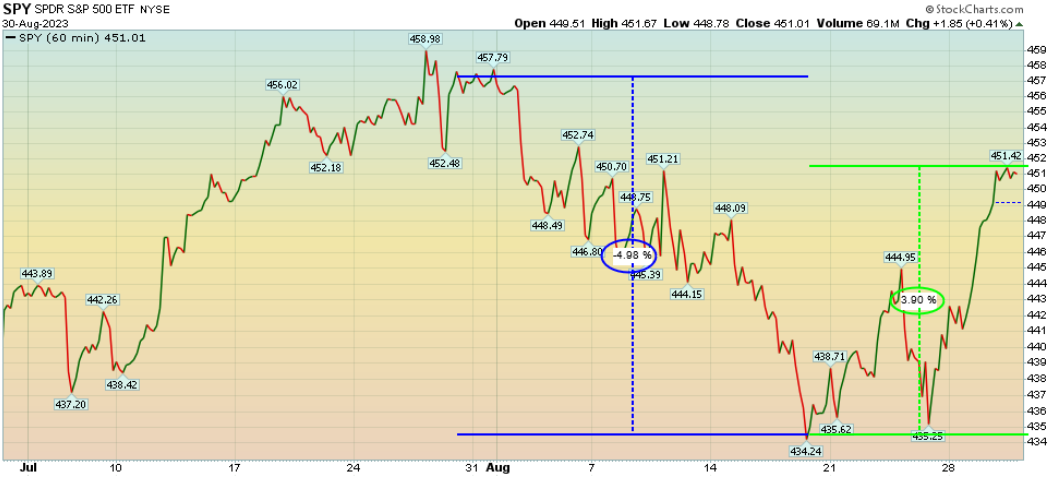

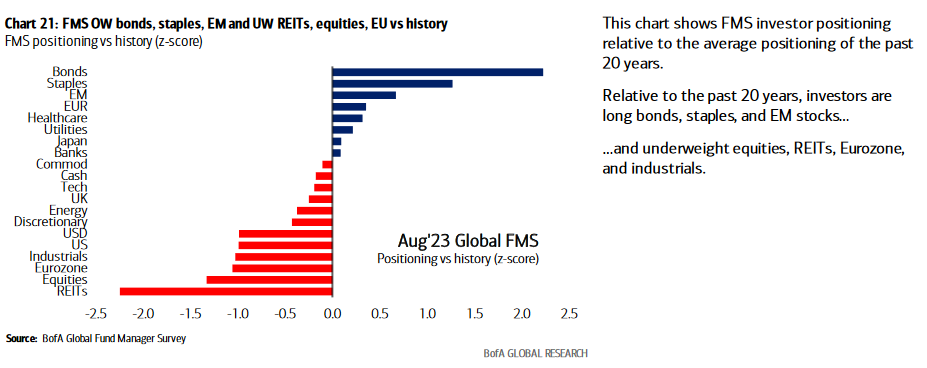

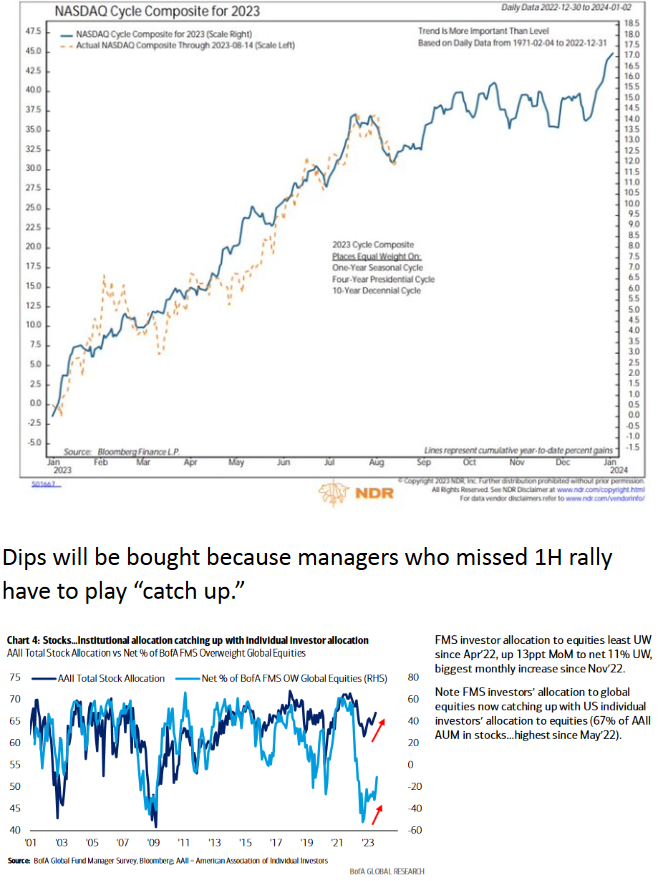

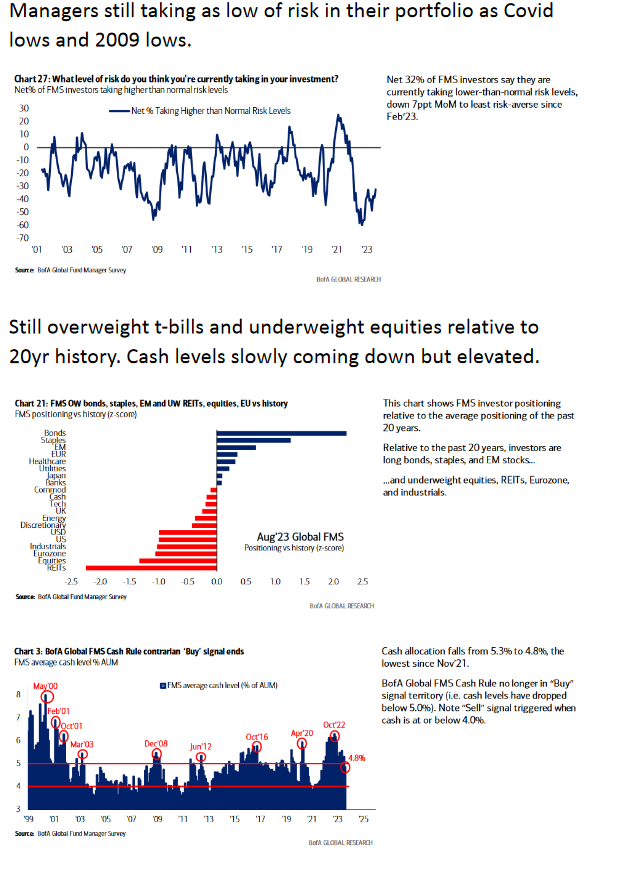

In our July 27, 2023 weekly note and podcast|videocast we talked about a 3-5% pullback in the month of August. We also said we expected these dips would be BOUGHT due to the fact that most managers under-performed in 1H and were still overweight cash/t-bills and underweight equities (relative to their 20 year history):

Last week we went through a sampling of the tremendous opportunities still to be had for those who feel like they missed the boat:

“At The Starting Gate” Stock Market (and Sentiment Results)…

The podcast was extremely detailed on a case by case basis:

In my media appearances yesterday I talked about what this “catch up” trade would look like and some areas we are finding opportunity to pounce.

First, I joined Nicole Petallides – on The Schwab Network – live from the NYSE. Thanks to Heidi Schultz and Nicole for having me on (and Kenny Polcari for making the connection). Also Thanks to Joshua A. Gallant for being a great host. You can watch it here 👇 👇 👇

Watch Directly on Schwab Network

Later in the afternoon I joined Seana Smith and Akiko Fujita on Yahoo! Finance. Thanks to Taylor Clothier, Sydnee Fried, Seana and Akiko for having me on. You can find it here 👇 👇 👇

Later in the afternoon I joined Seana Smith and Akiko Fujita on Yahoo! Finance. Thanks to Taylor Clothier, Sydnee Fried, Seana and Akiko for having me on. You can find it here 👇 👇 👇

