This week I traveled to Las Vegas to speak at the MoneyShow “Investment Masters Symposium” along with many great speakers like Charles Payne, Tom DeMark, Tom Lee, Kenny Polcari, Keith Fitz-Gerald, Mike Lee, Mitch Roschelle, Larry Williams and more…

The venue reminded me of a line from from the classic movie “Swingers” with Vince Vaughn and Jon Favreau:

The venue reminded me of a line from from the classic movie “Swingers” with Vince Vaughn and Jon Favreau:

My full live presentation is at the end of this article…

Market Outlook+

On Friday night, I joined Phil Yin on CGTN America. Thanks to Delal Pektas and Phil for having me on the show. As always, Phil asked me for some stock picks along with my view of economic developments and market outlook, so here they are. China, Disney, Jobs, the Fed, and more:

image source: Jeff Hirsch

CPS Update

As many of you know, Cooper Standard started as one of our largest three positions (by capital deployed) in May of 2022 and has grown into our largest position through price appreciation.

Those of you who listen to the podcast|videocast and were in at the $4-6 range are now up at least ~3x+ or ~200%+. Even if you first heard about it on Liz Claman’s The Claman Countdown on Fox Business on June 7, 2022:

Or on December 28, 2022 with Kelly O’Grady:

You still have at least a double or triple so far.

We most recently talked about the stock publicly on Yahoo! Finance on July 18, 2023:

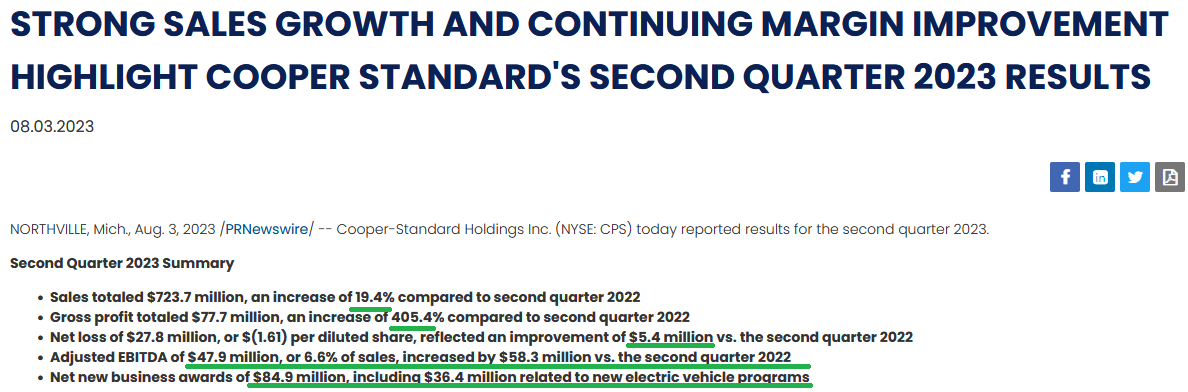

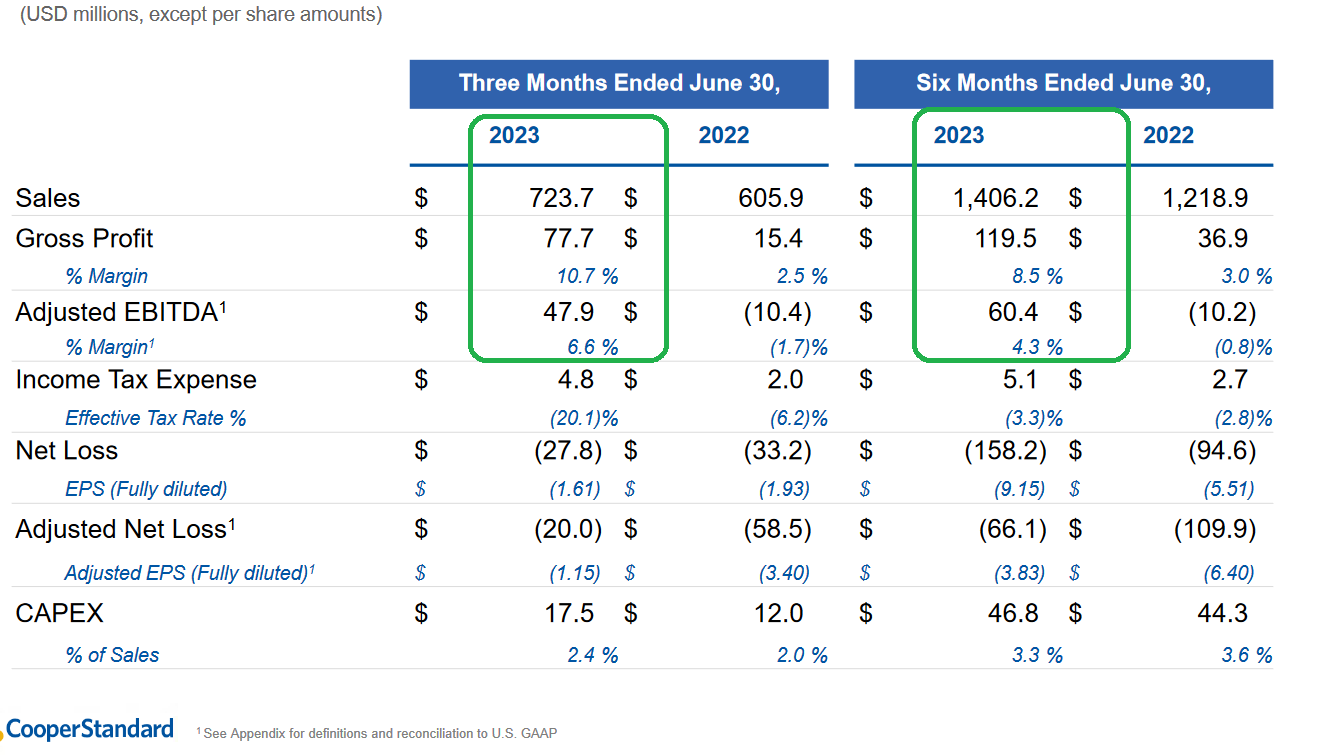

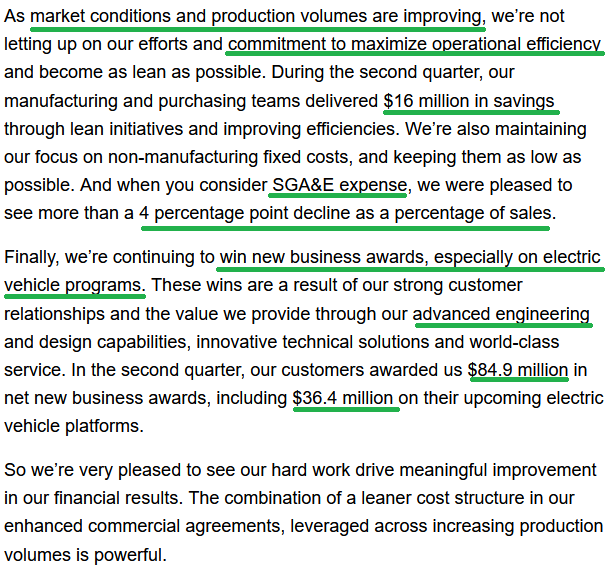

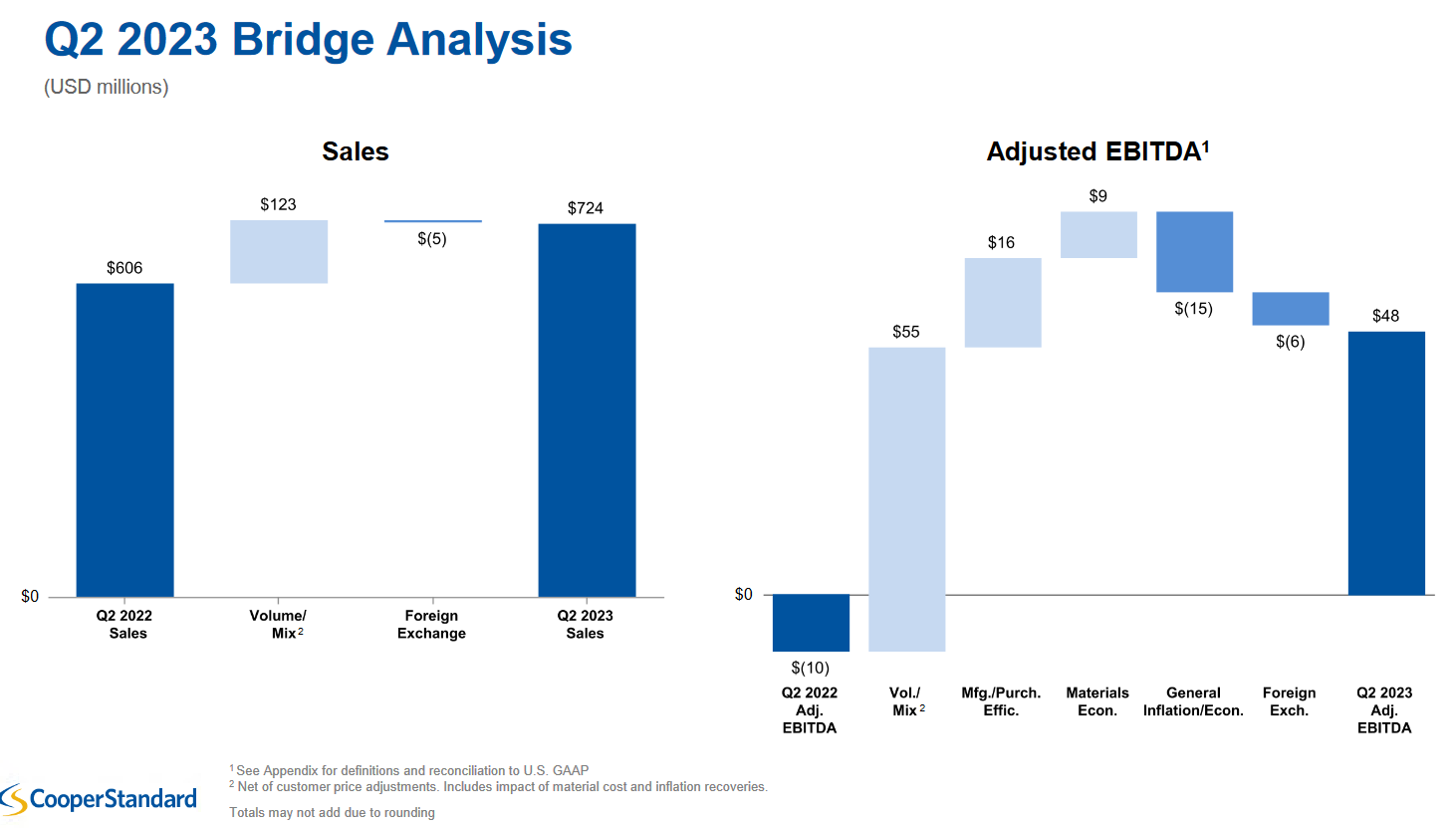

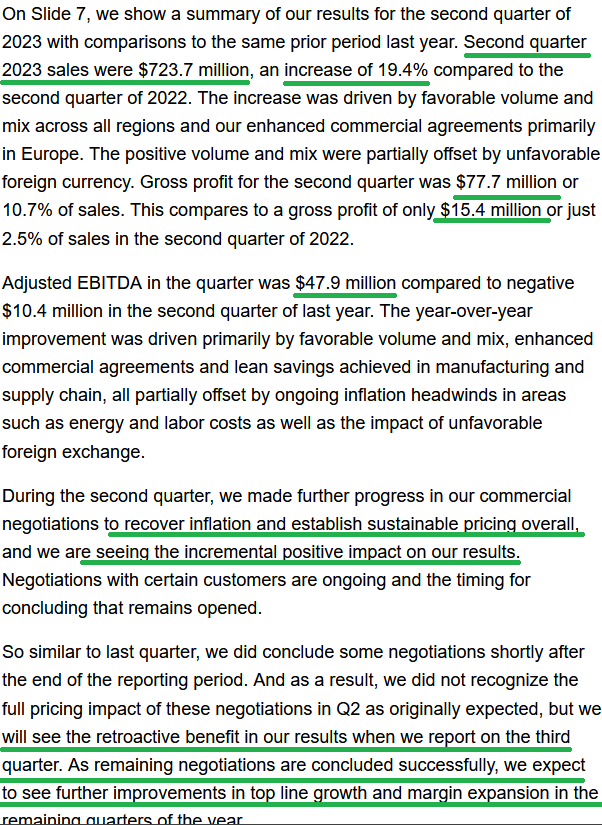

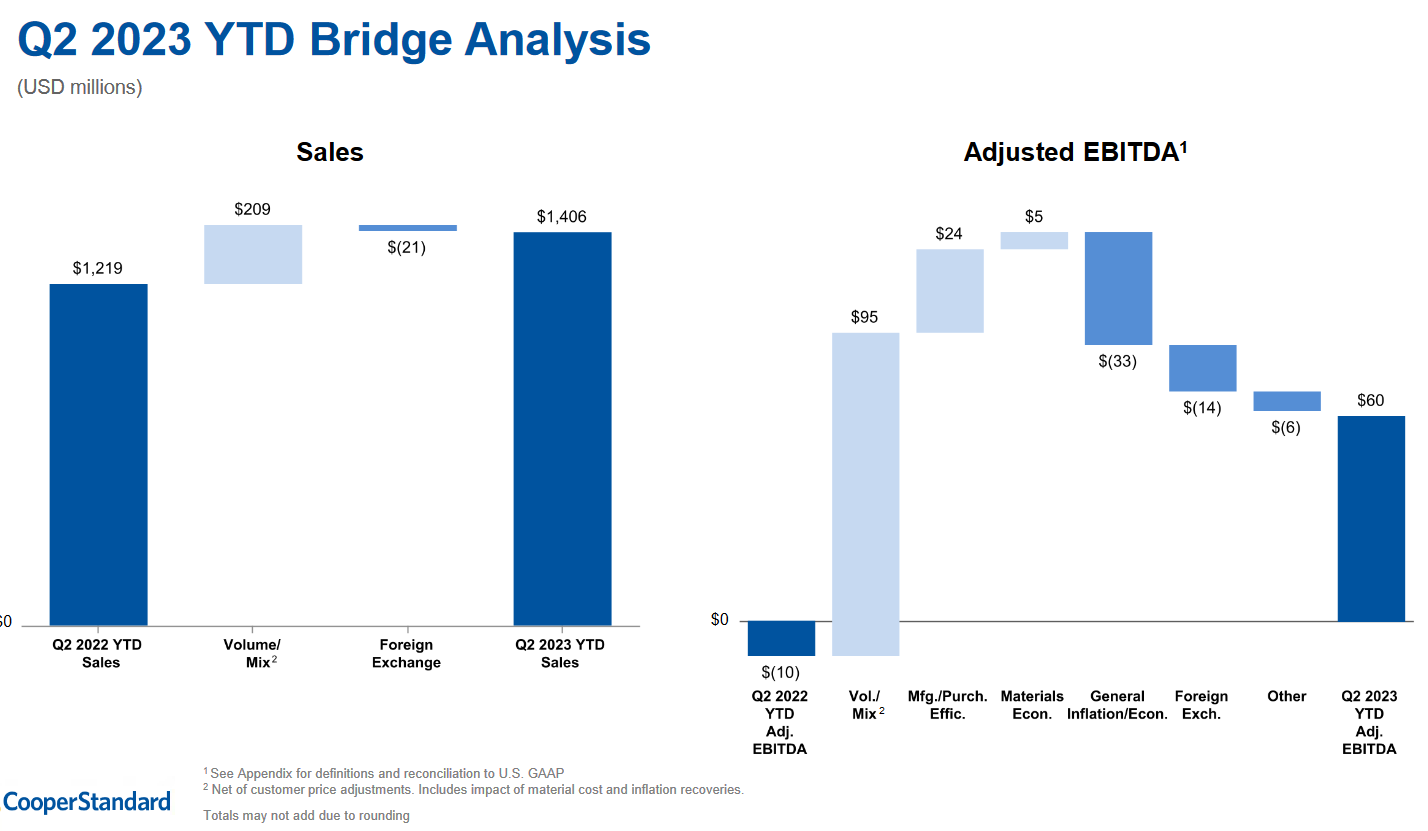

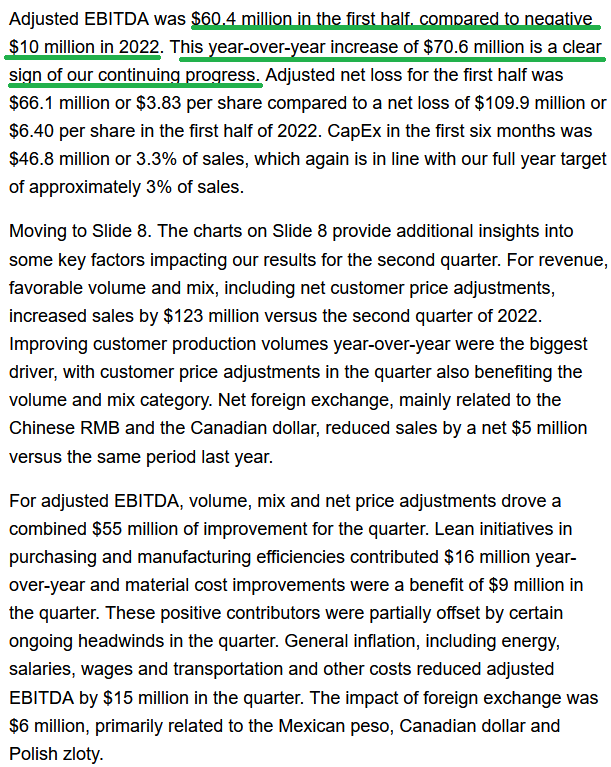

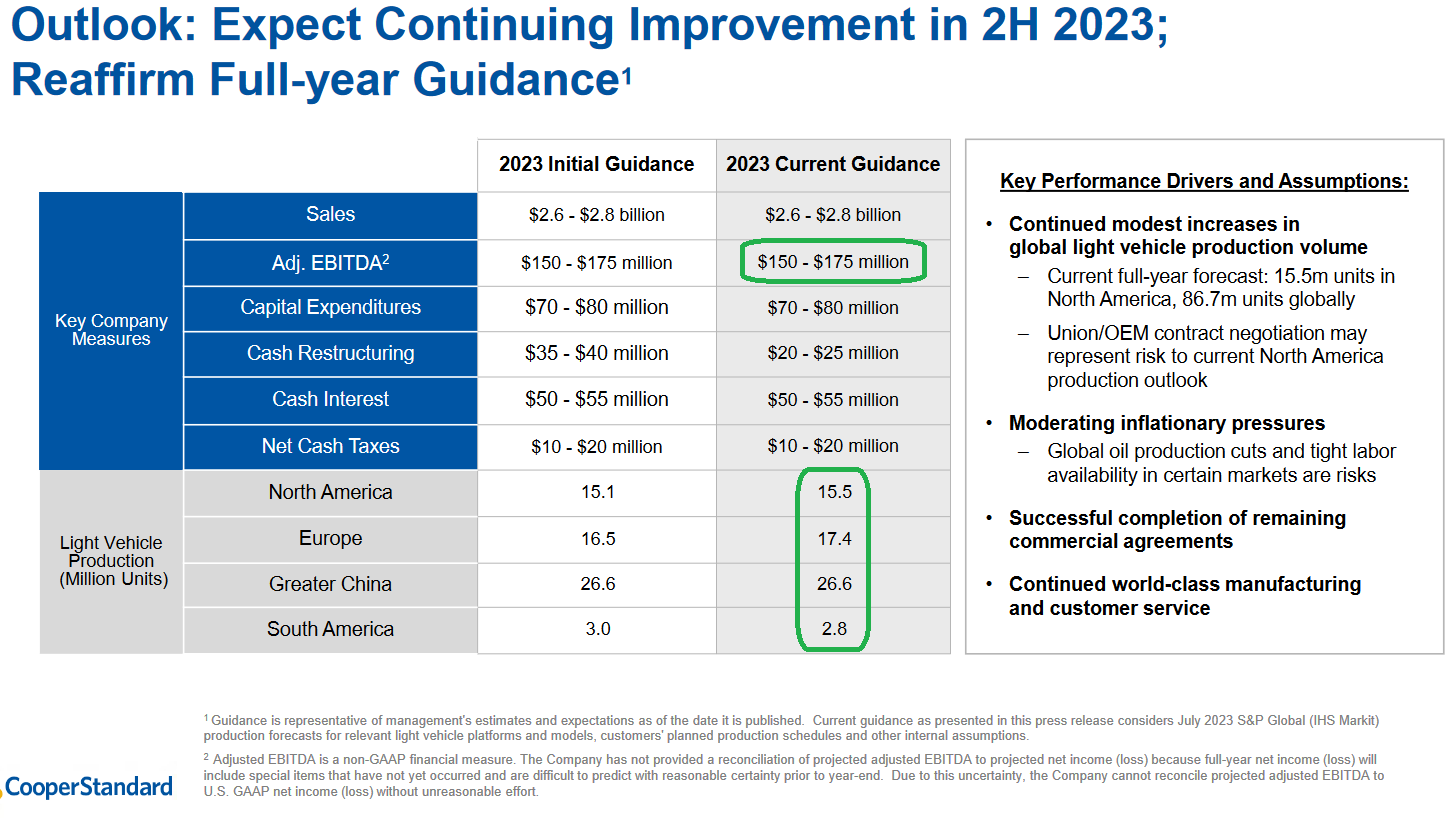

