Data Source: Finviz

Be in the know. 18 key reads for Wednesday…

- Northrop and Lockheed win missile defense contracts valued at up to $7.6 billion (StreetInsider)

- Pfizer Will Test a Pill to Kill the Covid-19 Virus (Barron’s)

- Pfizer Goes It Alone to Expand Vaccine Business Beyond Covid-19 Pandemic (Wall Street Journal)

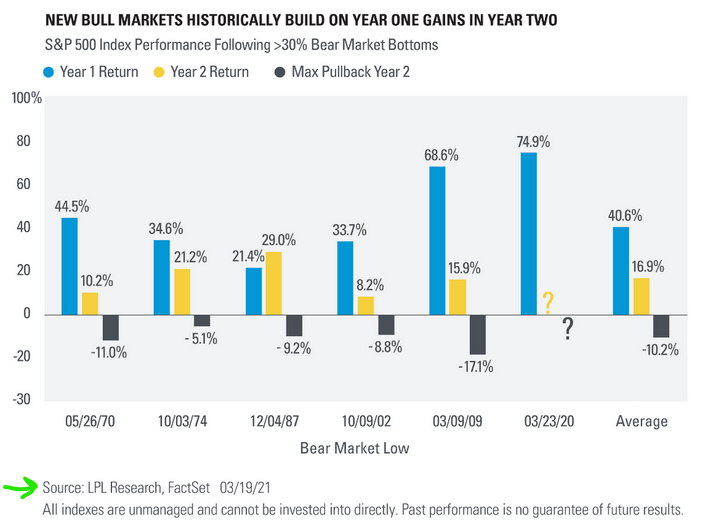

- The new S&P 500 bull market is about to enter its second year. Now what? (MarketWatch)

- Powell and Yellen’s game plan is evocative of the World War II playbook. Here’s what happened then. (MarketWatch)

- Convertible Bonds Are Booming. Here’s What You Need to Know. (Barron’s)

- Regeneron Stock Climbs on Positive Covid-19 Antibody Data (Barron’s)

- Citigroup and 5 More Lenders Poised for Gains in ‘Bank Renaissance’ (Barron’s)

- 5 Beaten-Down Renewable Energy Stocks That May Be Worth a Look (Barron’s)

- Intel’s New CEO Is Spending $20 Billion to Double Down on Chip Manufacturing (Barron’s)

- Powell Says Stimulus Package Isn’t Likely to Fuel Unwelcome Inflation (Wall Street Journal)

- New York Business Leaders Urge State Lawmakers to Not Raise Taxes (Wall Street Journal)

- Fed’s Bullard won’t forecast any interest-rate hikes until he sees proof of strong economy (MarketWatch)

- Bostic expects Fed to lift rates in 2023 – WSJ (Reuters)

- Hawaii gets tourism surge as coronavirus rules loosen up (Fox Business)

- Coronavirus latest: Merkel reverses course on Easter lockdown in Germany (Financial Times)

- BofA Raises Price Targets for US Banks on Faster-Than-Expected Recovery (StreetInsider)

- Banks stand firm on calls for oil ‘supercycle’ even as price drops (Financial Times)

Tom Hayes – Cheddar TV Appearance – 3/24/2021

Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 24, 2021

Tom Hayes – CGTN America Appearance – 3/23/2021

Tom Hayes – The Claman Countdown – Fox Business Appearance – 3/23/2021

Tom Hayes – TD Ameritrade Network Appearance – 3/23/2021

TD Ameritrade Network Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 23, 2021

Where is money flowing today?

Be in the know. 20 key reads for Tuesday…

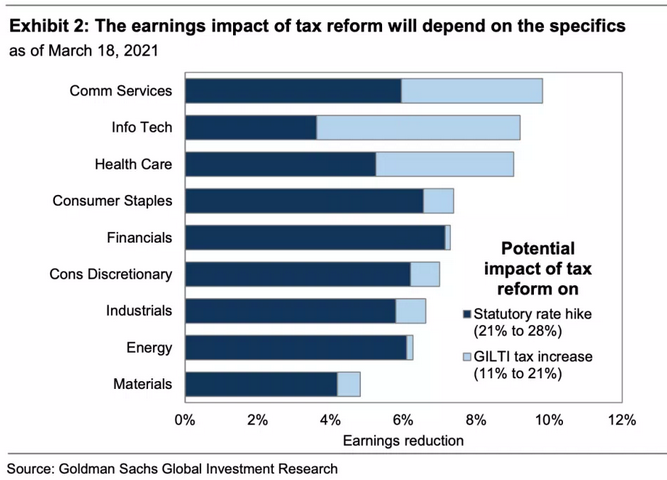

- Tax hikes are the next big investor worry: Morning Brief (Yahoo! Finance)

