Article referenced in VideoCast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

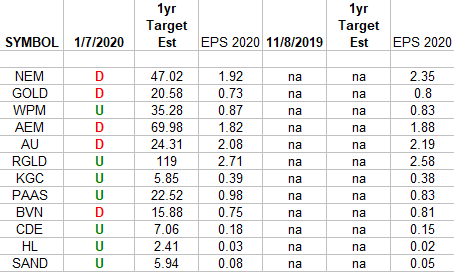

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?