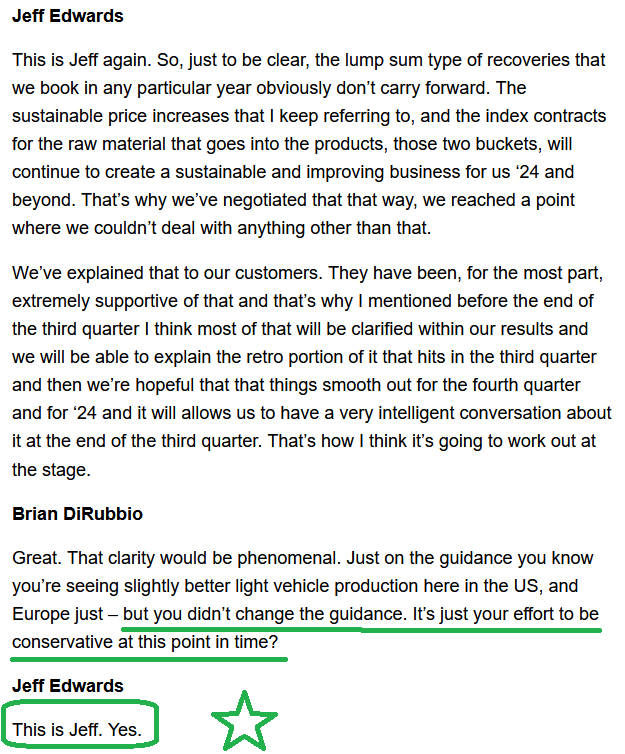

Last Thursday the company reported after the bell. Here were the key points:

***We are hopeful that there may be some short term overhang on the stock (until the UAW contract is negotiated with the OEMs) so that we can put new money to work at a lower price, but we are not holding our breath…

