If you are wondering when Value Tech, Biotech and China Tech are going to finish their bear markets and roar higher, you need only look at 1 chart (which we referenced in the last couple of weeks). Here it is (originally) and denoted with multiple other takes:

Source: Tom Hayes

Source: Tom Hayes

Source: Bryan Rich

Source: Chris Kimble

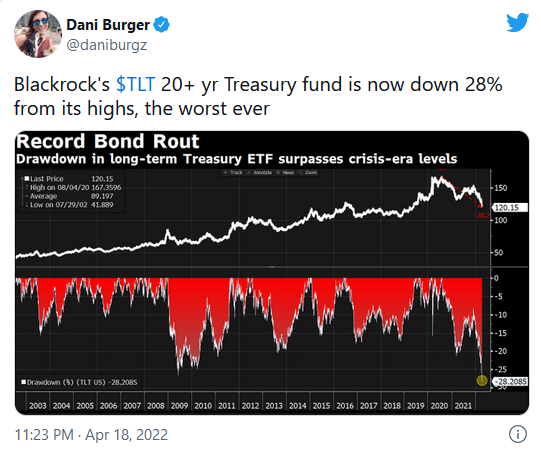

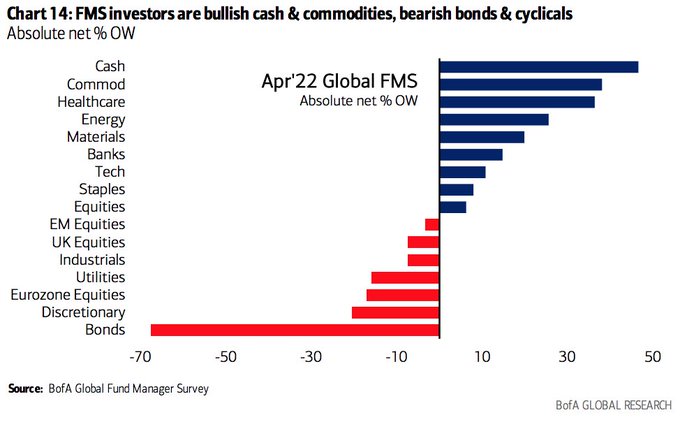

We have now come to a point where the market has priced in MORE RATE HIKES THAN ARE LIKELY TO OCCUR. As a result, we believe (regarding yields) that either a) the rate of change will grind to a halt, or more likely b) reverse. Once bonds get bid it will be an abrupt rotation as no one is positioned for it:

Everything they’ve been crowding into will get sold down. Everything they’ve been puking out will get bid. So if you want to know when the tide will turn, WATCH BONDS – then buy what no one has wanted of late (Biotech, China Tech, Value Tech).