Watch in HD directly on Yahoo! Finance

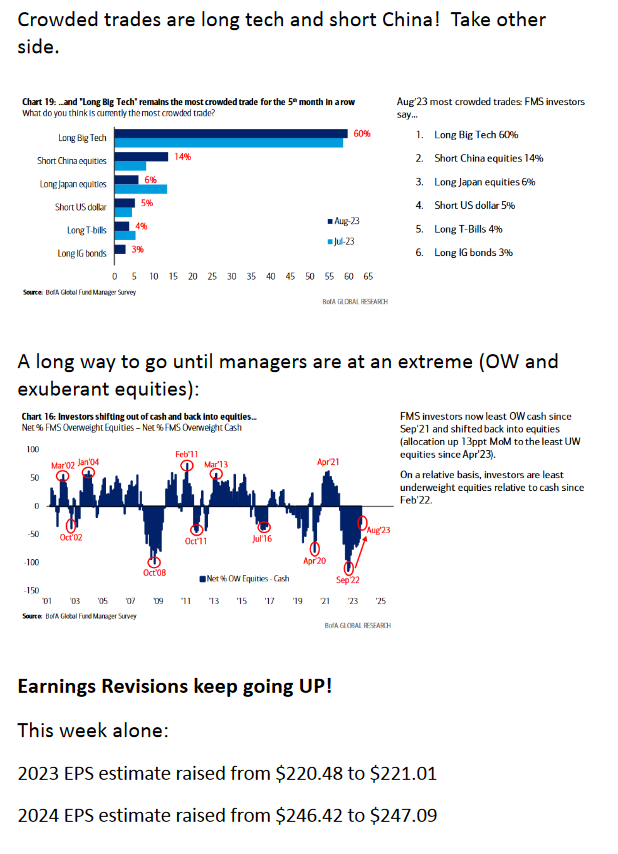

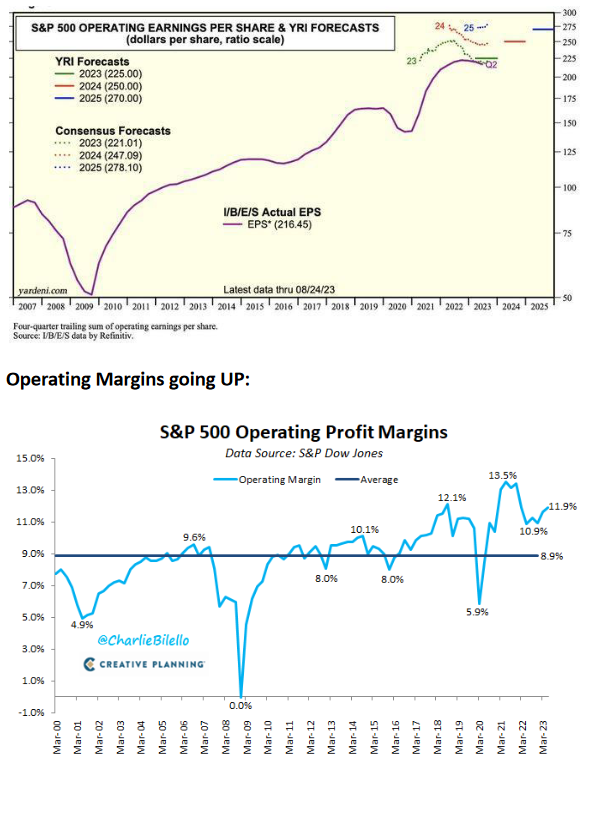