Alibaba Update

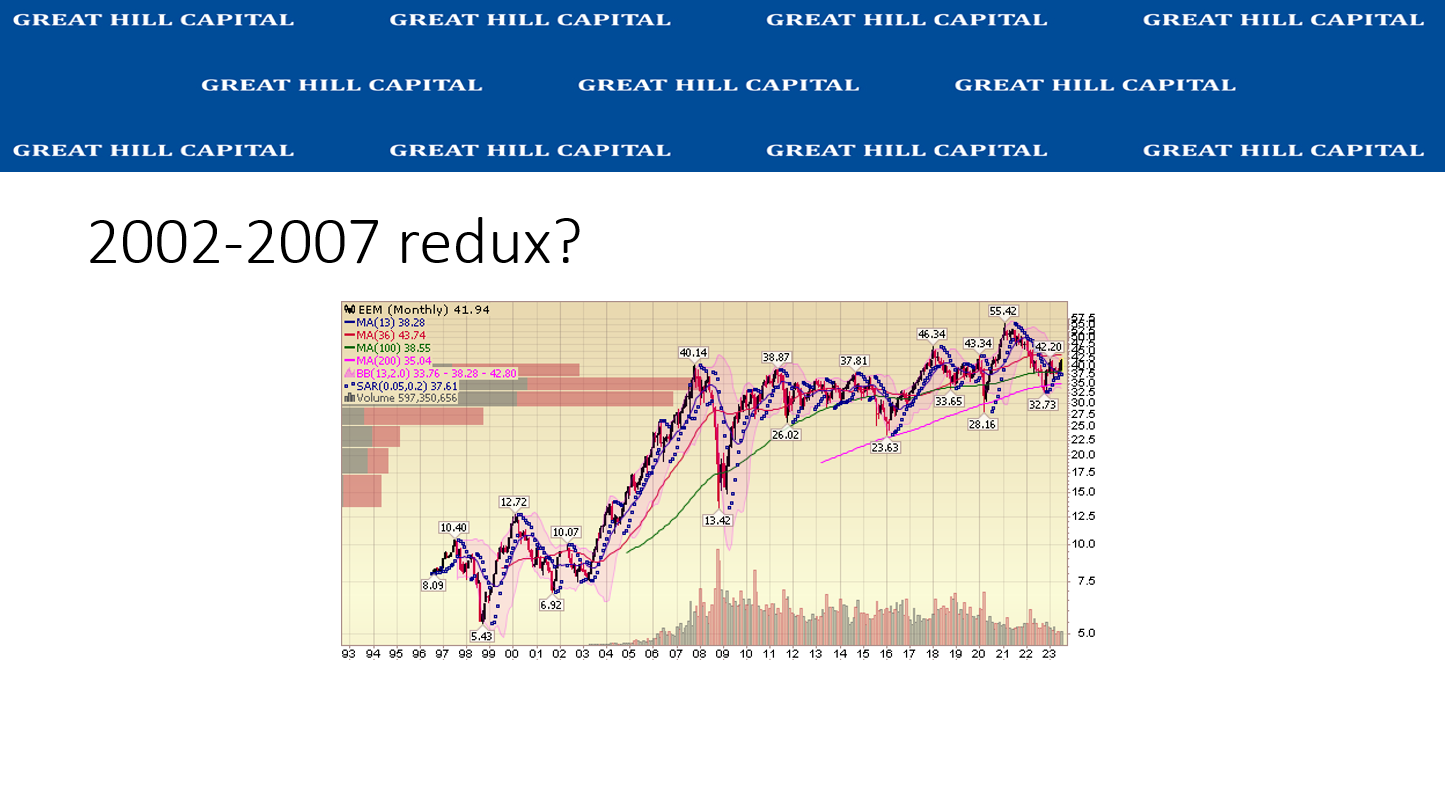

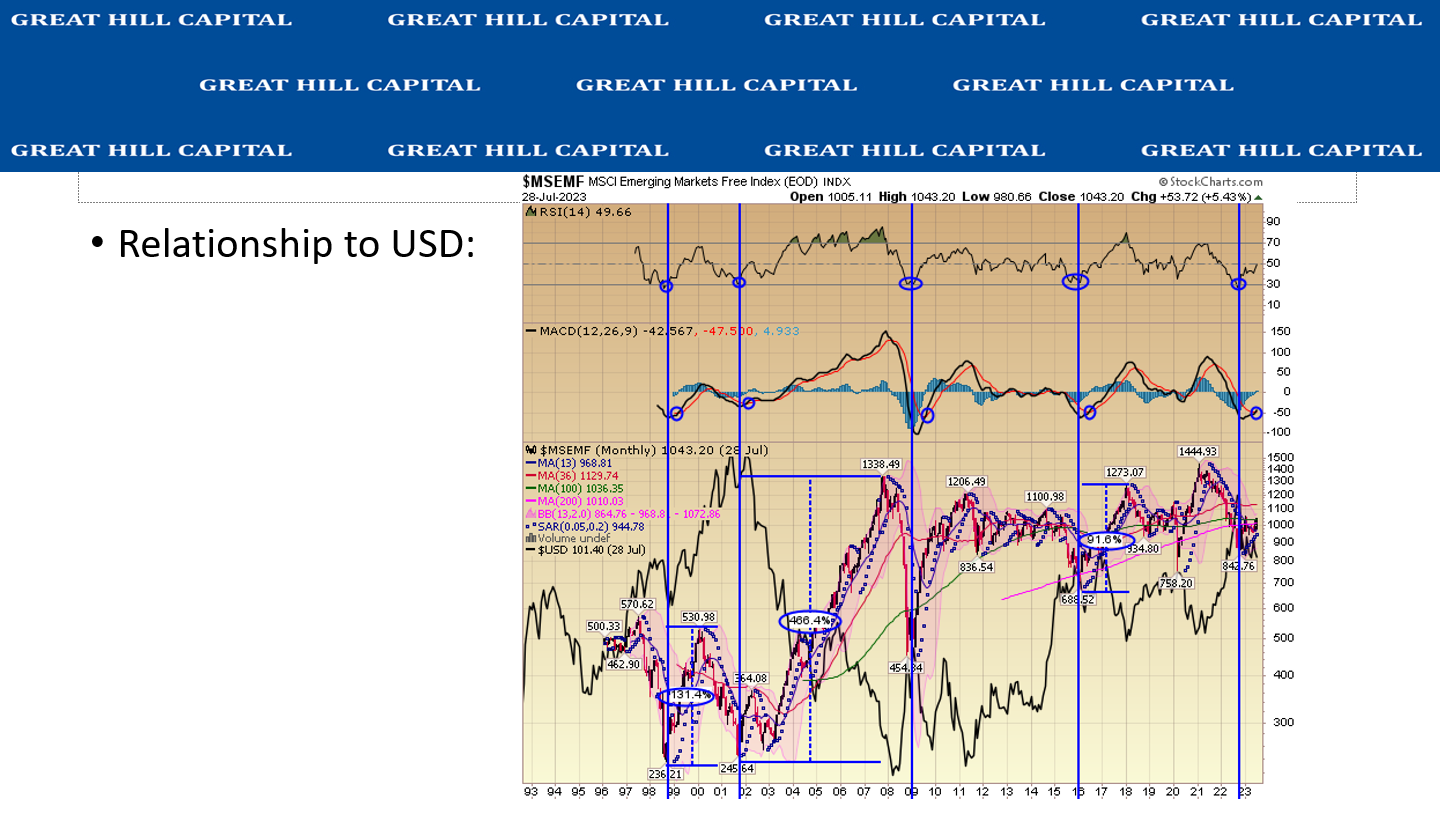

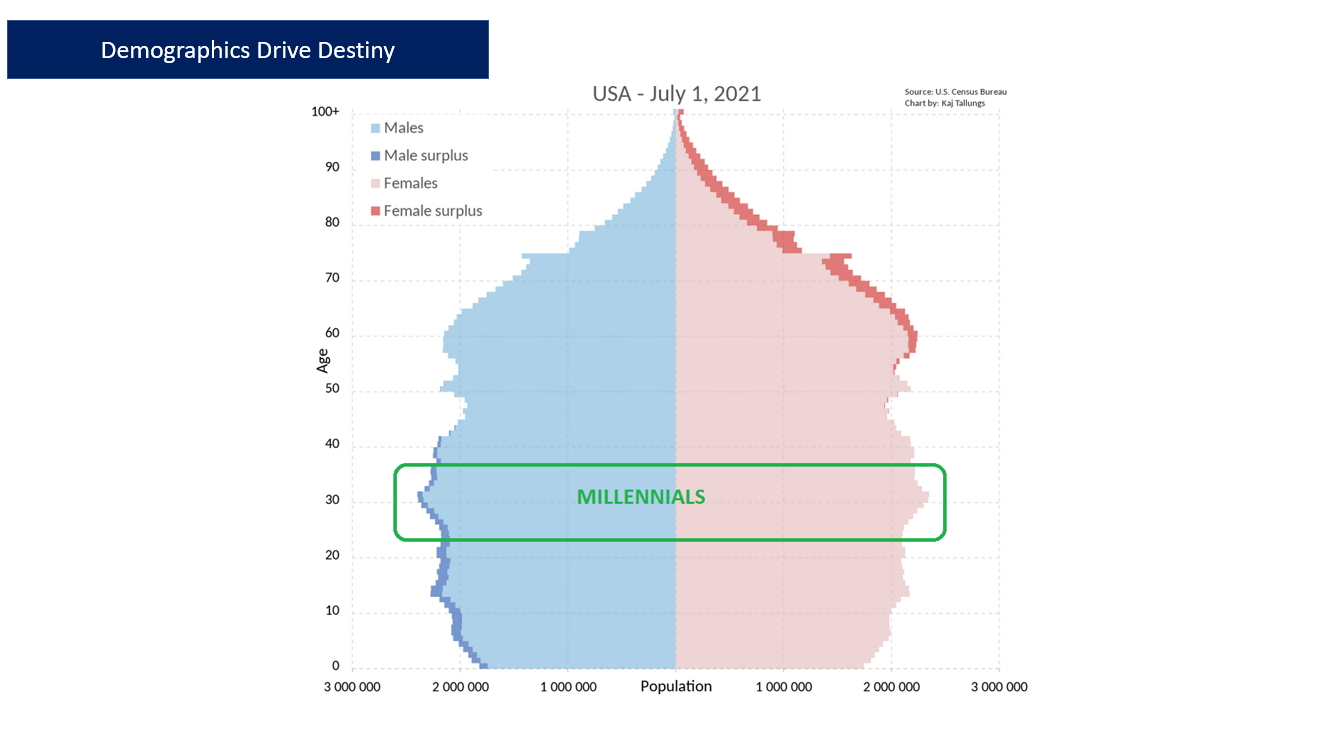

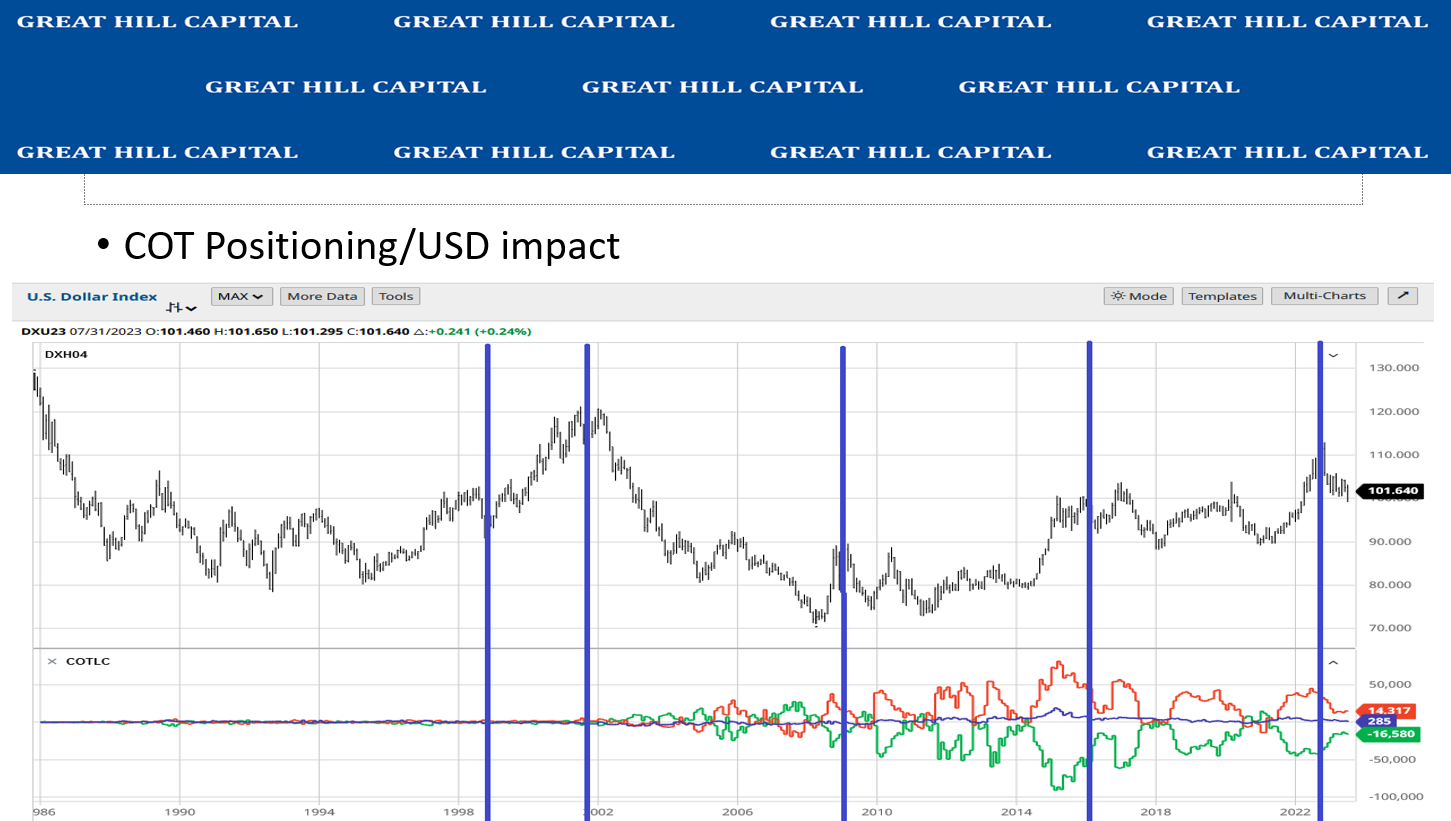

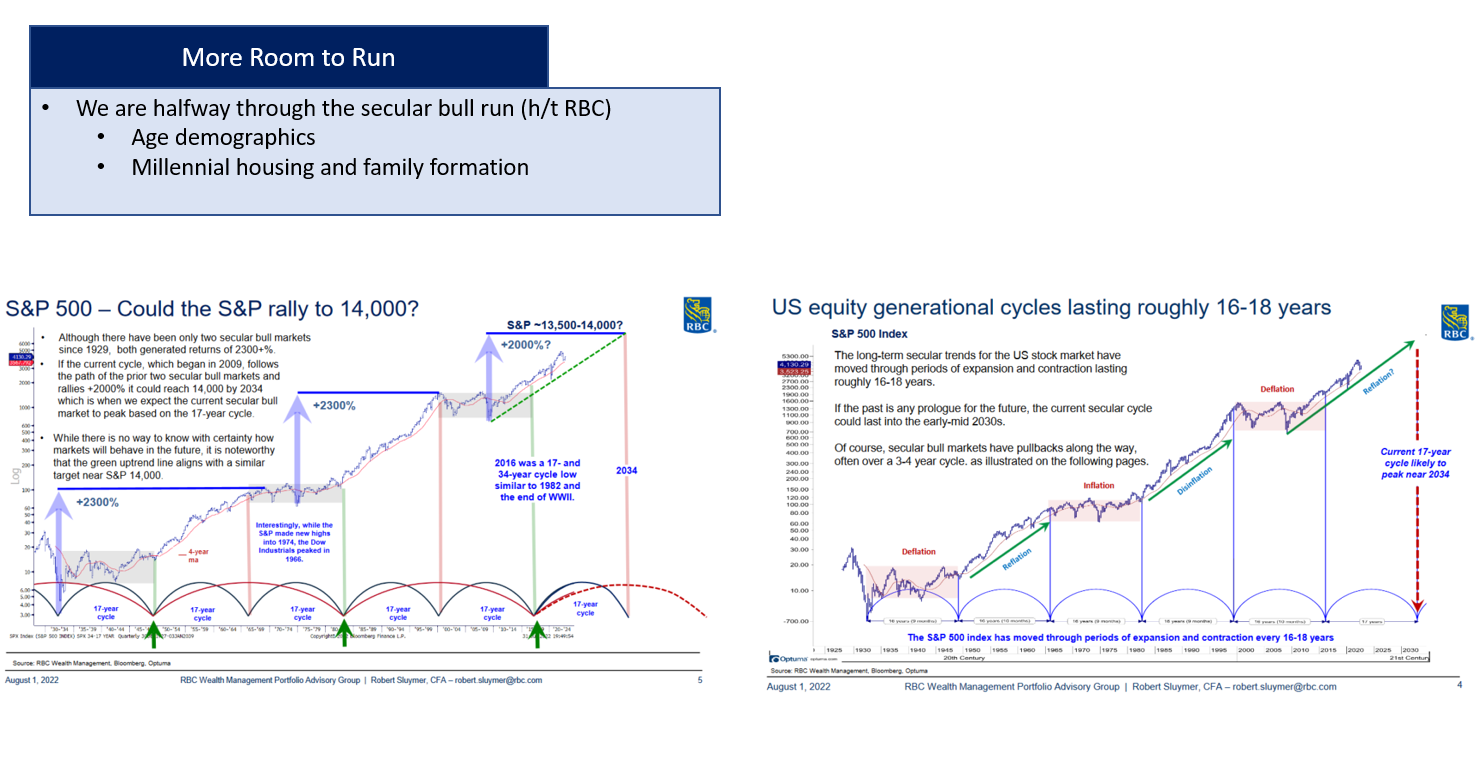

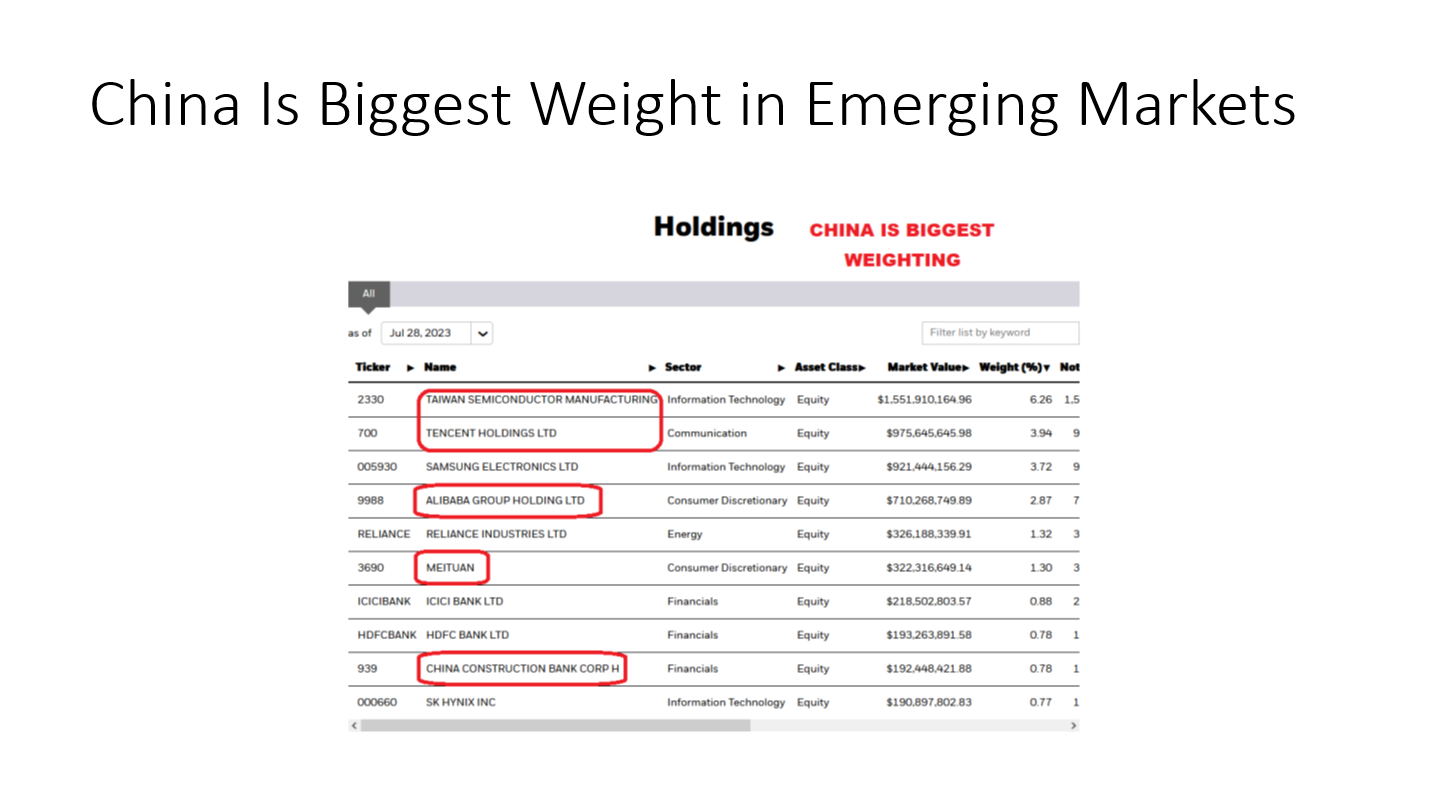