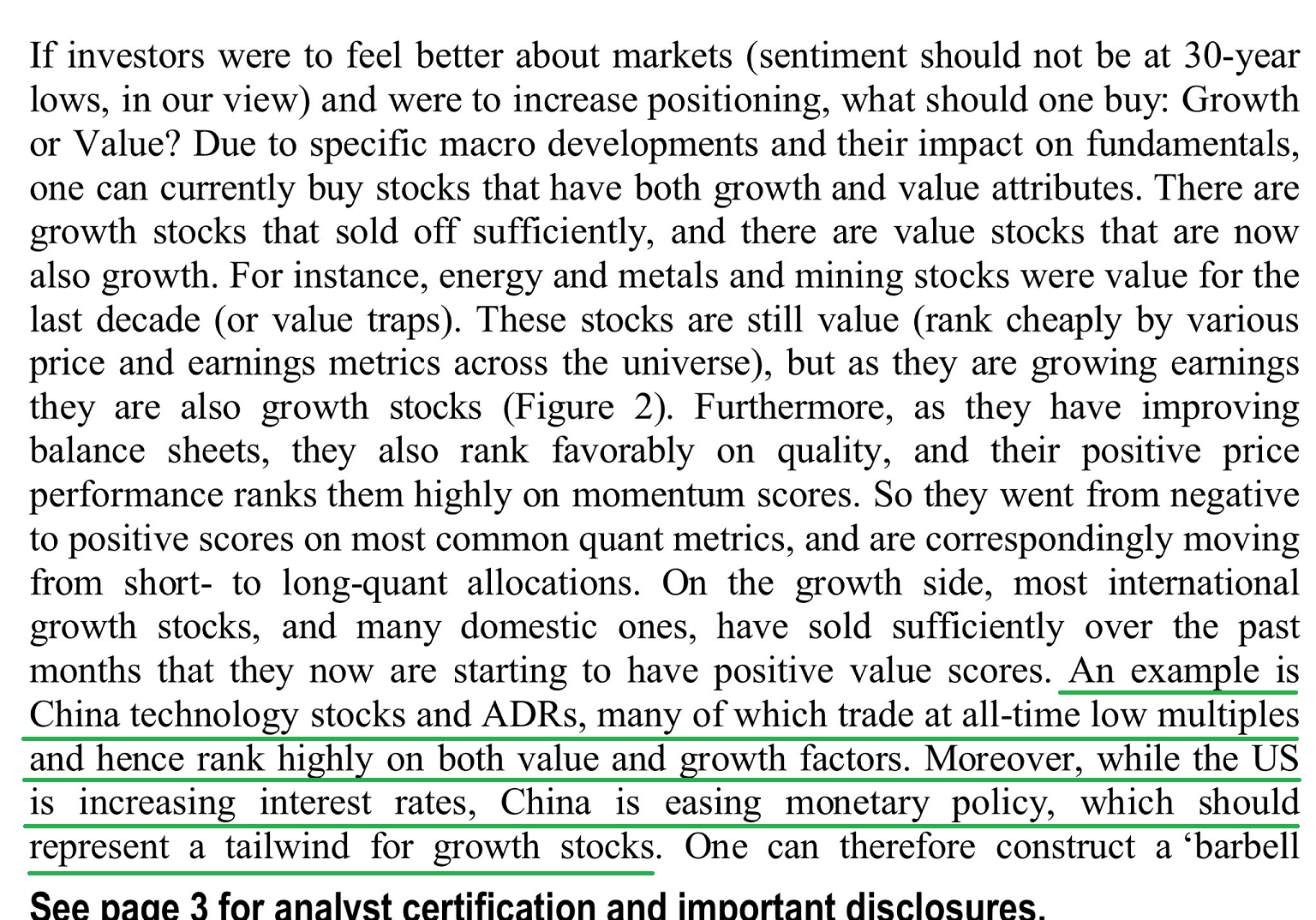

Marko Kolanovic of JP Morgan nails this concept in his Wednesday note:

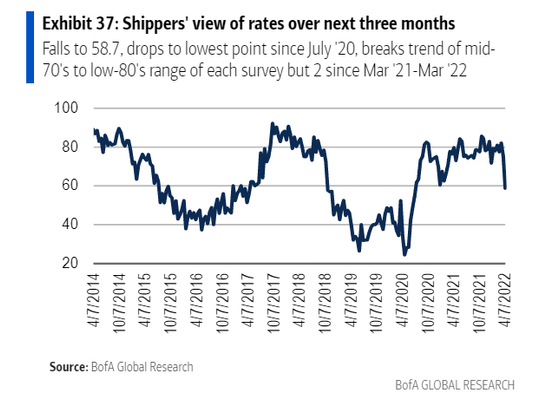

In last week’s In last week’s “Peak Everything” article we drilled down on CPI and inflation. This week we started to see some more favorable data points:

CNBC

I laid out the case in extensive detail on CNBC Squawk Box (Asia) on Tuesday. Thanks to Ginny Goh, Martin Soong, Will Koulouris, Naman Tandon and Audrey Tay for having me on.

On Rates and Biotech:

On China and Alibaba:

On Elon Musk and Twitter (Click here to watch in HD directly on CNBC):

Full 13 minute segment (Banks, Biotech, China Tech, Elon Musk, Twitter):

Here were my show notes for the segment:

-Earnings: Banks and Netflix (Tech)

–PROFIT SLUMPS: BAC Net income was $7.1 billion, 12% lower than for the first quarter of 2021. JPMorgan Chase (JPM) posted a 42% slump, while Wells Fargo (WFC) had a 21% drop.

