In last week’s note, “The 10:3 (Risk to Reward) Stock Market” we made the case that while there was limited upside, the downside risks had increased materially. You can review it here:

This week we realized some of that risk with the spread of coronavirus outside of China.

The Good News:

-China has plateaued and new cases are coming down every day.

-Central Banks are standing guard to continue liquidity as needed.

-Gilead has a drug that has shown anecdotal curative ability and is now awaiting approval for widespread use on humans.

-There are very few cases in U.S.

The Bad News:

-While AAPL started the Q1 earnings guidance takedown, many other companies are starting to follow suit. We warned of this on Yahoo Finance on February 12:

Tuesday night on i24NewsTV I compared this situation to the Euro Crisis in 2011-2012. No one could QUANTIFY the economic exposure if countries began to leave the eurozone one by one. As a result, the market corrected 20% before Draghi intervened with a “whatever it takes” bazooka – and took several months to find its footing before ultimately making new highs the next year.

My sense is that this time we will be able to QUANTIFY the impact much more quickly. The catalyst will be when they announce the approval to use Gilead’s Remdesivir to treat the coronavirus in humans (which could happen at any point in time).

I would not want to be short on the morning that you wake up to that headline because even if the virus spreads further, people will take comfort that there is a cure and that it is treatable like a regular cold. At that point the logic of the numbers will kick in and people will say, “I’ll go ahead with my plans because the odds of getting it are so low, and even if I do I’ll just take the anti-viral drug.”

The other similarity to 2011-2012 period was that after the market had rallied 32% of its lows in 2011 to Spring 2012, managers that were left behind, started chasing with leverage through massive purchases of options at the exact wrong time. They were doing the same thing in early February 2020, which we covered here:

What the market is grappling with on a day to day basis is whether this will be a one quarter event (China cases going down, many factories coming back online), or longer as new countries have to go through the same multi-month process of containment, quarantine, travel shutdown etc.

It’s very difficult to know, but some stocks are getting closer and closer to levels that most of the “worst case scenario” may be nearly priced in.

What good can come out of this short term uncertainty?

1. This may be the catalyst that forces governments around the world to drop their over-dependence on monetary stimulus and instead FINALLY take action with global fiscal stimulus and infrastructure spend. This would be paramount for global growth. We already saw signals from Germany yesterday morning that they may finally turn the corner on this front:

Germany may ease debt limit rules as pressure to spend more grows (Reuters)

Hong Kong has already opted for “Helicopter Money” stimulus:

Every Adult in Hong Kong to Get Cash Handout of $1,284 (Bloomberg)

2. This may force OPEC+ to implement “shock and awe” cuts in coming weeks (more than 500K/bbd) as an antidote to uncertainty around the magnitude of short term economic slowdown/demand.

3. Both of these positive catalysts may come to bear just as we are turning the corner into a warmer seasonal period (when viruses have a tendency to go dormant) which would buy us significant time to develop a vaccine before fall/winter.

There is no perfect way to trade this in the short term. If history is any teacher, the market most often overreacts and you are paid to step in selectively as the majority are puking out. There are a number of indicators we use to measure these extremes. You can learn about all of them here:

Click to view Market Indicators videos

The last risk that is compounding the short term volatility is the rise of Bernie Sanders. This was identified as one of the biggest risks to the market in last week’s Bank of America Global Fund Manager Survey:

February Bank of America Global Fund Manager Survey Results (Summary)

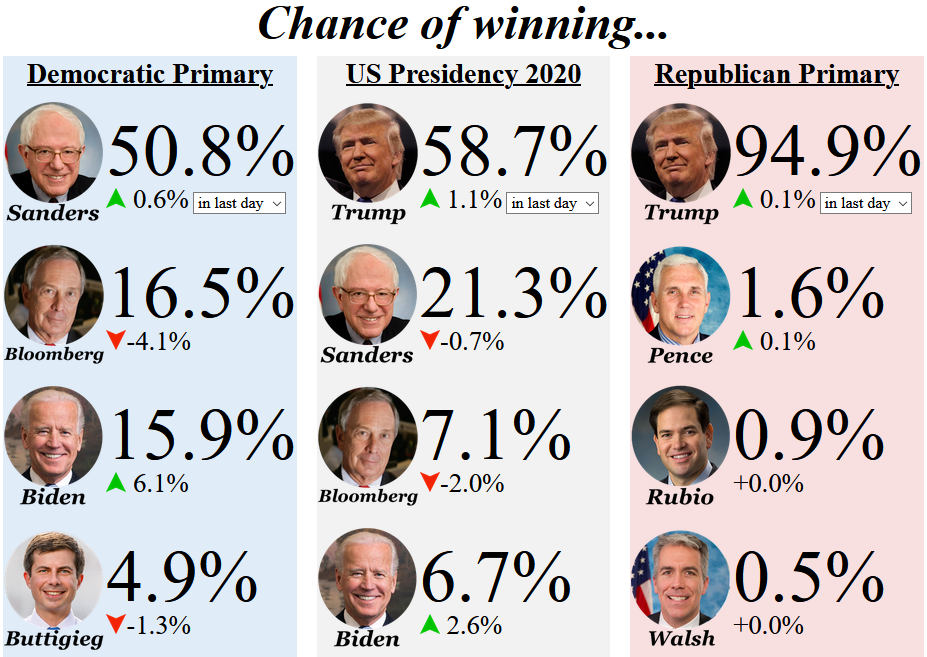

While Senator Sanders currently has very little chance of winning the general election against President Trump (as defined by the https://electionbettingodds.com/ below), the fact that he has gained this much momentum has the markets a bit on guard:

Now onto the shorter term view for the General Market:

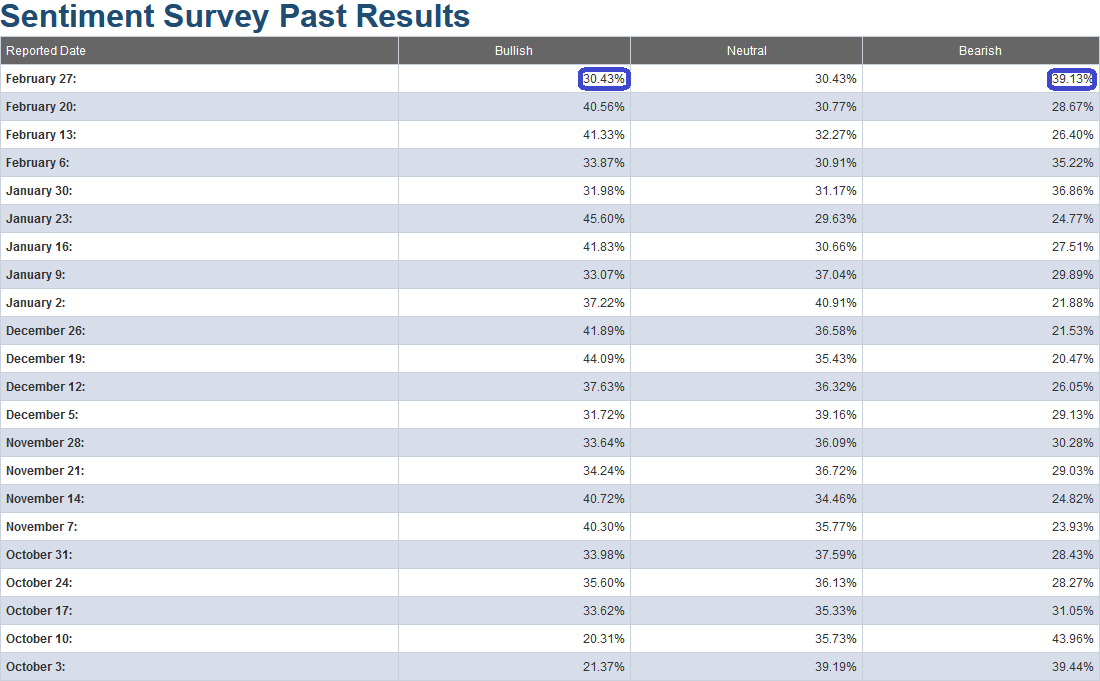

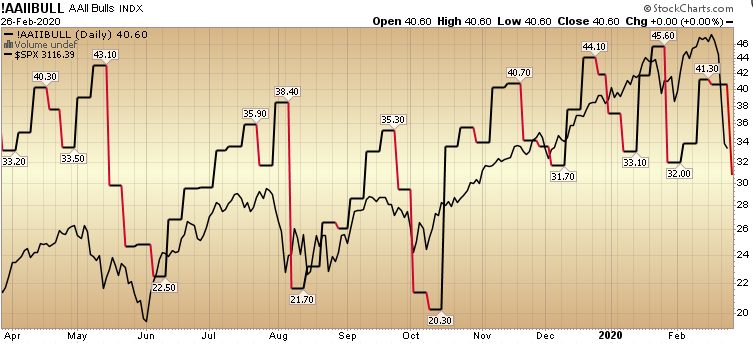

This week’s AAII Sentiment Survey result (Video Explanation) Bullish Percent dropped to 30.43% from 40.56% last week. Bearish Percent jumped to 39.13% from 28.67% last week.

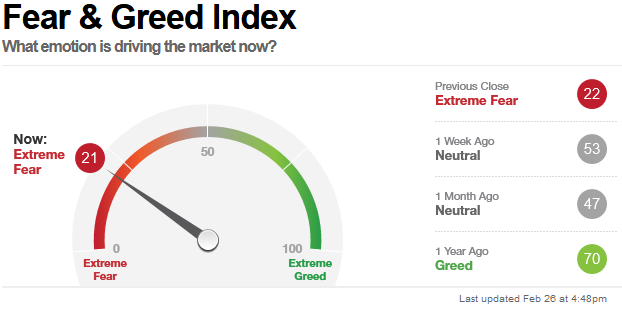

The CNN “Fear and Greed” Index dropped from 53 last week to 21 this week. We are nearing an extreme in sentiment on this measure. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation Here) rose from 86.08% equity exposure last week, to 87.91% this week. They chased up at exactly the wrong time:

We have started to selectively nibble on those stocks/sectors which are nearing valuation levels that we would define as “pricing in at/near the worst case scenario.”

Most stocks do not yet meet this measure (as the “worst case” is unlikely to materialize), but for those that do we are selectively nibbling and will continue to do so as opportunity presents itself in coming days and weeks.

As for those who have a long term horizon, this is mostly noise. It is more likely than not, the market will make new highs before year-end (2H) as Boeing gets the 737 Max back online and its earnings give a turbo-boost to the S&P 500 (they have lost $16/share of earnings power in the last 60 days due to the 737 Max).

But for now, it’s day by day and opportunistic execution…