- Biden Team Prepares $3 Trillion in New Spending for the Economy (New York Times)

- Campbell and B&G Foods Have Outperformed. Only One Is a Buy for This Analyst. (Barron’s)

- Infrastructure Plan Seeks to Address Climate and Equality as Well as Roads (New York Times)

- Regeneron says its COVID-19 treatment still works even at a lower dose (MarketWatch)

- Top Yale Doctor/Researcher: ‘Ivermectin works,’ including for long-haul COVID (trialsitenews)

- Change of menu: Kraft Heinz bets on old brands to win new consumers (Financial Times)

- Here Are 6 REITs Set to Gain as Economy Reopens (Barron’s)

- Germany To Enter Strict Easter Shutdown Amid ‘New Pandemic’ (Barron’s)

- Short and Hot: How Investors Can Play This Economic Cycle (Barron’s)

- Why the Canadian Pacific-Kansas City Southern Deal Is Bullish for Railroad Stocks (Barron’s)

- Bank of America CEO Says Its Earnings Are Poised to ‘Substantially Increase’ (Barron’s)

- Joe Biden Wants to Raise Taxes. What It Would Mean for the Stock Market. (Barron’s)

- Fed’s Powell Says Recovery Is Far From Complete (Wall Street Journal)

- Lockheed Martin partners with startup Omnispace to build space-based 5G network (CNBC)

- Pension funds to buy bonds to rebalance portfolios, and that may help stocks (CNBC)

- Billionaire investor Howard Marks touts value stocks, trumpets high-quality growth stocks, and says he’s open-minded about bitcoin in a new interview. Here are the 9 best quotes. (Business Insider)

- 5 Goldman Sachs Conviction List Stocks to Buy Now That Pay Big Dividends (24/7 Wall Street)

- UK unemployment rate unexpectedly falls to 5% in January as the country looks ahead to reopening (Business Insider)

- Stocks slump at the open Tuesday as fresh lockdowns sweep the globe (MarketWatch)

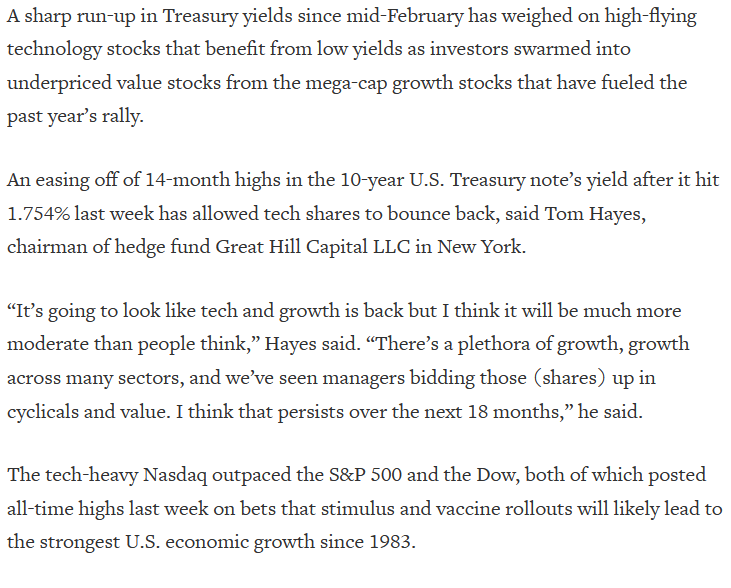

Tom Hayes – Quoted in Reuters article – 3/22/2021

Thanks to Herb Lash for including me in his article on Reuters this afternoon. You can find it here:

Unusual Options Activity – Pfizer Inc. (PFE)

Data Source: barchart

Today some institution/fund purchased 17,218 contracts of June $39 strike calls (or the right to buy 1,721,800 shares of Pfizer Inc. (PFE) at $39). The open interest was 10,240 prior to this purchase. Continue reading “Unusual Options Activity – Pfizer Inc. (PFE)”