–BAC – Beat: credit quality increased: Net loan charge-offs dropped 52%.

–JPM (only MC to miss top and bottom line) boosted reserves to brace for inflation and the war in Ukraine amid a sharp drop in deal activity.

–WFC grew its loan business by 2%, said the bank’s earnings will likely gain traction in the next two quarters on higher interest rates.

–GS: Investment banking business –36% (Ukraine/Omicron). Good trading (fixed income).

–Citi posted better-than-expected net interest income and trading, which offset higher expenses.

–TSM – The overall net profit margin in the Semiconductors & Semiconductor Equipment subsector hit 27.79% in 2021, 2 percentage points higher than at any point in the previous decade, and is expected to near 30% in 2022. Taiwan Semi predicted a gross profit margin of 56% to 58% in the June quarter. That’s up from 55.6% in the March quarter.

-Expect mild recession next year

Bad News: 2/10 spread inverted in recent weeks which likely means we will have a shallow recession in mid to late 2023.

Good News: Stock Market can still work up to new highs in coming months.

Why? Just as stimulus hits economy on a lagged basis (6-12 months after it starts), the same is true with tightening.

Earnings Estimates still going UP S&P 500: from $225 to $228.49 in ~last couple of months.

Inversions are BUY signals:

–Since 1977, there have been 8 yield curve inversions. The S&P 500’s average return in the following year was +11.5%, with dividends +15.2%. Inversions are not a good signal to short stocks.

-The last 4 times the 2/10 yr yield curve inverted shows the S&P 500 rallied for another 17 months and gained 28.8% until the ultimate peak.

-BIOTECH

What to do given the likelihood of a shallow recession in 2023?

-Enter sectors that:

1) have reasonable valuations, and

2) can thrive in a slowing growth environment and have low correlation to GDP. GDP will slow from 5.9% 2021 to ~3.5-4% 2022.

Biotech (ETF: XBI – play a basket) Fits the Bill:

-XBI was up ~140% over the last “tightening cycle” (2016-2018) following a similar ~50% drawdown in 2015 like we just saw in last 12mo.

-Biotech valuations are historically low (relative to their average multiples since 1986). Implies the sector should appreciate:

~24% – to get back to average Price to Book multiple.

~155% – to get back to average Price to Operating Cash Flow multiple.

~112% – to get back to average Forward P/E multiple.

–16% of components of XBI trading at 2x cash on balance sheet or less.

-Many trading at a discount to cash on balance sheet.

-Lowest price/sales ratio in over a decade.

2 Catalysts:

- Doctor visits, screenings and scripts are accelerating as covid winds down. Sales Reps are back on the road meeting with Doctors in person.

- M&A The cash balance of Russell 3000 Health Care companies exceeds $500B. This is up ~400% in the past 20 years. With Big Pharma losing their patents on many blockbuster drugs, but having tons of cash on their balance sheets, they will be forced to aggressively BUY innovation in the Biotech sector to maintain/accelerate growth.

-Buy US homebuilders?

–Too early to buy homebuilders – despite the fact valuations have come down. Need more time to consolidate as interest rate concerns have hit the sector. Revisit in a few months on weakness.

-Interest rate fears overblown as tightening cycle began in June 2004 and housing accelerated until 2007.

-72M millennials ~31 avg. age starting housing formation. Demand will persist. Starter houses may get smaller. Exurbs/remote work more affordable.

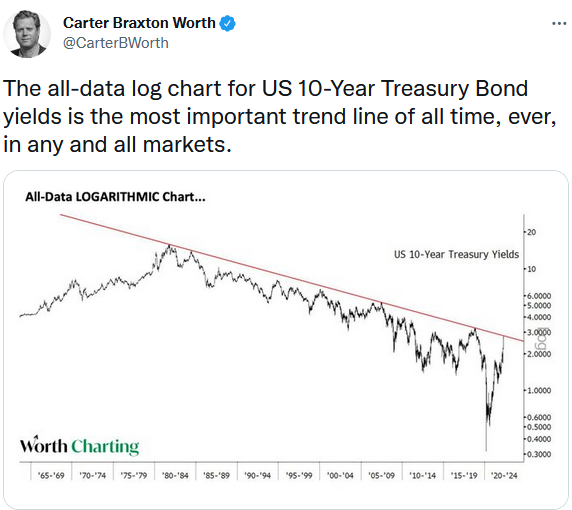

-Doesn’t buy bonds but thinks bonds will rally from April to Oct

-US 10yr Treasury yields are becoming too attractive to foreign buyers at these levels. One can borrow in yen or euros and mint money buying our Treasuries at these levels. I think we’re at a “sell the (Quant Tightening) rumor, buy the news” point in time.