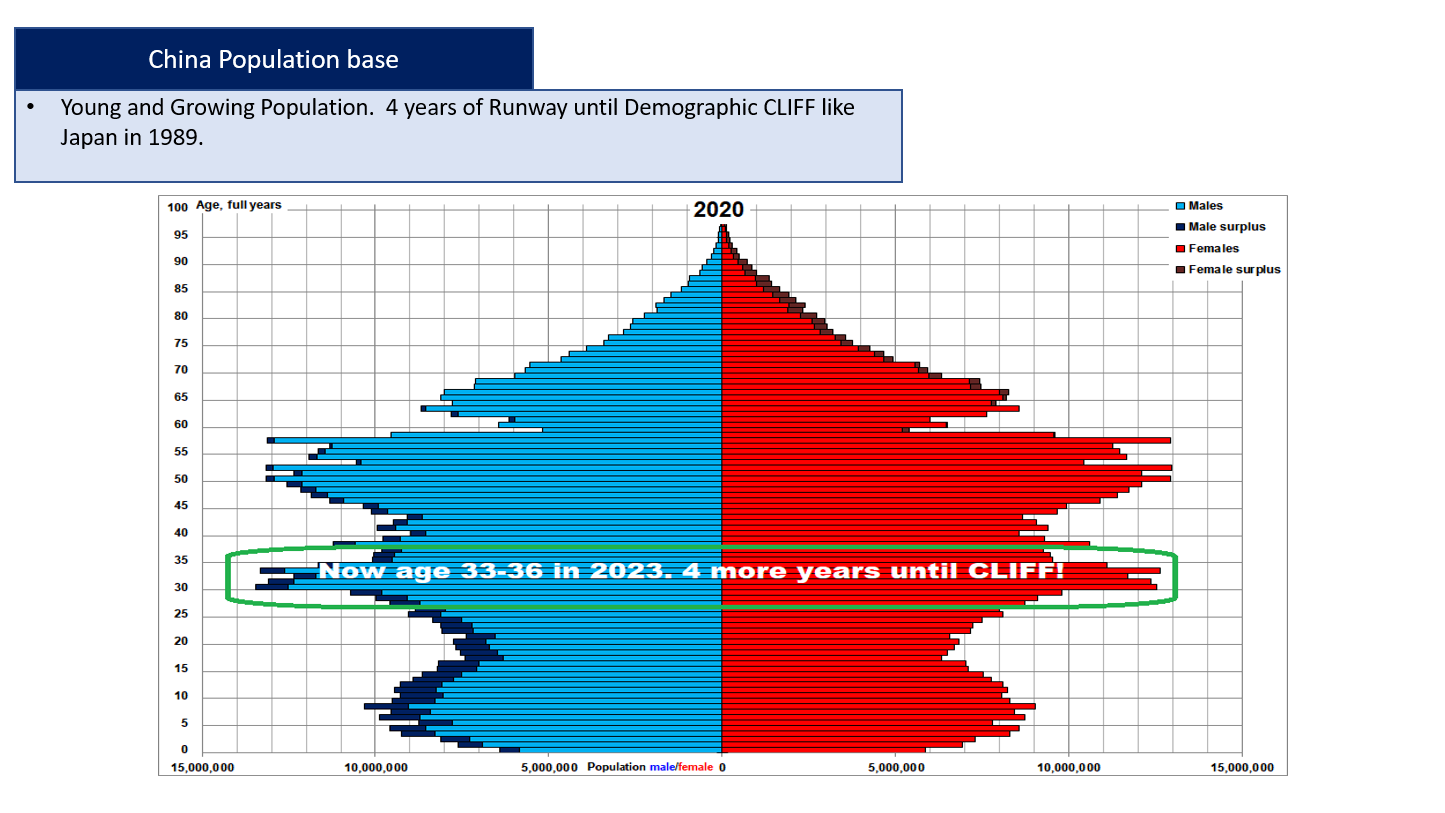

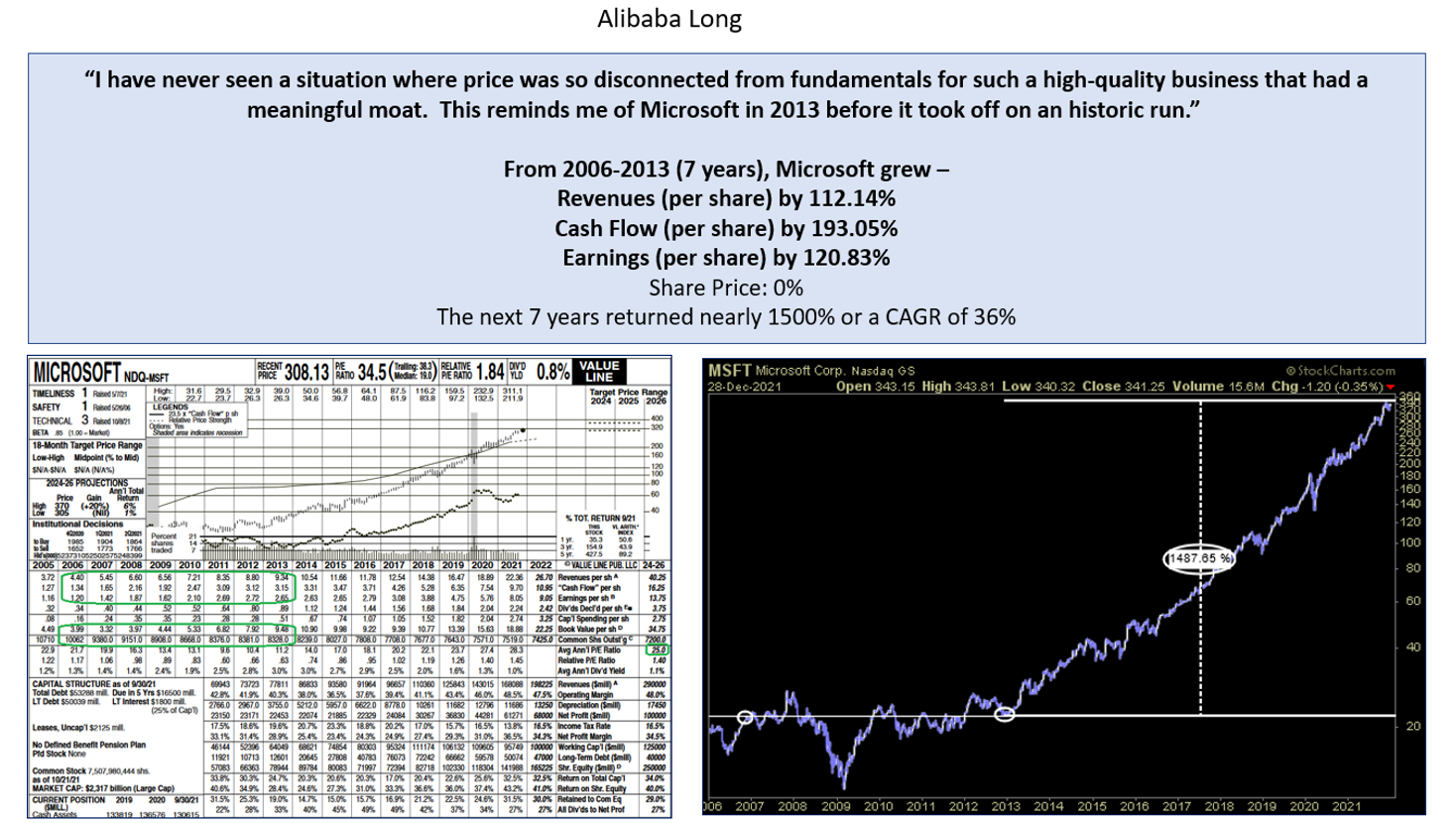

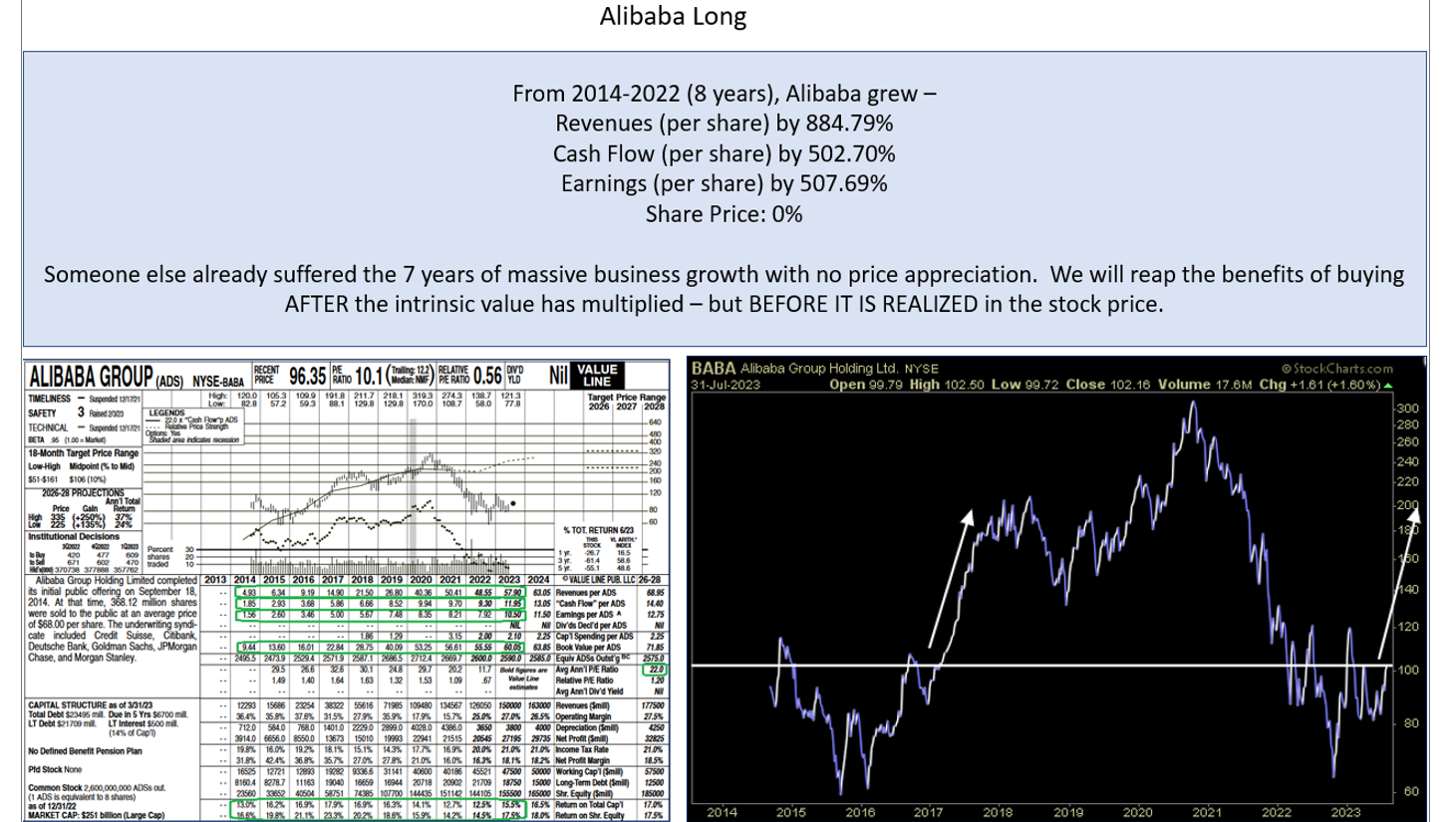

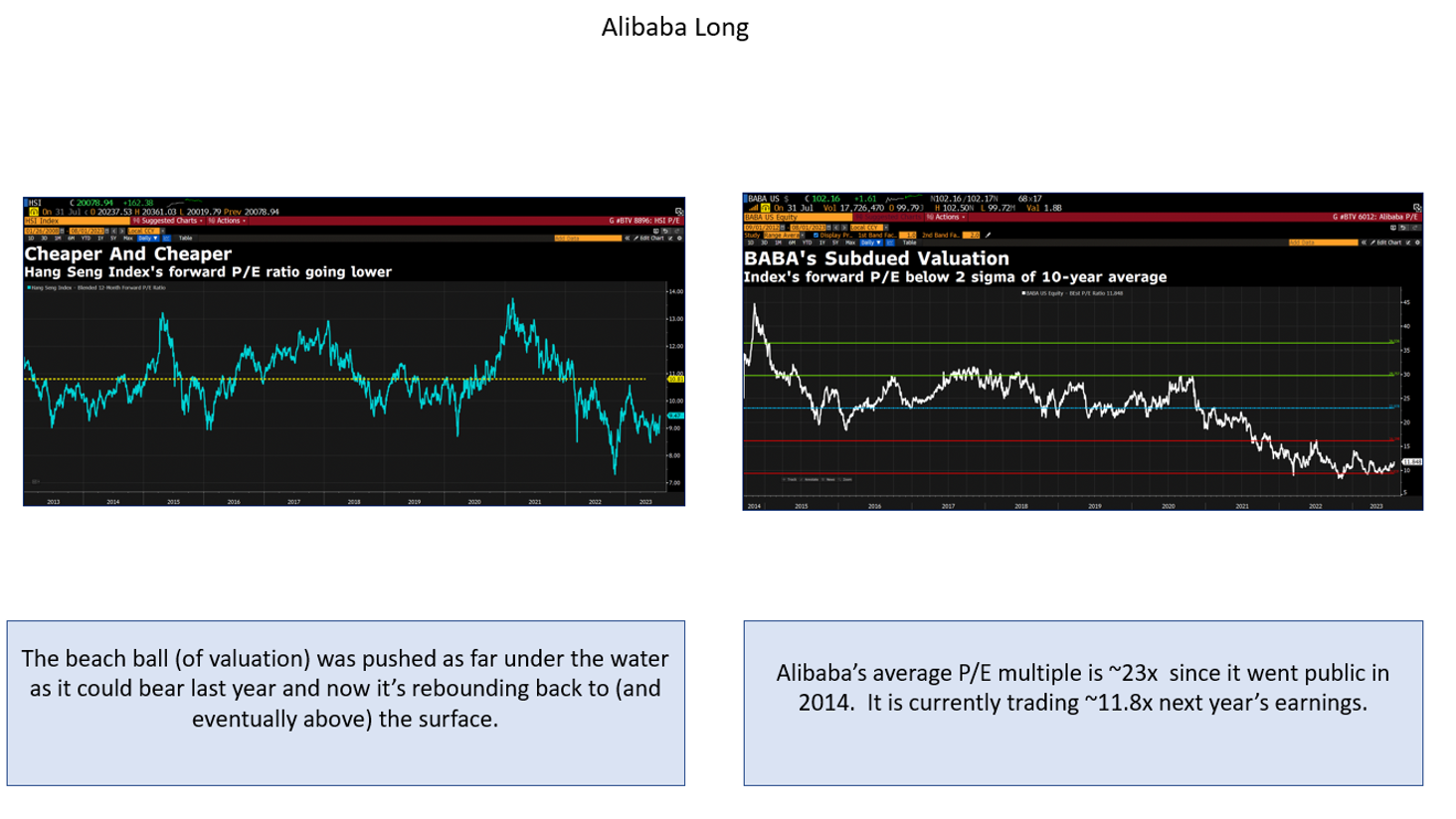

On Tuesday, I had the pleasure to speak at the Money Show in Las Vegas. Thanks to Kim