This week’s theme song for the Stock Market is “High Hopes” by, Panic! At The Disco. These hopes are rooted in three factors we will discuss in detail this week: Stimulus/Aid/Liquidity, Treatment, and Demand (re-opening the Country). The salient lyrics from this week’s song are:

Had to have high, high hopes for a living

Shooting for the stars when I couldn’t make a killing

Didn’t have a dime but I always had a vision

Always had high, high hopes

So while the CBO (Congressional Budget Office) estimates GDP will contract by 39.6% in Q2 and finish the year down -5.6%, 26 million people have filed unemployment claims, and we don’t have a vaccine – the market has rallied 34.8% off of its March 23 lows (Didn’t have a dime but I always had a vision!).

So what does the market see that the economy isn’t experiencing at present?

Let me start by saying something that no one is talking about. While in the short term it’s possible the stock market is a bit ahead of itself, WE MAY SEE GROWTH RATES IN 2021 THAT WOULD NOT HAVE BEEN POSSIBLE IF NOT FOR COVID-19.

This morning I discussed this concept on CGTN Global Business. You can watch the interview here:

Part 1:

Part 2:

Yes, I know that sounds crazy to be saying in the middle of a “recession” (2 consecutive quarters of negative GDP growth), but let me break it down further:

Watch Out For the Pothole!

Using round numbers, we have a $20T economy. Assuming we contract ~6% in 2020, that is a loss of economic activity of $1.2T (let’s round it up to $1.5T). This is what I continually refer to as the “pothole” that needs to be filled.

Call in the Government to Fill this Pothole!

Congress:

– Passed ~$2.8 Trillion in direct aid and stimulus (to date).

You can see how this is broken up between Individuals, Large Corporations, Small Businesses, State & Local Governments, and Public Services in our article from earlier this month here:

The add-on bill ($483B) was distributed as follows:

- $331B small business payroll loan program (PPP)

- $75B Hospitals

- $25B testing for the virus

- $52B misc.

The Federal Reserve Runs a Kitchen Sink Factory (will throw unlimited Kitchen Sinks at the problem until solved):

- Slashed rates to 0-.25%. Will hold close to zero until “Full Employment” and 2% inflation goal is sustained.

