If you have logged into Netflix lately, they have a new series out called, “Cobra Kai.”

The series is based on the original 1984 blockbuster movie, “The Karate Kid.” It stars the most likable guy in the world, Ralph Macchio (playing Daniel LaRusso). He is now in his 40’s – and runs a successful car dealership – while his nemesis Johnny Lawrence (played by William Zabka) is a failed handyman.

In the original movie, there was a scene where Johnny’s evil Sensei instructs him to, “sweep the leg” and show no mercy. As you will see in this short clip, Johnny takes Daniel out in one fell swoop:

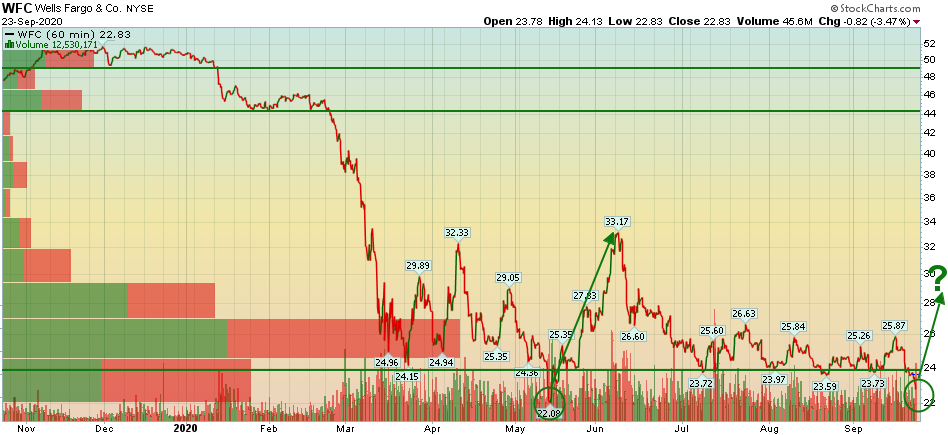

This is what happened to Wells Fargo stock yesterday (Wednesday). Whether it was the pressure on the sector from Monday’s European “illicit transfers” allegations (which Wells had no involvement), the CEO’s insensitive remarks, or wholesale selling in the general market – does not matter. What matters is there was a “leg sweep” that took out most of the remaining bulls by breaking down below a perceived level of “support.”

That’s the bad news. The good news is, that’s a common move before a hard reversal up (as we saw in May). The stock broke down below its previous support of 24.15, swept out all of the stop orders and then rapidly reversed 50.22% in the next 29 days. They took out the weak sisters and then didn’t let them back in.

Is it happening again? I don’t know but what has been interesting in the last few days is seeing big institutional blocks of call options in the name as people were getting pushed out of the stock. Here is an example of a reply I received when I posted one of these blocks of “Unusual Activity” (6269 contracts of WFC Dec calls bought yesterday):

I post it not to criticize (as I have removed the person’s name and handle), but to show what sentiment looks like at a “leg sweep” moment. It makes all the bulls doubt themselves and wipes out all of the retail traders who had stops below support. The pain of a “leg sweep” is palpable (and that is the point).