Githler, Mike Larson, Debbie Osborne and Aaron West for having me on the main stage. In this segment I covered why we believe Emerging Markets/China/Alibaba will outperform over the next 12-36 months. There were great questions from the live audience at the end as well:

FULL Slide Deck To Follow Along Presentation

Key Slides:

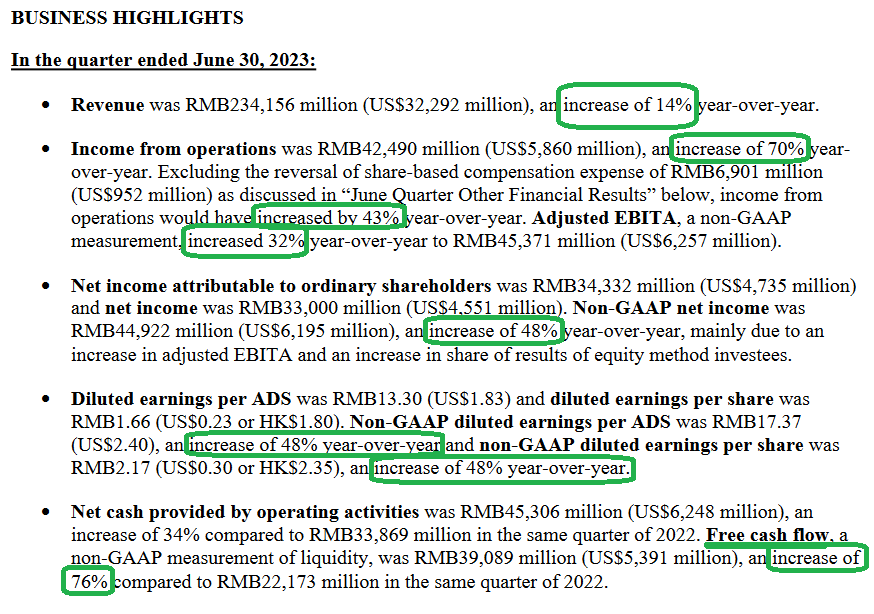

UPDATE: Alibaba CRUSHED earnings today:

![]()

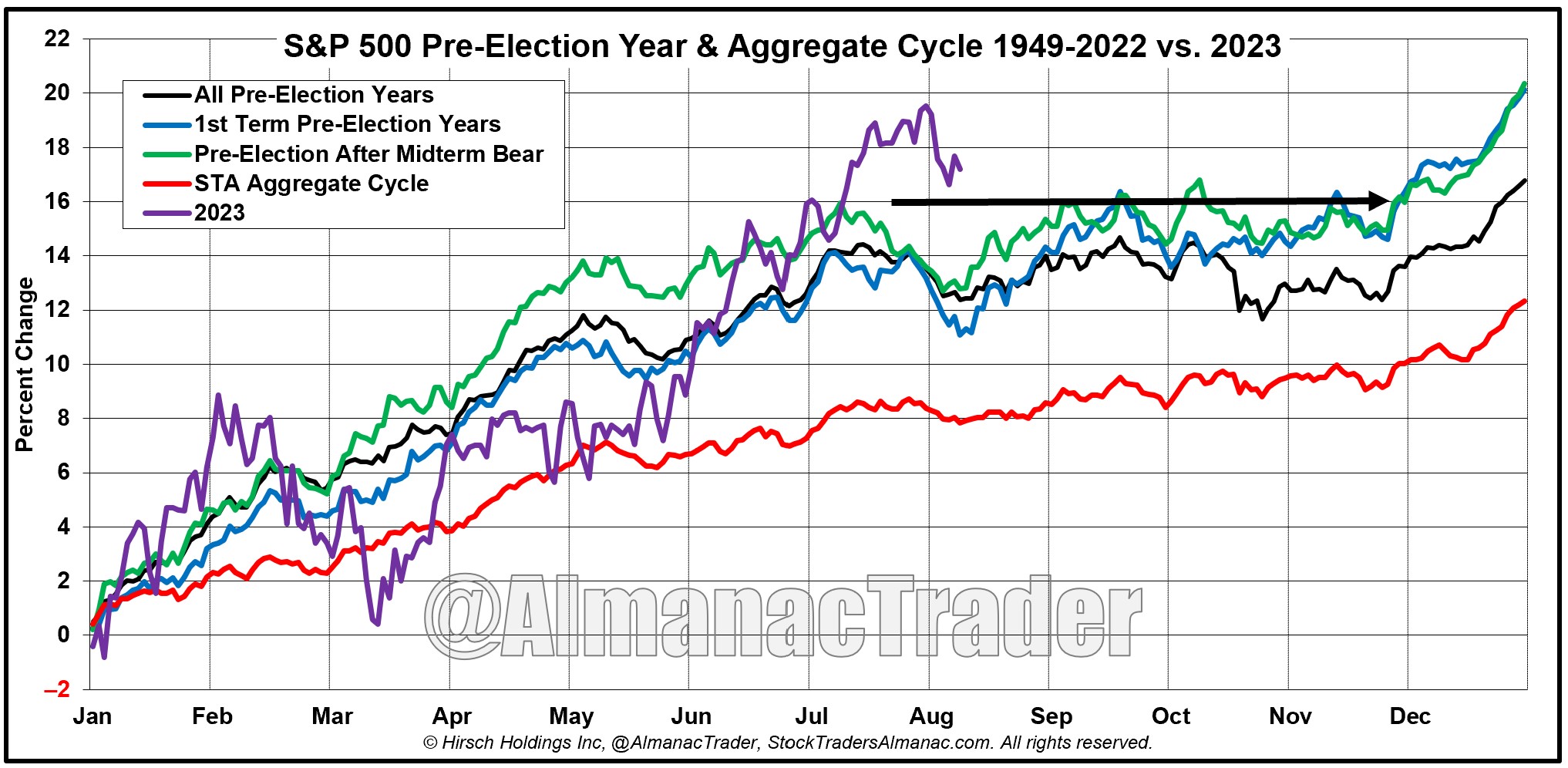

Now onto the shorter term view for the General Market:

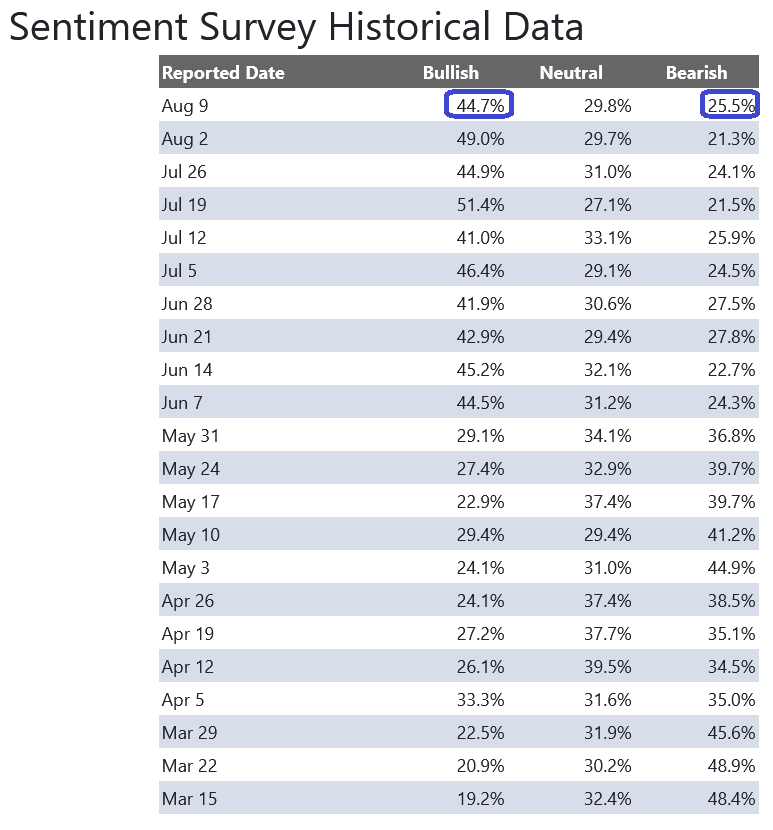

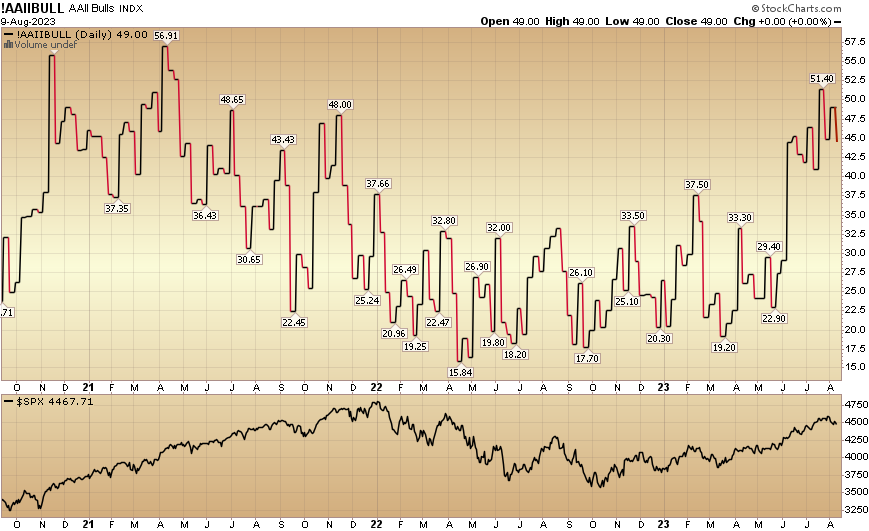

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) moderated to 44.7% from 49% the previous week. Bearish Percent rose to 25.5% from 21.3%. The retail investor is still optimistic.

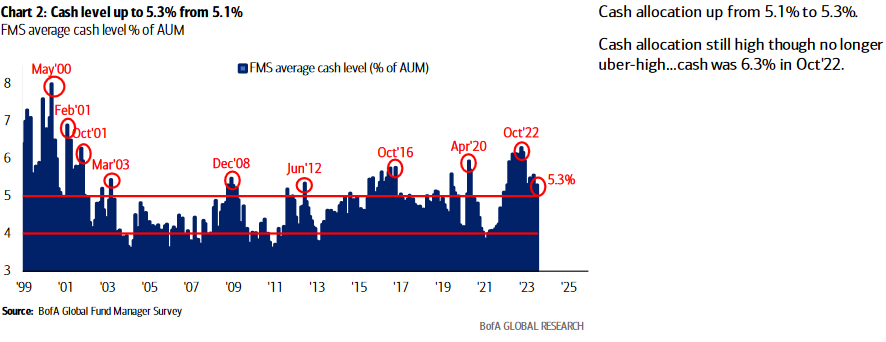

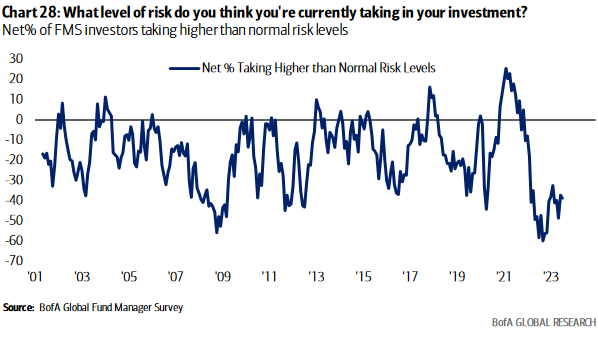

Keep in mind, institutional investors are nowhere near fully invested yet, so there will be a persistent bid on any bumpy/seasonal pullbacks through year-end.

Keep in mind, institutional investors are nowhere near fully invested yet, so there will be a persistent bid on any bumpy/seasonal pullbacks through year-end.

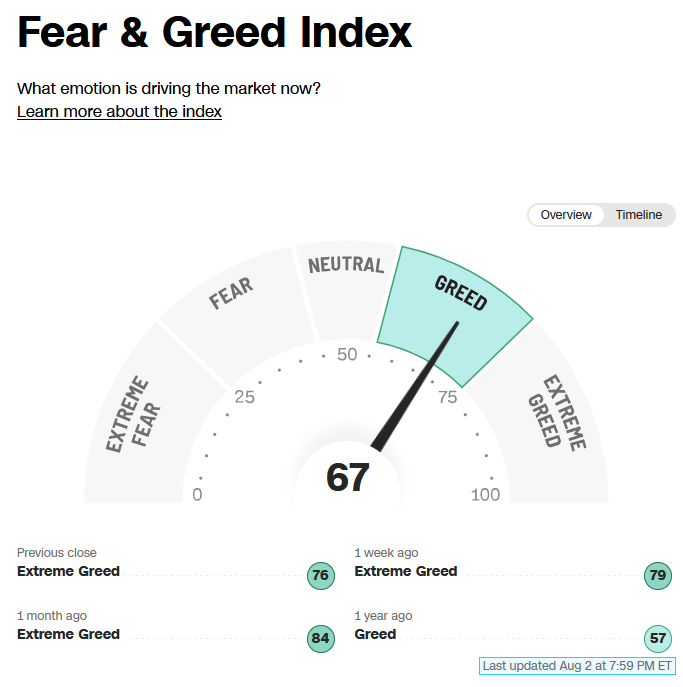

The CNN “Fear and Greed” flat-lined from 67 last week to 67 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

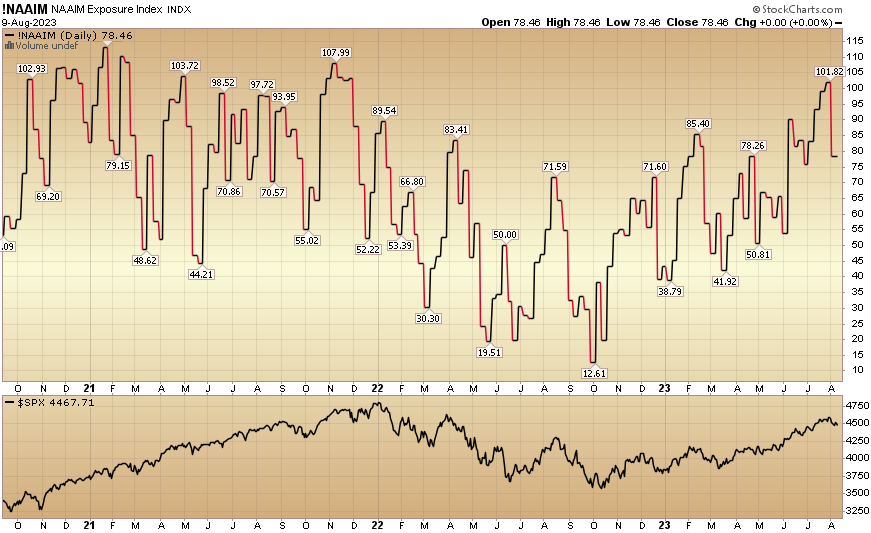

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 78.4% this week from 101.02% equity exposure last week.

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 78.4% this week from 101.02% equity exposure last week.

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

***After being highly exclusive since 2019 (and closed to new investors prior to that), our business is expanding to serve an additional tier of clients. The response we have received since opening up in the past few weeks has dramatically exceeded our expectations. If you missed this round, we expect to re-open to the current waiting list within 45-60 days after all of the new capital that has recently come on board is deployed (late September/early October). For details, to see if you qualify, and to join the wait list go here.

*Opinion, not advice. See “terms” above.