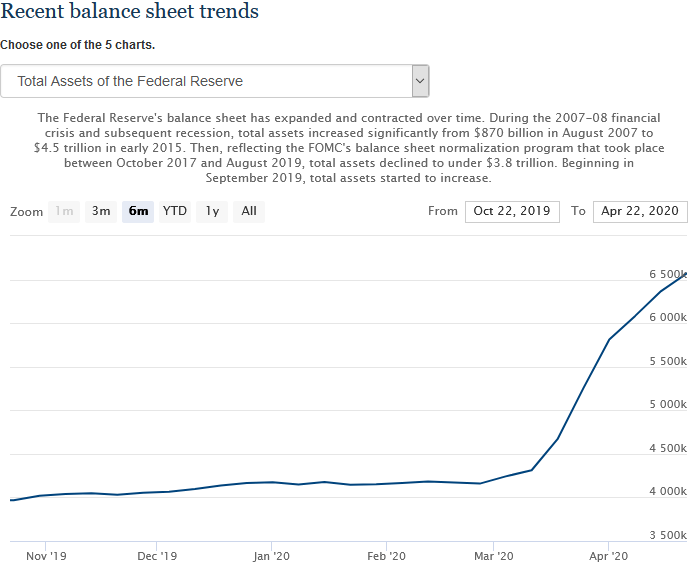

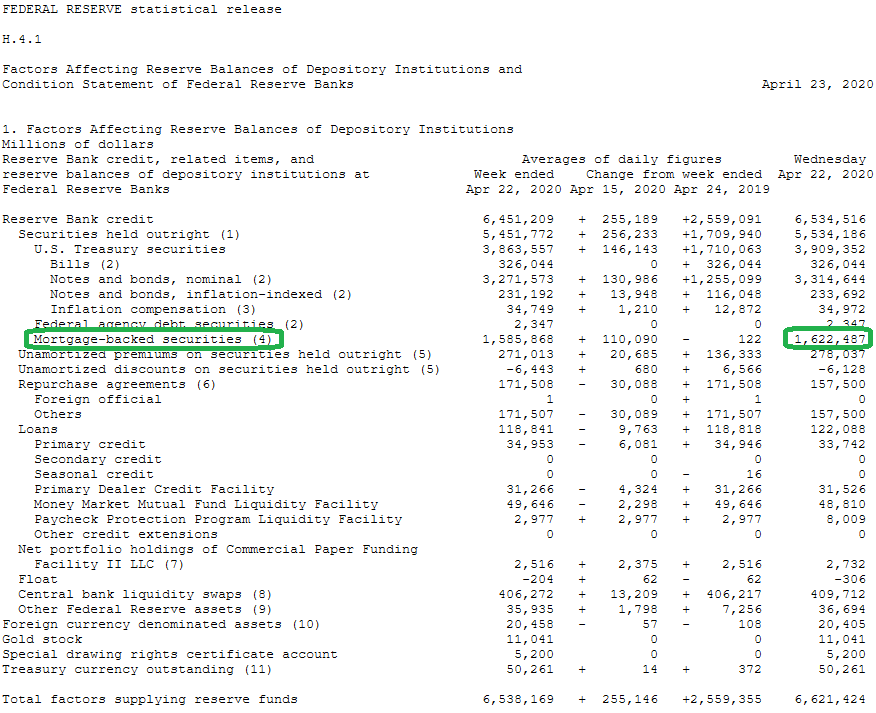

- Quantitative easing (QE). The Fed has increased its balance sheet by ~$2.5T since February 26, 2020 (with Mortgage Backed Securities representing ~1.6T of that increase).

- Discount Window. “On March 16, the federal bank regulatory agencies released a statement encouraging banks to use the Federal Reserve’s “discount window” so that they can continue supporting households and businesses. The discount window provides short-term loans to banks and plays an important role in supporting the liquidity and stability of the banking system. By providing ready access to funding, the discount window helps depository institutions manage their liquidity risks efficiently and avoid actions that have negative consequences for their customers. Thus, the discount window supports the smooth flow of credit to households and businesses.” (Federal Reserve)

- Bank Capital and Liquidity Buffers. On March 15, The Federal Reserve encouraged banks to use their capital and liquidity buffers as they lend to households and businesses who are affected by the coronavirus with this statement, “Since the global financial crisis of 2007-2008, U.S. bank holding companies have built up substantial levels of capital and liquidity in excess of regulatory minimums and buffers. The largest firms have $1.3 trillion in common equity and hold $2.9 trillion in high quality liquid assets. The U.S. banking agencies have also significantly increased capital and liquidity requirements, including improving the quality of regulatory capital, raising minimum capital requirements, establishing capital and liquidity buffers, and implementing annual capital stress tests. These capital and liquidity buffers are designed to support the economy in adverse situations and allow banks to continue to serve households and businesses. The Federal Reserve supports firms that choose to use their capital and liquidity buffers to lend and undertake other supportive actions in a safe and sound manner.” (Federal Reserve)

- Commercial Paper Funding Facility (CPFF). $10B in SPV (multiplies up to $100B). (New York Fed)

- Primary Dealer Credit Facility (PDCF). Up to 90 day loans to Primary Dealers. The facility will allow primary dealers to support smooth market functioning and facilitate the availability of credit to businesses and households. (Federal Reserve)

- Money Market Mutual Fund Liquidity Facility (MMLF). The MMLF will assist money market funds in meeting demands for redemptions by households and other investors, enhancing overall market functioning and credit provision to the broader economy. (Federal Reserve)

- Primary Market Corporate Credit Facility (PMCCF). $75B in SPV (multiplies up to $750B). Serves as a funding backstop for corporate debt issued by eligible issuers. (Federal Reserve)

- Secondary Market Corporate Credit Facility (SMCCF). $75B in SPV (multiplies up to $750B). Will purchase in the secondary market corporate debt issued by eligible issuers. (Federal Reserve)

