Data Source: Finviz

Hedge Fund Tips with Tom Hayes – Podcast – Episode 175

Article referenced in Podcast above:

“Tell Me You’re Pausing, Without Telling Me You’re Pausing” Stock Market…

Be in the know. 15 key reads for Friday…

- What Bank Turmoil? Insiders Are Scooping Up Bank Stocks. (barrons)

- Intel CEO Pat Gelsinger Buys Up Stock After Earnings (barrons)

- Apple’s Earnings Were All About the iPhone (barrons)

- Why Powell Thinks the Federal Reserve Can Tame Inflation Without Recession (barrons)

- Block’s Revenue Grew 26%, Driven by Cash App (barrons)

- Why a tumbling 2-year Treasury yield may signal Fed ‘policy mistake’ (marketwatch)

- ‘Taking out the hike that just happened’: Traders ignore Powell and begin pricing in a Fed rate cut as soon as June (marketwatch)

- Royal Caribbean Stock Surges. Consumers Are Still Spending on Cruises. (barrons)

- ChatGPT Will Disrupt Many Jobs. These Are the Most at Risk. (barrons)

- U.S. Trade With World Rose in March on Energy, Auto Shipments (wsj)

- Billionaire Stephen Ross Bets on New Offices, Sees Havoc for Old Towers (bloomberg)

- Consumers in China are paying to dine at nicer restaurants (cnbc)

- Chinese insurance stocks back in favour after best first-quarter result in five years (scmp)

- Ping An, Baidu, Tencent push Hong Kong stocks to best week since March on US rate-cut bets amid bank crisis (scmp)

- The market is wrong and this will be the last rate hike, says Fmr. Fed Vice Chair Quarles (cnbc)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 185

Article referenced in VideoCast above:

“Tell Me You’re Pausing, Without Telling Me You’re Pausing” Stock Market…

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Thursday…

- Watch the “Deadpool” (hedgefundtips)

- Billionaire investor Bill Ackman warns more banks will fail unless the FDIC insures all deposits (businessinsider)

- Consumer spending by China Alipay, WeChat Pay users surges over holiday (scmp)

- Retail investors have ‘rage sold’ out of the stock market after driving the pandemic-era trading boom just 2 years ago (businessinsider)

- Powell Says Banking System ‘Sound and Resilient.’ Try Telling That to PacWest Investors. (barrons)

- Here’s when history says the post-Fed pause rally should start — and the two unlikely sectors to benefit (marketwatch)

- ‘We are running out of time to fix this problem’: Bill Ackman’s latest warning on regional banks (marketwatch)

- ‘Deposits are going to keep drifting out,’ says DoubleLine’s Gundlach, warning of echoes of S&L crisis at banks (marketwatch)

- Fed pause baked in after “dovish” hike (streetinsider)

- PacWest Drops Further. Other Regionals Follow. (barrons)

- One Sign Inflation Will Wane: It’s Getting Easier to Find Truck Drivers (barrons)

- Apple is about to rain billions more on investors as cash position shrinks (marketwatch)

- Moderna Posts Earnings Beat. (barrrons)

- Biotech ImmunoGen Stock Jumps 140% After Positive Drug Trial Data (barrons)

- ‘Generous but expensive’: The costs of helping banks alleviate deposit stress don’t come cheap (marketwatch)

- Workers Have High Hopes for Pay Raises, Companies Not So Much (wsj)

- China’s Tightening Grip on Foreign Firms Risks Hitting Investment (wsj)

- Pushback Against Powell’s Prognosis Comes Almost Immediately (bloomberg)

- PacWest Tries to Calm Jittery Markets After 60% Stock Plunge (bloomberg)

- Mohamed El-Erian slams Powell’s suggestion that the bank turmoil is over – says it could be added to a list of Fed communications that eroded its credibility. (businessinsider)

- First Horizon Shares Crash After TD Bank Deal “Terminated” (zerohedge)

- Alipay and WeChat Pay data shows China consumer spending over May holidays exceeded pre-Covid levels (scmp)

