Travel Demand. (barrons)

- Pfizer Stock Jumps After Sales Beat. There’s More Good News From Earnings. (barrons)

- Molson Coors adjusted profit jumps 82% (marketwatch)

- Yellen Sets June 1 as New Debt Limit Deadline (barrons)

- Casinos Are Still a Good Bet, Surging Macau Data Show (barrons)

- Tesla Raises EV Prices by $250. Why It’s a Brilliant Move. (barrons)

- Ford Earnings Are Coming. What’s Needed to Get the Stock Out of Its Doldrums. (barrons)

- FDIC recommends raising deposit insurance limit for business accounts after bankfailures (marketwatch)

- “Alibaba now trades at its steepest-ever discount to net asset value, according to Goldman’s estimates.” (bloomberg)

- Federal Reserve Meeting: Will ‘Dovish Hike’ Spark S&P 500 Rally? (investors)

- Why the human genome could be healthcare’s holy grail (yahoo)

- Investors warn of First Republic aftershocks at gloomy Milken gathering (ft)

- How Jamie Dimon swooped on the remains of First Republic (ft)

- Fed in stride to pole-vault 5% policy rate, then perhaps catch its breath (reuters)

- Stocks could soon retest all-time highs as markets react to possible ‘thesis-changing’ final rate hike from the Fed, Fundstrat says (businessinsider)

- 3 Failed Banks This Year Were Bigger Than 25 That Crumbled in 2008 (nytimes)

- The Inside Story of Buffett’s Big Japan Bet, Over Glasses of Coke at Four Seasons (bloomberg)