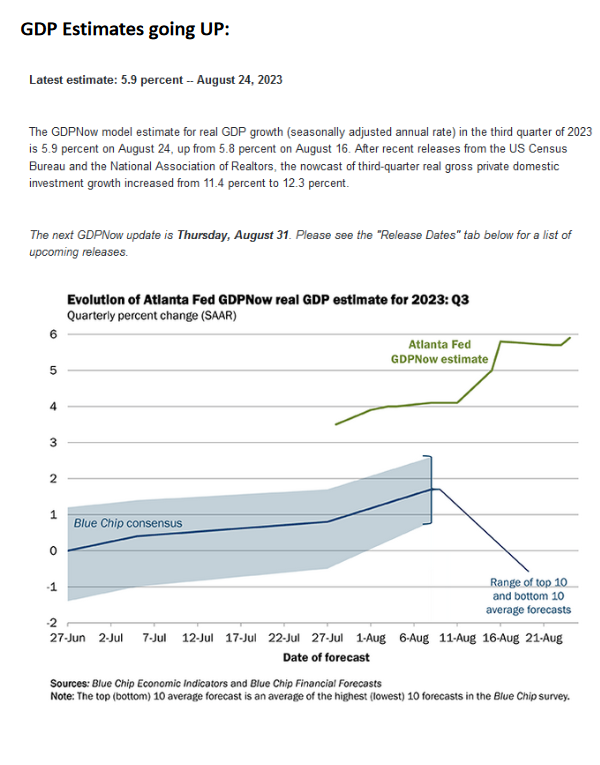

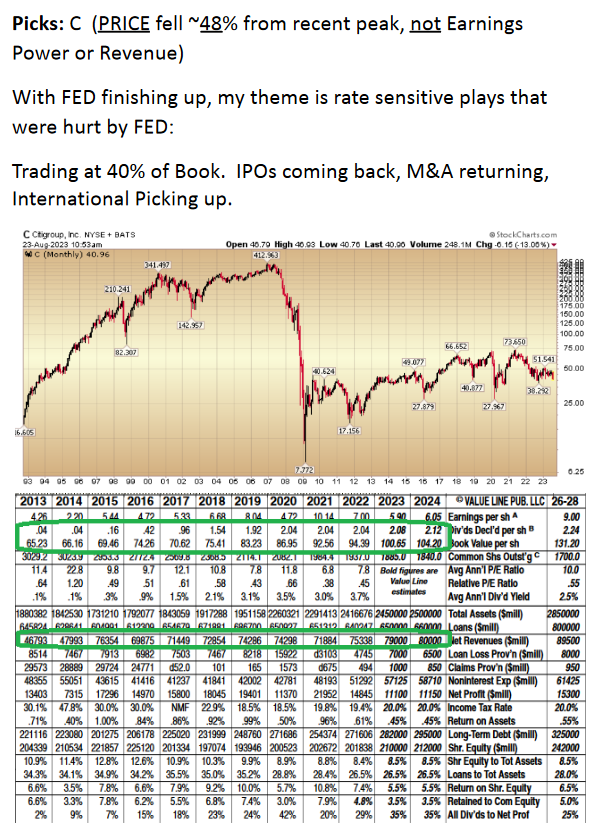

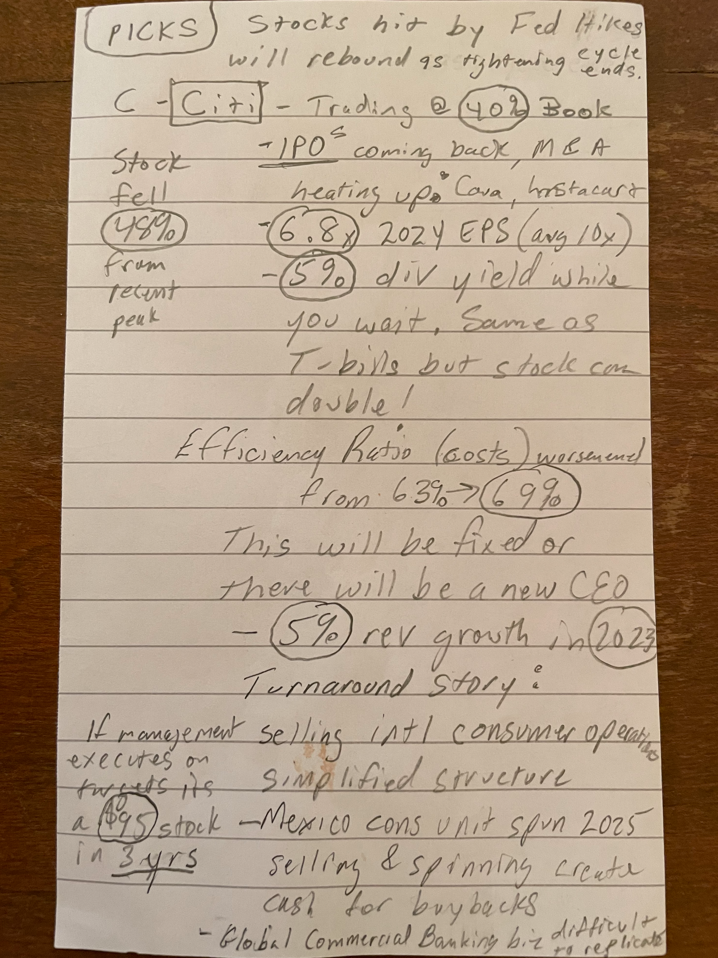

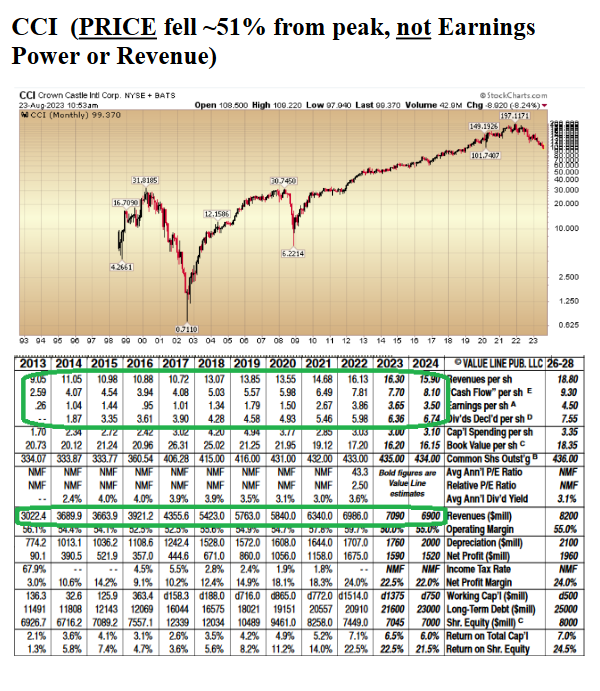