- Term Asset-Backed Securities Loan Facility (TALF). $10B in SPV (multiplies up to $100B). Intended to help meet the credit needs of consumers and businesses by facilitating the issuance of asset-backed securities (“ABS”) and improving the market conditions for ABS more generally. (Federal Reserve)

- Foreign and International Monetary Authority (FIMA) Repo Facility. The facility reduces the need for central banks to sell their Treasury securities outright and into illiquid markets, which will help to avoid disruptions to the Treasury market and upward pressure on yields. (Federal Reserve)

- Paycheck Protection Program Liquidity Facility. Under the Facility, the Federal Reserve Banks (“Reserve Banks”) will lend to eligible borrowers on a non-recourse basis, taking PPP Loans as collateral. (Federal Reserve)

- Main Street New Loan Facility (MSNLF). MSNLF will be up to $600B. Facilitates lending to small and medium-sized businesses by Eligible Lenders. (Federal Reserve)

- Main Street Expanded Loan Facility (MSELF). MSELF will be up to $600B. Facilitates lending to small and medium-sized businesses by Eligible Lenders. (Federal Reserve)

- Municipal Liquidity Facility. Facility will be up to $500B. It will support lending to U.S. states and U.S. cities with a population exceeding 250,000 residents. (Federal Reserve)

Big Hat Tip to Brian Cheung – a great Reporter at Yahoo! Finance – for pulling all of these programs together into one article. In his article, you can read a short summary of each line item and see how it directly impacts Main Street. Read Brian’s article at (Yahoo! Finance)

2 KEY LESSONS

What I hoped to accomplish by listing (and quantifying) all of the “Kitchen Sinks” that the U.S. Government and Federal Reserve are throwing at the problem – is that you walk away with 2 realizations:

- DON’T FIGHT THE FED.

- DON’T BRING A KNIFE TO A GUN FIGHT.

We have a ~$1.5T short term problem (economic contraction/pothole), and a ~$9T long term solution (excess asphalt to pave over the pothole). We’ll probably get to over $10T – when all is said and done – with Infrastructure and additional aid to the States.

As I said in last week’s note, we will not feel the effect of all of this money/stimulus until people SLOWLY start returning to work and demand returns. But when that in fact happens by late Q3/early Q4, WATCH OUT! There will be in the vicinity of $8.5T of excess stimulus, aid and liquidity – COUPLED with large pent up consumer demand.

The Kanye West, “Drive Slow” Stock Market (and Sentiment Results)…

And that is why I have stated that I think, “many people are underestimating the level of growth that will be achieved in 2021 with an excess $8.5T in the system.” Provided we continue to make progress on treatments (as we have recently seen with Gilead’s Remdesivir – and a few other drugs), and possibly a vaccine, the growth levels we can see in 2021 – will be greater than they would have been without COVID-19 – because we would not have the pent up demand meeting excess stimulus at the same time.

Now onto the shorter term view for the General Market:

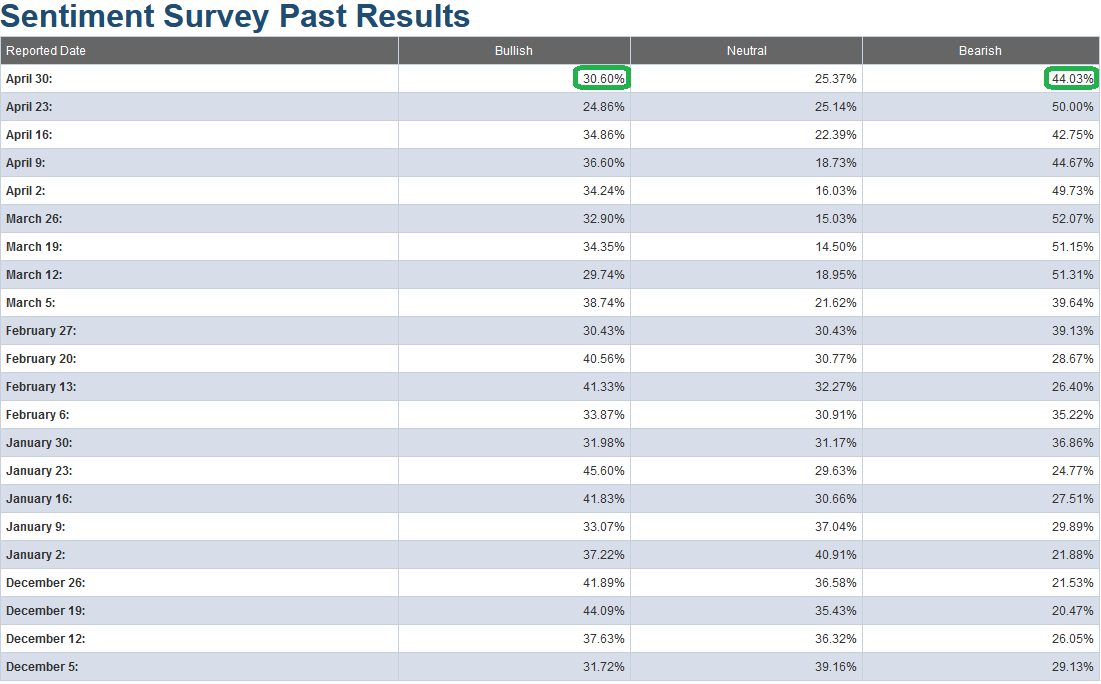

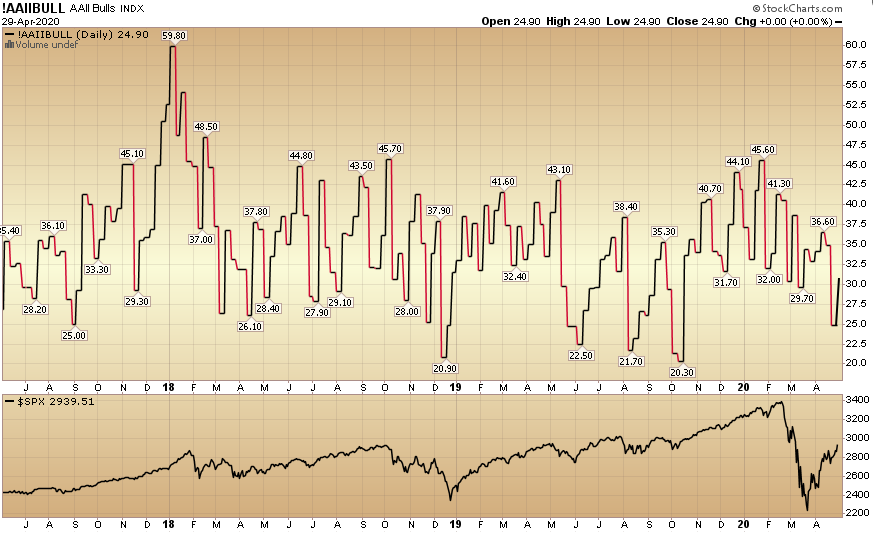

This week’s AAII Sentiment Survey result Bullish Percent (Video Explanation) rose to 30.60% from 24.86% last week. Bearish Percent fell to 44.03% from 50.00% last week. Fear is beginning to thaw only AFTER a 34.8% rally off the March 23 low!

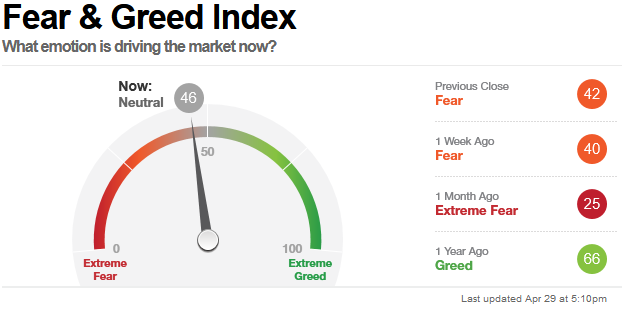

The CNN “Fear and Greed” Index rose from 41 last week to 46 this week. The fear continues to slowly thaw and will move in fits and starts in coming weeks. You can learn how this indicator is calculated and how it works here: (Video Explanation)