-Treasury issuance will decline in coming months as receipts from income tax are used to fund government. Seasonality: This is one of the reasons that bonds outperform from April to Oct (on average last 20 years)

Any relief in yields will begin to favor that which no one is currently positioned for: 1) biotech, and 2) value (low multiple) tech. Out of Crowded Trade: Commodities/Cyclicals

-Buy China? Shutdown/Crackdown won’t last forever

-While the rest of the world is tightening policy, China is the only developed country that has been AGGRESSIVELY easing.

-As the shutdowns ease, the impact of the policy will begin to show up meaningfully in the economy – as we are now approaching six months since inception of the policy pivot. GDP was up 4.8% Q1.

-Hang Seng trading at a discount to book value. Did this 4x in past before REBOUNDS:

1998: 156.46% in 17 months

2008: 110.77% in 21 months

2016: 82.52% in 23 months

2020: 35.99% in 11 months

Alibaba more than doubled index returns during these periods:

–234% in 2016-2017

–70% in 2020

China Tech has been the least loved sector globally for months. That’s about to change. “The last shall be first.” As always, opinion follows trend. No one wanted BABA at $75. EVERYONE will want it again at $250.

Alibaba will grow Revenues and Earnings by >~30% each over next 2 yrs.

-I can buy it at a multiple that is 1/2 the S&P with ~2x the growth.

–Reminds me of Microsoft in 2013 before it took off on an historic run.

From 2006-2013 (7 years), Microsoft grew –

- Revenues (per share) by 112.14%

- Cash Flow (per share) by 193.05%

- Earnings (per share) by 120.83%

Next 9 years up ~1,500%.

From 2014-2021 (7 years), Alibaba grew –

- Revenues (per share) by 894.93%

- Cash Flow (per share) by 559.46%

- Earnings (per share) by 601.92%

Alibaba’s stock has done nothing. You can buy at 2014 prices.

Stimulus: MSCI China up 31% on avg 12 mo. leading into CNC.

CGTN America

On Wednesday evening I joined Mike Walter on CGTN America (Global Business). Thanks to Mike and Kamelia Kilawan for having me on to discuss Tesla earnings, Elon Musk and the deal for Twitter:

Here were my show notes for the segment:

Elon Musk is the Thomas Edison of our day. The hits just keep on coming….

FINANCIAL RESULTS:

–Revenue: $18.8B vs. $17.8B Expected. +81% yoy.

–EPS: $3.22 adj. vs. $2.26 Expected.

–EBITDA adj: $5.02B v $1.84B yoy.

–Free Cash Flow up 7.6x yoy to $2.2B

–Operating Margin record 19.2% in Q1

–Automotive Gross Margins record 32.9%.

–Cash $18B of cash end of Q1

–Valuation trades at 96x forward earnings.

DELIVERY RESULTS:

-Tesla delivered a record 310,000 vehicles Q1 2022. +68% from the 185,000 vehicles in Q1 2021.

-Tesla will produce more than 1.5M cars in 2022 despite production and supply chain issues.

-Tesla says they will achieve 50% annual growth in vehicle deliveries for the foreseeable future.

-Musk says $TSLA could grow deliveries by 60% this year.

-Musk says ‘growing very rapidly’, aspire to reach 20M cars per year.

-Not demand limited, production limited. Waiting lists are long.

*CUSTOMER DEPOSITS ROSE TO $1.125B Q1, UP FROM $925MM

PRODUCTION:

–Factories have been running below capacity for several quarters as supply chain became the main limiting factor.

-Will see a record output of Giga Shanghai this quarter. It’s possible we may pull a rabbit out of our hat and Q2 vehicle numbers will be higher than Q1.