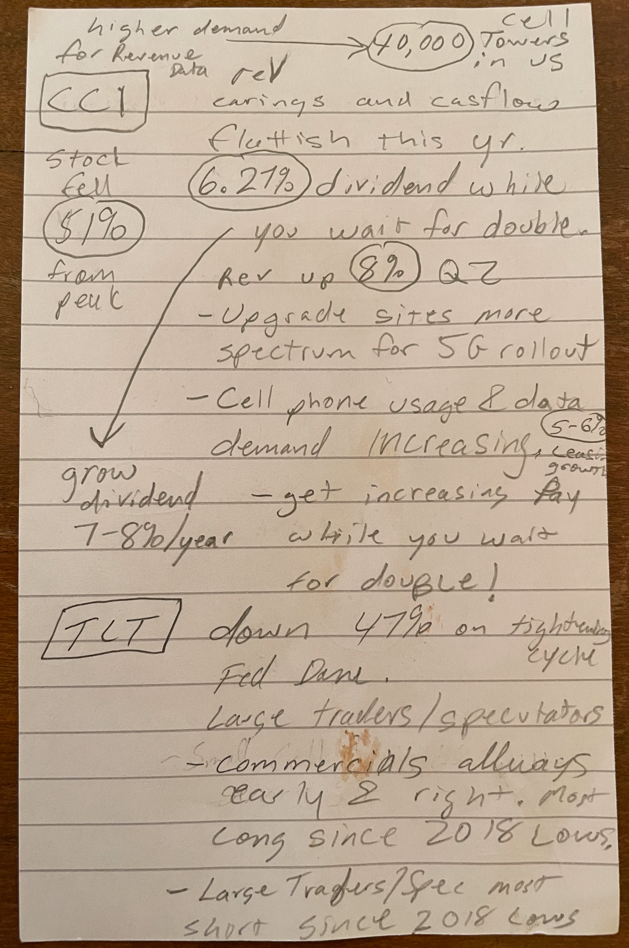

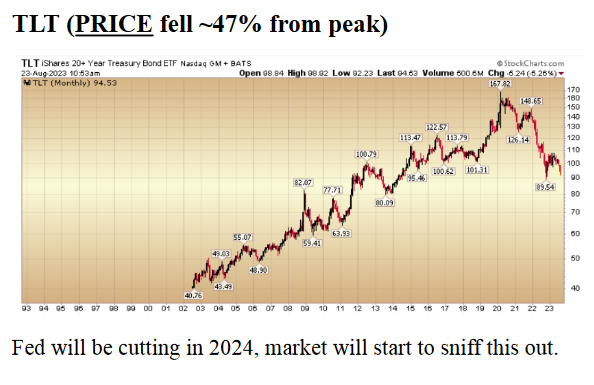

Here were some of my “show notes” ahead of the segments:

h/t Seth Golden

h/t Seth Golden

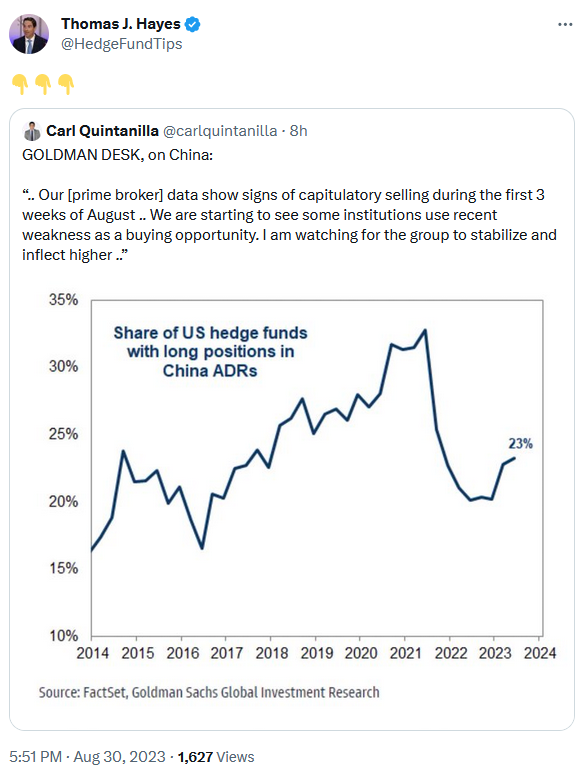

BABA UPDATE

Cooper Standard Update

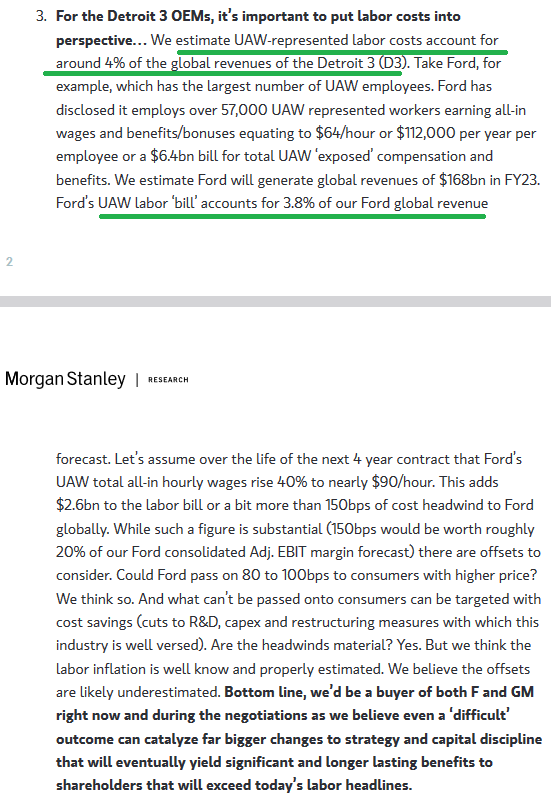

Morgan Stanley’s Jonas on UAW strike:

Now onto the shorter term view for the General Market:

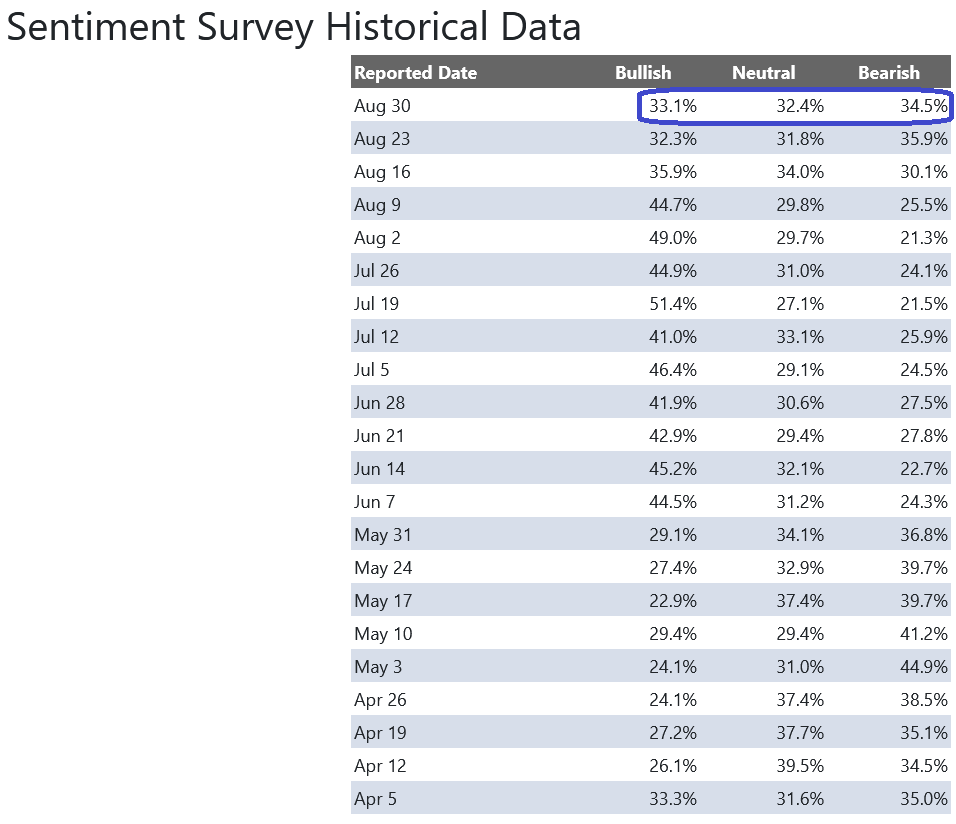

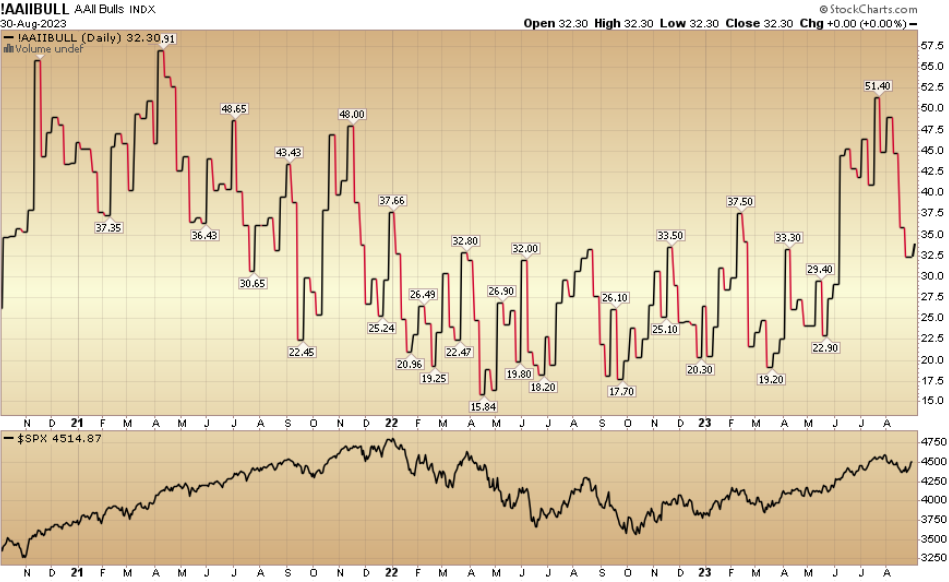

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 33.1% from 32.3% the previous week. Bearish Percent ticked down to 34.5% from 35.9%. The retail investor is showing continued trepidation.