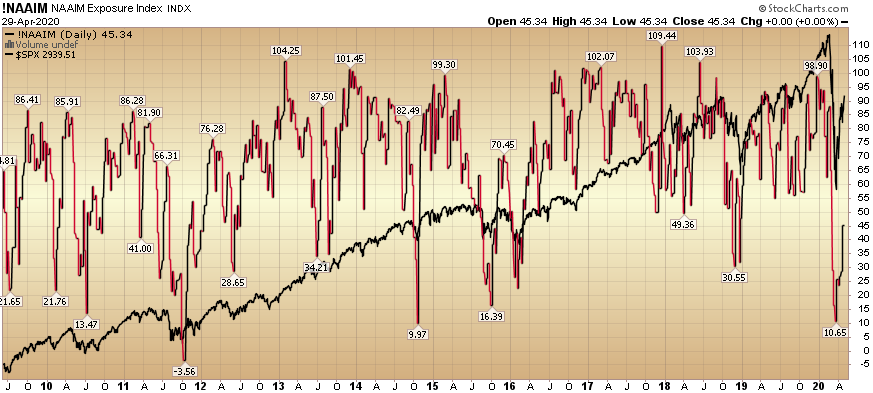

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped from 28.71% equity exposure last week, to 45.34% this week.

As I said for the last few weeks, “Active managers will have to regain exposure in coming weeks as the worst of the news starts to move into the rear view mirror.” After a 34.8% rally off the March 23rd lows, they are finally starting to chase.

Our message for this week:

In last week’s note, we made the case for a sector rotation into banks. You can read it here:

The Kanye West, “Drive Slow” Stock Market (and Sentiment Results)…

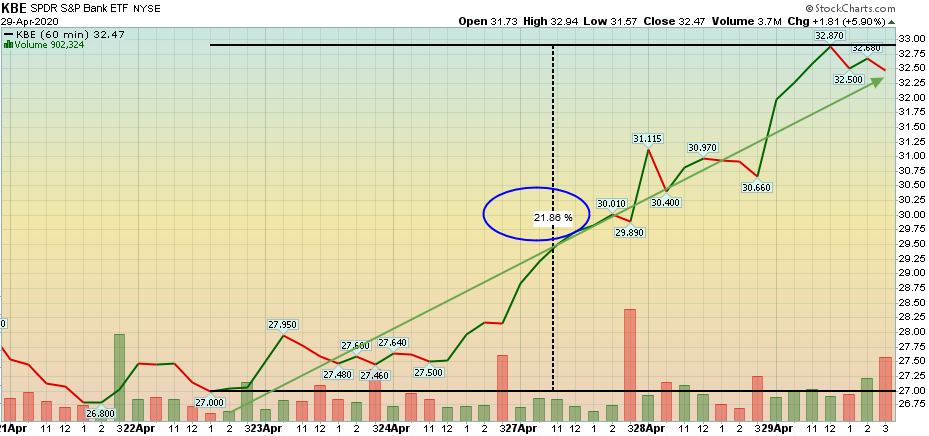

This week, the rotation started in earnest with a 21+% rally in the KBE bank index in the last 7 days:

We continue to keep a close eye on the recent out-performance/relative strength/ broadening of the rally to Banks, Small Caps, Home Builders, etc.

Because we have taken advantage of most of the best discounts that were available in equities (during mid-March to early April – see previous weekly notes under “sentiment” category of the site), we shifted focus in the past few weeks to start picking up a selective portfolio of distressed high yield credit – that has fallen materially since the advent of COVID-19 (i.e. some bonds have fallen as much as 40-60% in the past 8 weeks – from par).

There are selective pockets that have not recovered to the same extent as the equity markets have. We believe that many of these securities will recover to par over time as credit markets repair and government provided liquidity (see above programs) finds its way to this distressed corner of the market.

We also have dry powder available to add to equities in the event we do get a re-test (or lower in coming weeks and months), but that appears to be a low probability at this point. If the facts change, we will adjust, and be ready to take advantage. But for the time being, the bulk of the opportunity is in a selective basket of researched individual distressed credit securities.

As was our repeated plan in the previous weeks (prior to early April) of buying the highest quality equities on every red/down day (and sitting on our hands on green days), we have followed and will follow the same template in the high yield credit markets.