-Shanghai factory production will be similar in Q2 but rapidly increase in Q3 and Q4.

-Elon Musk expects factories in Texas and Berlin to expand down the line.

FUTURE:

-Tesla to launch its robotaxi in 2024. Robotaxi doesn’t have a steering wheel or pedals. Fully autonomous.

-Robotaxi ride will cost less than a bus or subway ticket. Will be lowest cost per mile travel that consumer has ever experienced.

-Musk said to pay attention to “optimus,” robot: “Optimus Humanoid Robot ultimately will be worth more than our car business worth more than Full Self Driving. ”

–Insurance: Next Quarter TSLA could be the largest insurer of Teslas. Working to get to 80% of Tesla customers that have access in 3 states that are open. Real time insurance score = safer driving. Premiums lower.

TWITTER BID:

-Bought 9.2% of Twitter.

-Made unsolicited offer $54.20 ($43B) to buy Twitter.

-Board adopted poison pill to prevent Musk from buying more than 15% in the open market, but has not yet rejected.

-Board has FAILED to deliver value to shareholders since IPO in 2013.

-Musk needs to show “funding secured.”

-Apollo and 1 other PE considering providing debt financing.

-Clean up “shadow banning”: A social media platform’s policies are good if the most extreme 10% on left and right are equally unhappy

-Twitter must update on deal April 28 when it reports earnings.

-Over the weekend, he tweeted “Love Me Tender,”

-Musk tweeted ‘_______ is the Night,’ a possible reference to F. Scott Fitzgerald novel ‘Tender Is the Night’: Tender Offer – direct to shareholders.

–Tender: approach Twitter shareholders directly to buy their stock at a specific price over a defined period.

–By taking the bid directly to Twitter investors in a tender offer, Mr. Musk could pressure the board to withdraw opposition and its poison pill if he garnered enough shareholder support.

-Deal gets done >$60. Maybe $64.20!

Now onto the shorter term view for the General Market:

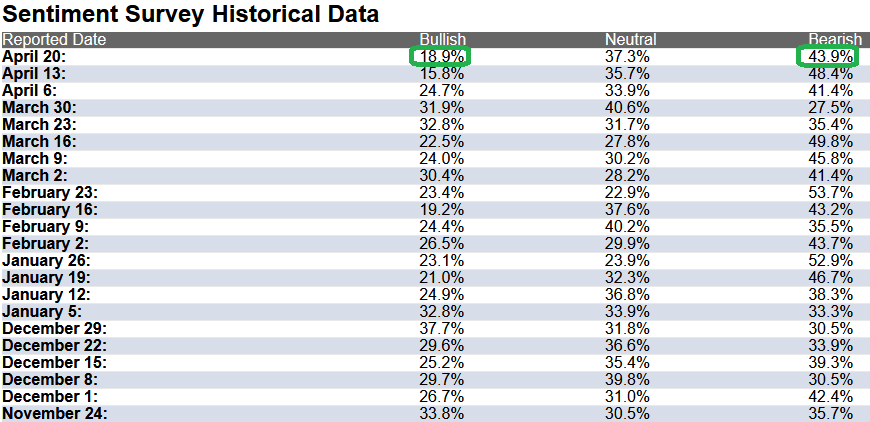

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 18.9% this week from 15.8% last week. This is the still near most pessimistic sentiment in the history of the survey. Bearish Percent dropped to 43.9% from 48.4%. Retail investors are fearful.