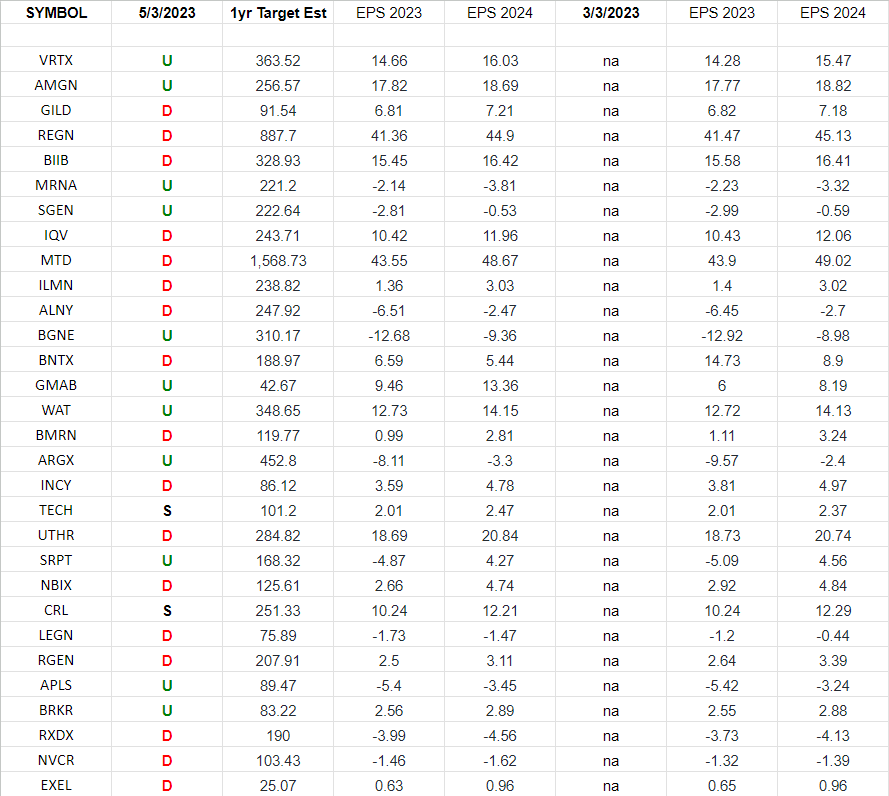

Biotech Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Biotech ETF (IBB) top 30 holdings.

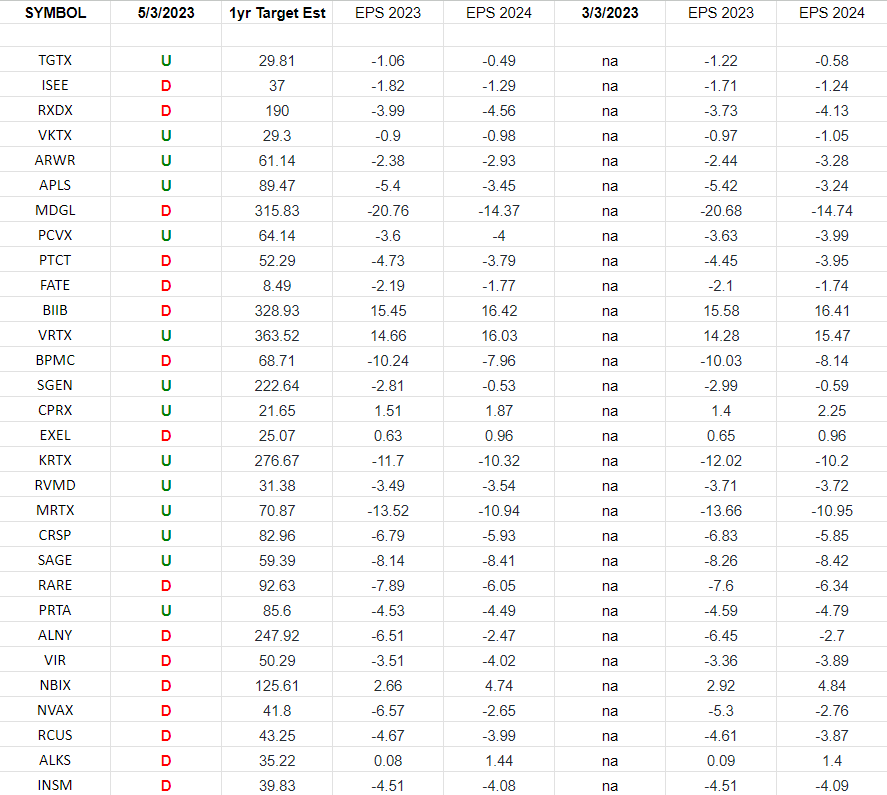

(Equal Weight) Biotech Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Equal Weighted Biotech ETF (XBI) top 30 holdings.

Continue reading “(Equal Weight) Biotech Earnings Estimates/Revisions”

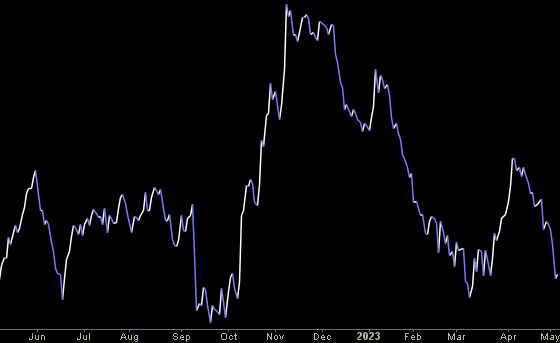

“Tell Me You’re Pausing, Without Telling Me You’re Pausing” Stock Market…

On Wednesday, Chairman Powell bumbled his way to another selloff. Par for the course – as he holds the record for worst market performance following his communications: Continue reading ““Tell Me You’re Pausing, Without Telling Me You’re Pausing” Stock Market…”