This week I chose the classic 1987 rap song, “It’s Tricky” by Run DMC to embody the current status of the market. They lyrics are self-explanatory:

It’s Tricky, it’s Tricky (Tricky) Tricky (Tricky)

But it’s the story that fits the bill. The music video features the famous magic duo – Penn and Teller, who are hustling a group of people in a game of three-card Monte in front of the Rialto Theater in downtown Los Angeles (source: wiki). Run-DMC are called and shut Penn and Teller’s business down by winning every hand they play.

My sense is that Tesla’s selling $5B of stock to the public after a parabolic move (trading close to 12x sales), may be a little like Penn and Teller taking money from the untrained spectators in front of the Theater. I’m a fan of Elon Musk (he is changing the world in numerous ways) and he is not to blame for the valuation, but this feels a bit excessive.

The Inmates are Running the Asylum

Now Tesla may be a bit overdone in the short term, but the leader of the pack is Zoom. Like Tesla, Zoom has changed the world in its own way (and benefited from being in the right place at the right time).

In the past 8 quarters, revenues are up 9x (Q2 2018: $75M and Q2 2020: $664M). That IS growth. Yesterday, the stock was trading at $126B market cap. It traded to 63x sales and 287x earnings. Not sure why we haven’t seen a secondary offering yet. Particularly because the technology could be replicated at a very modest cost – relative to the valuation.

On Tuesday, I was invited on Cheddar with Brad Smith. I discussed the “Tale of Two Markets” theme we have presented for the past two weeks. You can find the first note here:

The Lionel Richie “Dancing on the Ceiling” Stock Market (and Sentiment Results)…

With Brad, I broke down the valuation of AAPL and why it looked a bit overdone and due for a break. We also discussed the stimulus deal, the November Election outlook and impact on the market, Vaccine (approval, distribution and adoption) and the Market in general. You can view it here:

In the case of AAPL and TSLA, the stock splits have exacerbated the excess froth in these small pockets of the market. On Monday, I was on OANN with Greta Wall discussing the splits, the Market and valuations. We also discussed WHY tech stocks are doing well, and what will change to cause a rotation. You can see how I break it down here:

Juanita (Aline) Wiratmaja interviewed me on CNBC Indonesia on Tuesday. This was a two segment interview so we had time to dig deep into overpriced sectors versus underpriced. We covered the following subjects in a long-form format:

- Is the market toppy, or just certain parts?

- Is there a disconnect between the stock market and economy?

- Most loved stock in the S&P 500 “AAPL” valuation versus most hated “WFC.”

- Is a rotation coming, how and what will it look like?

- What will trigger a potential rotation?

- Outlook on Emerging Markets and Indonesia.

- China Stimulus, Data and Recovery update.

- Western/Developed World recovery.

- Buffett buying Japanese Trading Stocks. What’s behind it?

- Shinto Abe’s resignation as Prime Minister of Japan. Legacy and implications/policy moving forward.

- U.S. Election Outlook, implications, parties and policies impact on business/Stock Market.

- September Seasonality in Election vs. Non-Election years.

- GRIDLOCK is GOOD…

- If Blue Sweep, what happens to Stock Market? Is it likely anymore?

- How investing in gold could cost you $50M. Is it the best hedge for inflation? Does pricing power win over time?

- Fed’s stance on “symmetric inflation.”

- Why are growth stocks bid up right now? Hint: Growth is Scarce. What will change that and make growth options plentiful?

- Look for the “rallies under the surface.” They are coming.

Watch it here:

Part 1

Part 2

Following up on the CNBC interview I did a quick segment for CGTN Global Business with Rachelle Akuffo. We went into a detailed review of the recent China Manufacturing PMI results and many other data points. We have watched China carefully since March as a roadmap for our recovery as they were “First In, First Out” with respect to COVID. In this clip we go into the nuances of Chinese Stimulus and Government Policy and its results/impact on the global economy:

As I said in last week’s note, the salient question is not, “what do you think of the market?” but rather “where is there still value to be had/what’s set to take a rest, and what’s set to take off?” You can review it here:

The Stevie Wonder, “Faith” Stock Market (and Sentiment Results)…

One of the key points I made last week is that most people would say, “Wells Fargo will outperform Apple on a relative basis – when PIGS fly!” Well, they were flying yesterday as I posted this tweet:

One day does not make a trend, rotation or change. We’ve been buying WFC consistently for some time. The bad news is it hasn’t gone up, the good news is it hasn’t gone down. It’s just been sitting and waiting for a catalyst. If money comes out of some of the frothy pockets of the market in coming weeks, it may very well wind up in the “left behind” sectors of Banks, Defense Stocks, Industrials, Energy, etc. We’re positioned to benefit.

Now onto the shorter term view for the General Market:

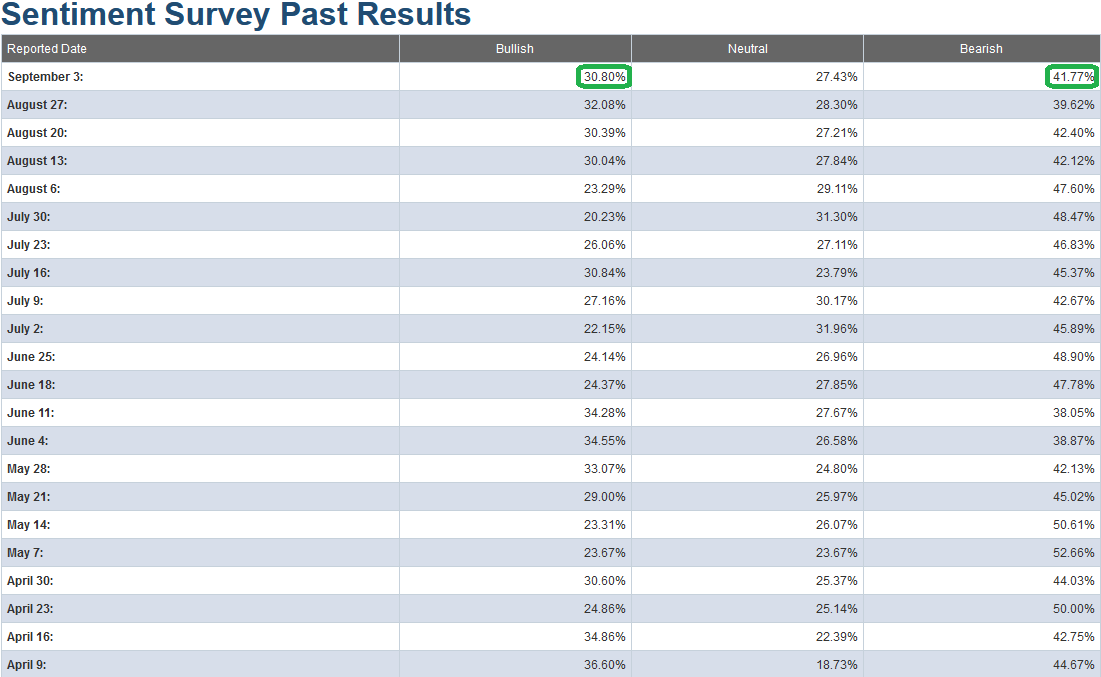

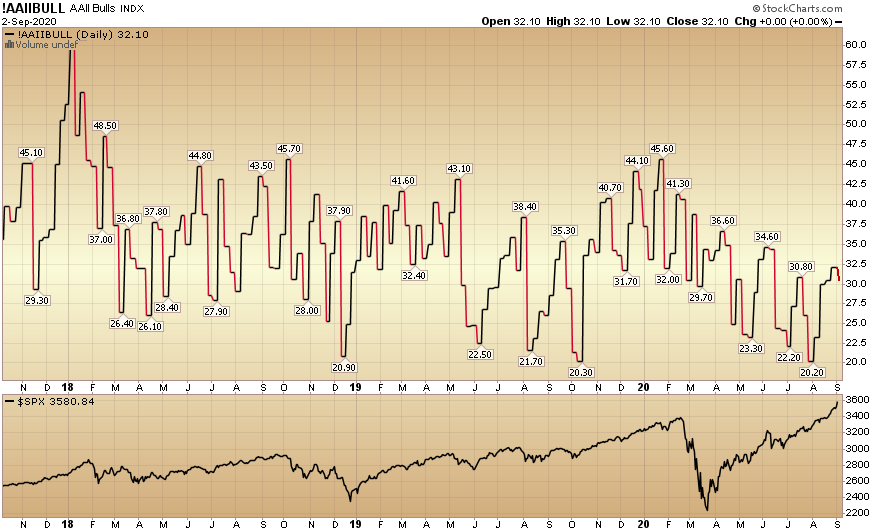

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) fell to 30.80% from 32.08% last week. Bearish Percent rose to 41.77% from 39.62% last week.

While a bit of optimism started to finally creep in the past four weeks, we are still nowhere near euphoric levels. By this metric, there is room to climb the “Wall of Worry,” but that could change in coming days/weeks when euphoric levels start to return. We have not seen a “Bullish Percent” read above 40 since February.

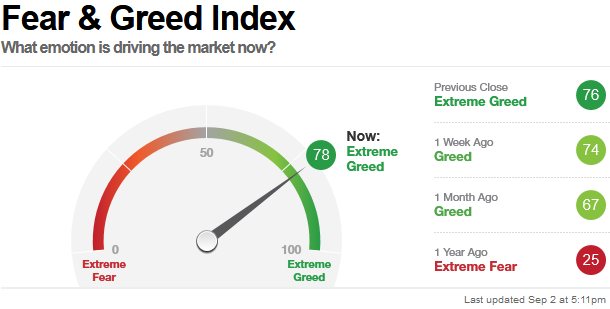

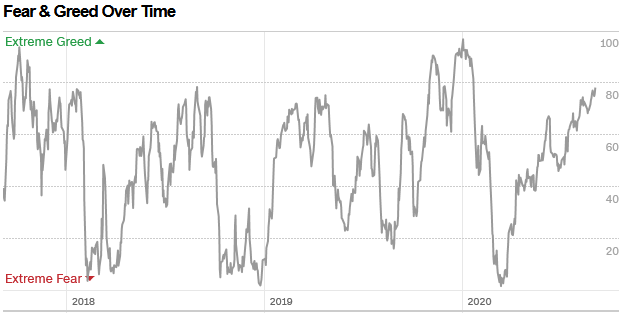

The CNN “Fear and Greed” Index moved up from 68 last week to 78 this week. While we have still not hit an extreme/euphoric level (80-100) yet we are very close. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose from 101.20% equity exposure last week, to 106.56% this week. This is an extreme level, so we must be on alert to trimming some huge runners.

Our message for this week:

Signals are mixed. We’ve moved a long way in a short period of time. Some stocks are extended, but many sectors/stocks are trading at valuations that will prove to be attractive buys for the intermediate term. As we said last week, the catalyst for this change will likely come from science at this point. Don’t bet against science.

We remain very constructive in the intermediate term and will take advantage of any additional buying opportunities in laggard/cyclical names – should they arise over the Late Summer/Fall (on any pullbacks/corrections). I would not be surprised to see a bit of volatility/chop over the next few weeks.

I don’t think you’re going to win “Calling the Market” in coming months. I think the opportunity is in finding the long-term value and pouncing, while at the same time peeling off some runners that have made you big gains in recent months. It’s not binary, it’s Tricky!