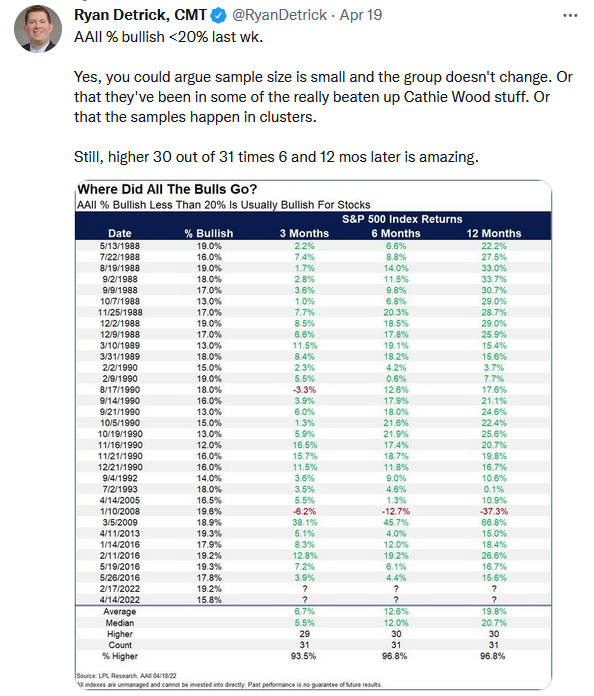

Last week’s “Bullish Percent” was the lowest in 30 years. Ryan Detrick of LPL pulled together some data the shows what can happen after sentiment becomes that pessimistic. If you can’t read the fine print, the color tells you everything you need to know:

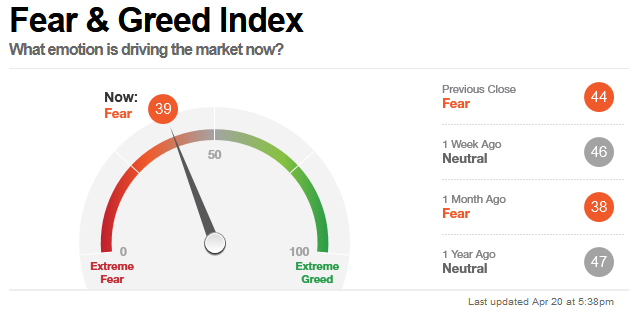

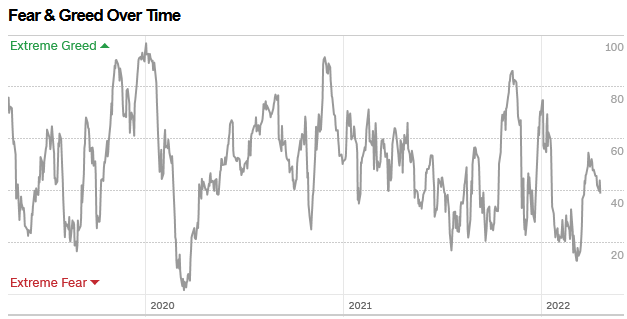

The CNN “Fear and Greed” Index ticked down from 46 last week to 39 this week. Sentiment is still cautious in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

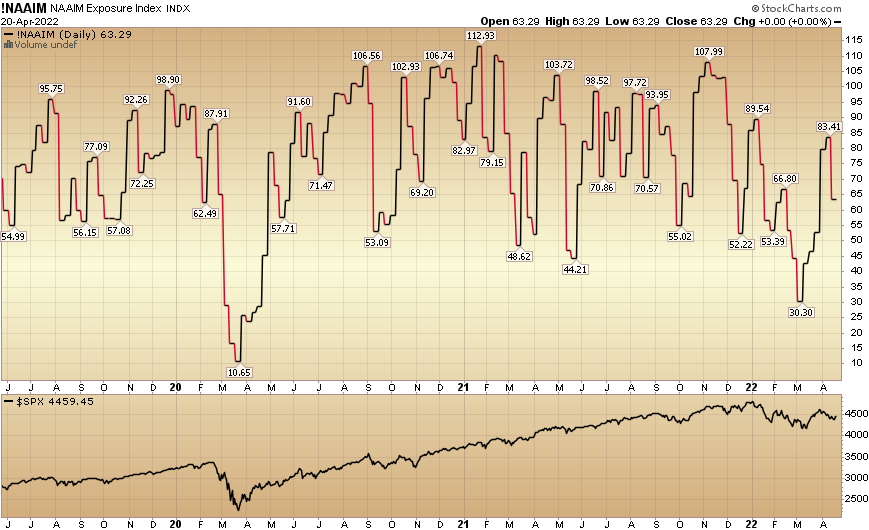

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 63.29% this week from 83.41% equity exposure last week. Managers will have to chase any strength.

Our podcast|videocast will be out on Thursday or Friday this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

We pulled together a few testimonials from recent months. Here’s what people are saying about Hedge Fund Tips:

Don G.