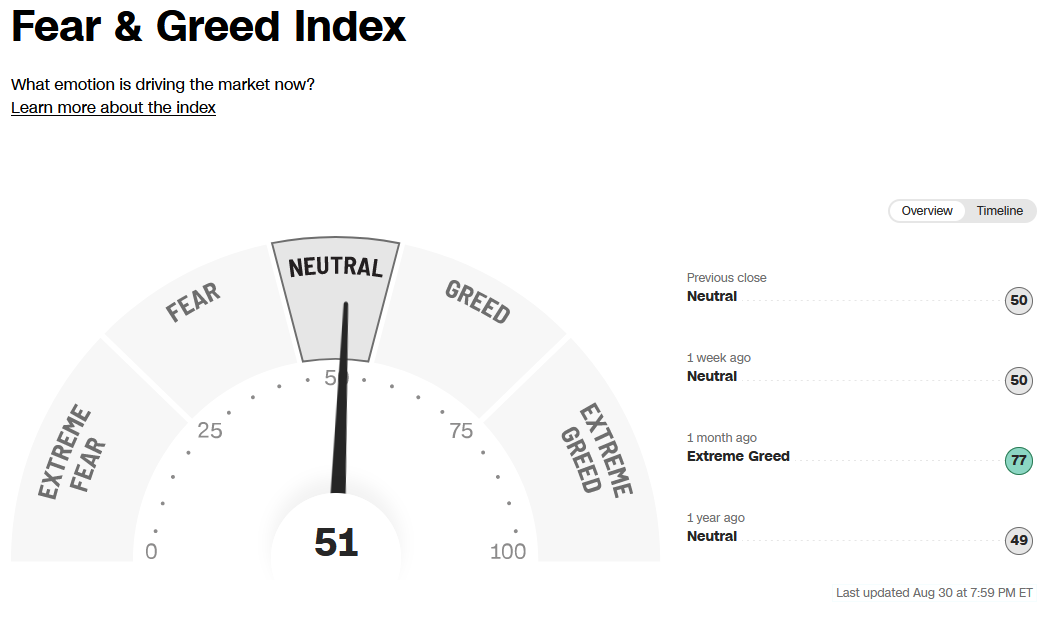

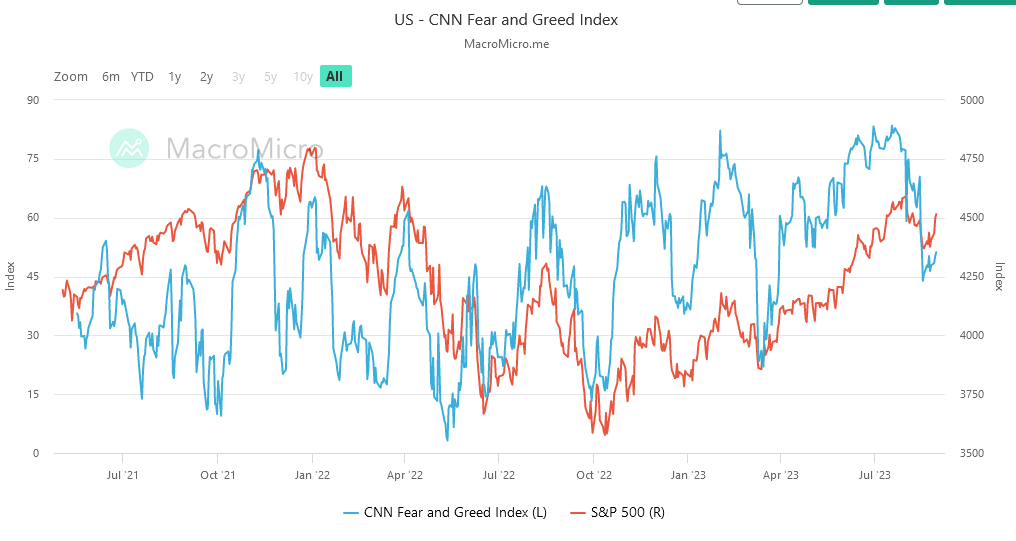

The CNN “Fear and Greed” ticked up from 49 last week to 51 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

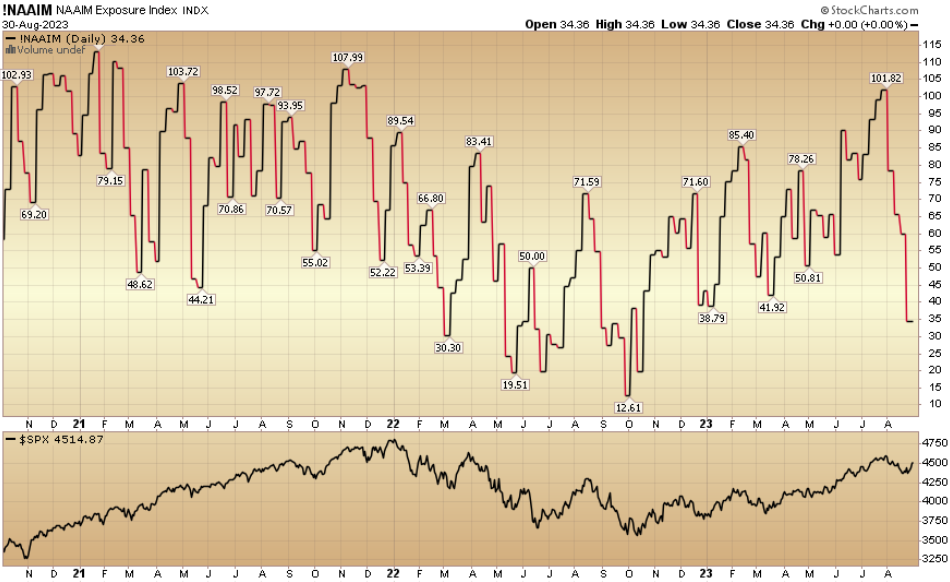

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 34.36% this week from 59.87% equity exposure last week. Guess who sold in the hole and is going to have to “chase up” yet again?

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 34.36% this week from 59.87% equity exposure last week. Guess who sold in the hole and is going to have to “chase up” yet again?

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

***After being highly exclusive since 2019 (and closed to new investors prior to that), our business is expanding to serve an additional tier of clients (below $5MM). The response we have received since opening up ($1MM+ accounts) in the past month or so has dramatically exceeded our expectations.

If you missed the last round, we expect to re-open to the current waiting list on or around September 15. Those of you who have submitted your documents and set up your account at IB should be ready to fund on (or around) that day (we will notify you in the order you sent in your documentation). You are confirmed for this round. Anyone looking to move ahead and join the list should go here for further details.

*Opinion, not advice. See “terms” above.