I’ll read Tom’s work like an economist parses a Fed Chairman’s Meeting; going over it with a fine tooth comb. He is one of my favorite financial gurus.

Brady T.

Love the podcast. I listen to it every week and read your newsletter. Your advice has helped me minimize my losses and build wealth. Thank you so much.

Tyler W.

Firstly, been listening to you for about a year now and you are consistently great. Your podcast is easy to listen too and digest, and it’s turned into somewhat of an end of week treat/ tradition for me. So, thank you for sharing your wisdom and opinion, not financal advice.

Gerald B.

I am professionally impressed with your work and timely communication. It adds tremendous value in maintaining prospective in a fast changing market(s) focus. Thank you.

Mark D.

Hi, Thanks for all the valuable information you share on your ‘Hedge Fund Tips’ site. I’m trading option strategies for half an year now.

Adam D.

Really appreciate your thoughts on the market, happy to have stumbled on your channel last year and appreciate your LinkedIn connection. I currently work in IB in NYC and you are a great role model of who I aspire to be professionally some day.

Michail B.

Big thanks as always for making your podcasts. I look forward to hearing them every week. I especially enjoy hearing your analysis and contrarian view on your high conviction plays over the last years.

Glass D.

The Best. Tom is the smartest guy in the markets right now that shares his research (lots of supposedly smart people but they’re secretive – Tom’s investments are public and free on this podcast). I’ve made stunning amounts of money following this guy. He’s a great person, too. Insane respect for his contributions to the investment community.

T. Veran

Best Financial Podcast Out There. Been listening for about 6 months. Every week Tom provides actionable items for real results. He has a unique market prospective that so far has been spot on.

Joey R.

Listened to one episode and I’m hooked. Tom Hayes presented a logical analysis of today’s markets and brought forward informative empirical data. I will be sure to listen more.

Jordan H.

Hi Tom, Long time listener, second time question asker – I hope you are well and want to start by saying thank you for the podcast! Your opinion (not advice !!) has been very helpful over the past couple of years!

Rich C.

Tom, Really like your investing style. All aligns with my 36 years observing the investment management business….most of whom are followers…..not you.

Mark D.

Hi Tom, Thanks for all your great insights you share with us in the weekly podcasts, your web site and the media. Your opinion on the markets are very valuable to me and my account!

Dr. Matt

First, thanks for your revolutionary podcast bringing sound investment principles to “retail investors”. Hooked on it, and look forward every week!

Alan A.

I would like to echo sentiment someone shared recently – your videocast is also the highlight of my week! The education in investing you are giving us is nothing short of stunning.

Matt M.

Thanks and keep up the great work!

Michael B.

Always great hearing your podcast! It is incredibly informative and always great hearing your take on the economy and individual stocks. You have helped me grow my portfolio considerably and I am very, very grateful for all your insight that you have given. Will continue to tune in every week and have told all my friends about it.

Shan S.

I spend my entire week looking forward to your video. It literally is the greatest thing since sliced bread.

Greg S.

First off, let me say that your last two videocasts were just great. So much great information which has really helped me make some good decisions.

John B.

Tom, Thank you for all the thoughtful content you put out. It’s like no other pod or webcast out there. You give us subscribers phenomenal insights in real time; I’ve learned so much from you the past few months that I’ve been following along. You do the work and stick to your knitting, which seems to be quite rare in this investment environment we find ourselves in. Keep up the great work and continue staying humble. It’s truly a pleasure.

Antonio A.

Tom, I wanted to start by thanking you for all your work. I know this takes a lot of time and between your tv presentations and managing a fund and family I know you can’t have a lot of time to do these videos week after week. So I will thank you a second time and third. I have watched you since the beginning on youtube and you only get better. Thank you again.

Prasad M.

Looking forward to this week’s videocast. Thanks again for your generosity in sharing your knowledge, experience and analysis with all of us. I feel like I’ve been in an advanced investing course this past 1 1/2 years reading your posts and listening to your videocasts.

Stan F

Hi Tom, It has been very helpful listening to your weekly podcast. Thanks for spending time on it.

James S.

Hi Tom, hope you had a great weekend! I’m an avid listener of your podcasts and greatly appreciate all the work you put in to sharing your opinions (not advice) on a regular basis.

Nick D.

Hi Tom, thanks for taking the time to do the podcasts -they are full of really interesting insights into how you think about the market, and a great learning tool for us less experienced investors.

Adam D.

Tom, Great video cast as always this week.

Shanan S.

Your weekly is great. Your appearances on TV fantastic. Both exceptional because you give arguments and then support arguments with data. This is in contrast to most of the Talking Heads you see on TV that say things like “we’re looking at companies that have good multiples and we think they are going to outperform.” Thanks in advance for more enjoyable and informative road trips.

Markus D.

Hi Tom, Thanks a lot for your great article!

Sumeet K.

Hi Tom, Thanks for sharing your wisdom. Thanks for all that you do for us. Thanks for sharing so generously.

Tim G.

Thank you again for all that you do. I never miss a Thursday morning article or a Friday afternoon podcast.

Daniel S.

I am a weekly listener of your podcast, and appreciate your insight. Thanks for all of the Alpha you share!

John W.

Love what you teach us and many thanks to you all.

Bridger P.

A lot of people on my team love your podcast, and I was wondering if you guys are open to doing a podcast episode.

Krister J.

Keep up the good work.

Prasad M.

Hi Tom. Another great commentary and video! You were prescient on yesterday’s market. And thanks for reading and answering my question on your video.

Roy R.

Hello Tom, Listening to your podcast and now on your website. Pat yourself on the back! Definitely should appreciate the word of mouth you get as a voice for finance and money manager.

Ben F.

Tom… Good podcast last night. Thanks for your oil thoughts.cc I’m all in with ibb since you were right about banks, energy, consumer staples, Boeing, Splunk, the March 2020 bottom, etc.

John P.

Hello Tom. I listen to your podcast every week and look forward to the commentary. I really appreciate your strategy.

Alan A.

Thanks for sharing your SUPERB insights and analysis with us throughout the year.

Greg S.

Great shoutout for your video cast.

Michael B.

Your podcast over the last year has been excellent as both a way to learn general investment principles as well as a week by week analysis of the world/economy/stock market. Just wanted to say a huge thank you to all the work and effort that you put in, it has honestly been very valuable and I look forward to more next year.

Don G.

Tom H. I consider you to be one my favorite financial gurus, thanks for all the opinions and not advice.

Tim G.

Thank you for sharing your knowledge with your podcasts, tweets and YouTube channel.

Sho M.

It’s amazing I learn something new everytime from your weekly videocasts! Keep up the fantastic work 🙂

Sumeet K.

Thank you for the weekly podcast, it is an excellent source of learning.

Jeff B.

Big fan of the show and your great opinions (not advice)!

Bee H.

Great podcast. Thanks for thorough analysis.

Sumeet. K

Thanks for all that you do for us! Have a great weekend.

Kai G.

Thank you so much for what you are doing. Your way of reasoning your thoughts every week has made me a better investor and learn so much more than reading a book or the news.

Shanin S.

Tom, Magic mountain doesn’t have rides that are this fun. One thing I appreciate about the tools you use to produce your podcast is that they are largely accessible and/or free to us little guys.

Blake C.

Hi Tom, First off, I love your show and appreciate all of the insight you give to the listeners. As someone who wants to get into the industry, your podcast has been an incredible tool to supplement my learning.

Shourob M.

Hi Tom, How are you? Great videocast, extremely informative and now you gave us the process you go through… Fantastic as usual!

Surya S.

HI, I am very much impressed by your podcast and the service you are providing for small investors.

John D.

Your knitting is definitely sector rotation.

Greg S.

Once again I have to say your videocast this week was just great and it makes it so easy to be patient and calm and to slowly build my portfolio with good value investments.

Marat A.

Hi Mr.Hayes, My name is Marat Asatryan, just want to say that I wait for your podcasts at the end of the week every week in order to get my head straight with what is happening in the markets, thank you so much.

Mike B.

Hi Tom, I am a big fan of your podcast and I am very grateful for all it has taught me!

Jared M.

I love listening to the podcast every week with Tom.

Alan A.

Thanks for answering my question and delivering another phenomenal videocast. As per usual, your response was extremely enlightening and helpful.