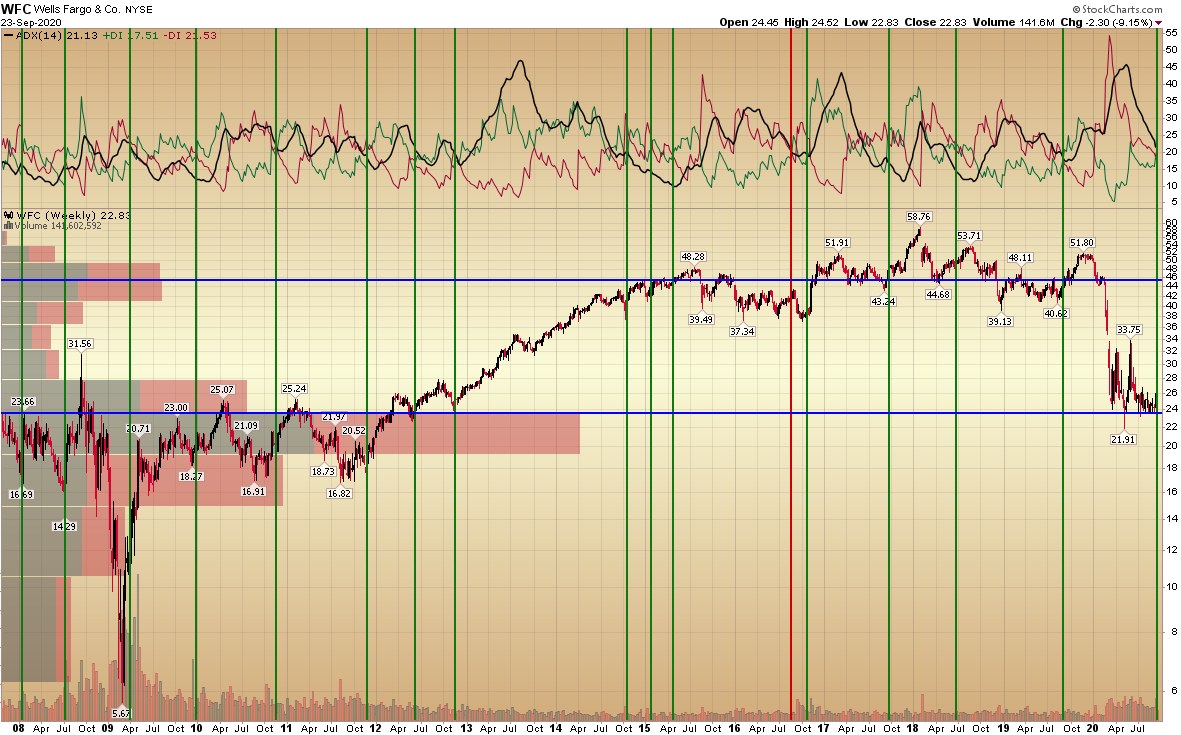

If you step back and take a breath, the stock has done nothing in 7 months. The thesis we laid out is still in tact, and even the support/adx indicators we pointed out on last week’s VideoCast are still in-tact:

That could change and we could be 100% wrong – but as of today nothing has changed – and in accounts that did not have a full position yet, we added. As Mr. Miyagi told Daniel in his famous quote:

Warren Buffett put it a bit differently when talking about patience. Some things just simply take time:

Cyclicals Beginning Their Move

Now, leaving aside one position in a large portfolio, let’s revisit the theme we laid out in past weeks – that money would start to come out of tech and move into cyclicals.

We couldn’t have been any more timely than our interviews and note from August 31- Sept. 1 when we were talking about AAPL being overvalued with a current year earnings multiple 61% higher than its highest ever multiple in the previous 15 years:

The Run DMC, “It’s Tricky” Stock Market (and Sentiment Results)…

So what’s the latest update on the S&P’s most loved stock AAPL (which we said was overvalued), and most hated stock WFC (which we said was undervalued)?

In the ratio chart above, you can see that Wells Fargo has outperformed AAPL on a relative basis since those interviews and note. It broke the “downtrend line” (which is bullish), and this week took a breather to possibly retest the line (before potentially breaking out to the upside). AAPL has fallen as much as 22% in September:

You can review the fundamental story on these two stocks here in our note dated August 27, 2020:

The Stevie Wonder, “Faith” Stock Market (and Sentiment Results)…

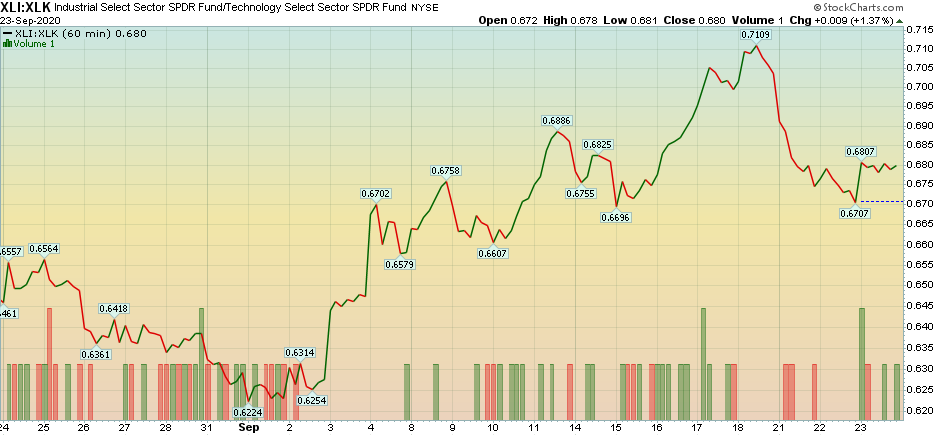

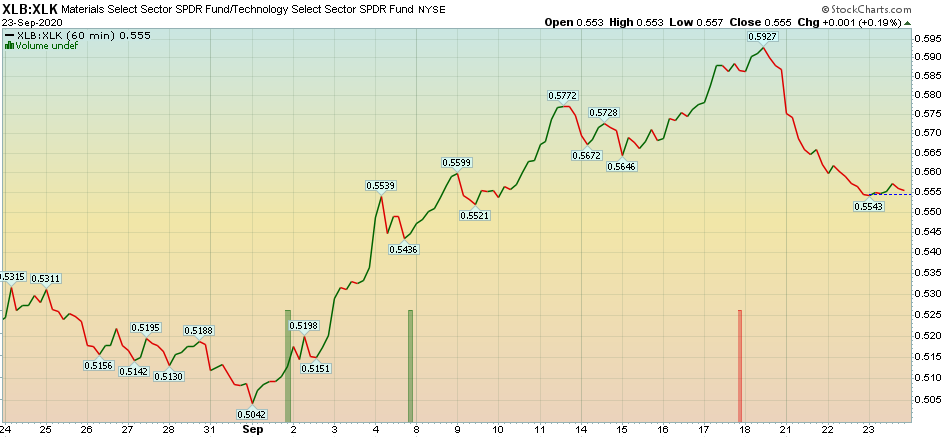

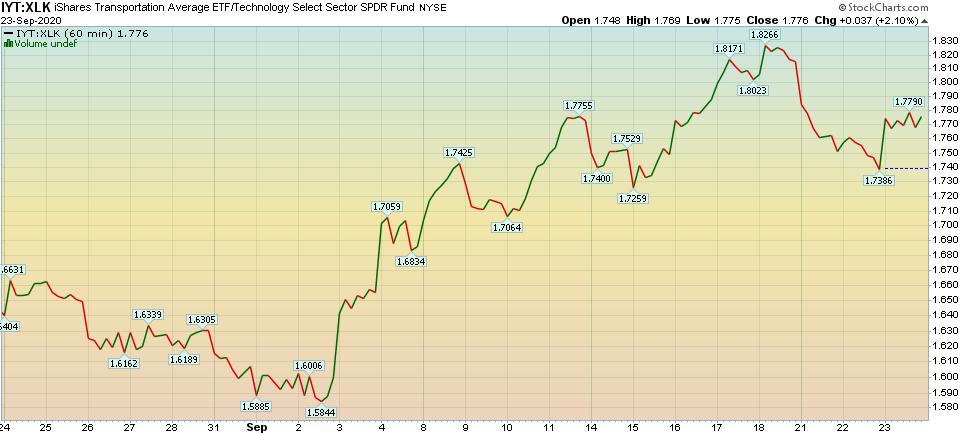

For much of the month (in-line with our thesis from the notes above) Cyclicals have been outperforming Tech – implying the “re-opening trade” is starting:

Industrials relative to Tech:

Financials relative to Tech:

Materials relative to Tech:

Transports relative to Tech:

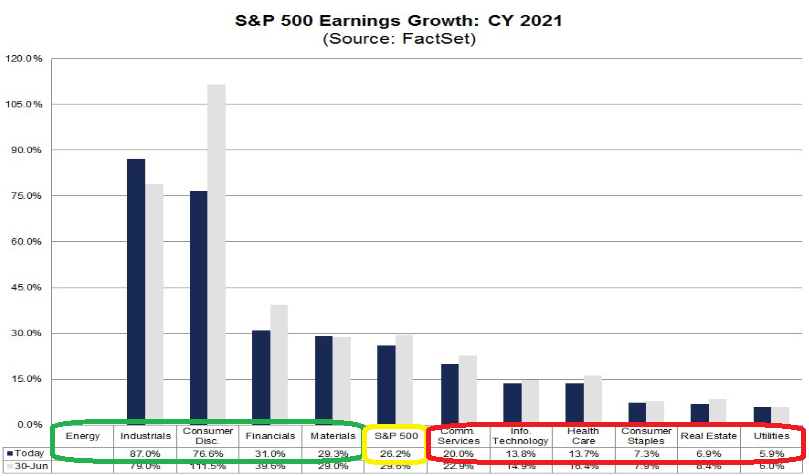

This remains consistent with 2021 Earnings Estimates for the S&P 500. Most cyclical sectors will grow earnings at a FASTER pace than the S&P 500, while Tech will grow earnings at HALF the pace of the S&P 500:

Where to find INCOME these days?

This week I was asked by a reporter from Bloomberg, “where can one find income with yields so low?” Since many people have been asking this question, I thought I would illustrate the answer with a story about Warren Buffett. My answer to the reporter was as follows:

“We are less focused on income at this stage – as there are so many opportunities for long term price appreciation. Laggard sectors like banks, defense stocks, industrials, materials, and some pockets of energy, etc. will turn hard to the upside once the vaccine is announced. Cyclicals that have been left behind – historically outperform in the early stages of a new cycle – which we are now entering.

With rates low, there is a demand for income – which cannot be had with ease in a low rate environment. The Federal Reserve has recently committed to keeping short rates low until 2023. With this in mind, an opportunistic selection for income would be among mid to large-cap high quality dividend growers – that have consistently increased their dividend over time.

It is not only the yield you receive at time of purchase that matters, but the pace and consistency at which they increase the dividend over time. These are generally companies with good management and have a leading position in a stable industry.

A good example of this concept in action is Warren Buffett accumulating (KO) Coca Cola in the late 80’s to early 90’s for an average split adjusted cost of ~$3.25 per share. The dividend in 1989 was $.085 per share or about a 2.6% yield at the time.

Most people would say, “2.6% is nothing, I’ll pass.” But what they missed is not only the appreciation of the stock price, but more importantly the increase in the dividend over time…

Today the dividend on those same shares is $1.64 (or a 50.4% yield on Buffett’s initial basis of ~$3.25). On his initial investment of $1.3B he receives ~$650M in annual dividends.

He has received over $20 of dividends for each $3.25 share he purchased during that period. On top of that, the price of the stock has appreciated 15x (for a capital appreciation of almost $20B) over that period.

So the secret is not how much does the dividend yield right now, but how good is the business and what is their history of consistently raising the dividend? Some examples of quality companies – that are still down from the pandemic and have a history of increasing their dividend every year for the past ten+ years are – MMM, CB, TR, BKH, SYY, BDX, VFC, ADP, KO, ED, WBA, XOM, AFL, T, IFF, TIF, BMY, PFE, HSY, HEI, WRB, TRV, GD, and MDT…

These are not recommendations, but rather a list you can begin to explore in your quest for potentially ongoing steady and increasing income over time.”

Hat Tip to “Dividend Growth Investor” on Twitter for posting the historic data.

What about Insurance?

Another reporter from US News and World Report asked me what I would do to insure against a potential crash in Q4. As I learned at the first hedge fund I worked at, “Opinion Follows Trend.”

It is natural that the editors would assign this story AFTER the market had already corrected and volatility was spiking. My reply may be helpful:

“This is the best quote you may want for this article, ‘the time to buy insurance is before the fire!’

This is (currently) a normal pullback that will likely be resolved within a week(s) of you going to print. The time to get defensive was the end of August/beginning of September when I put this note out:

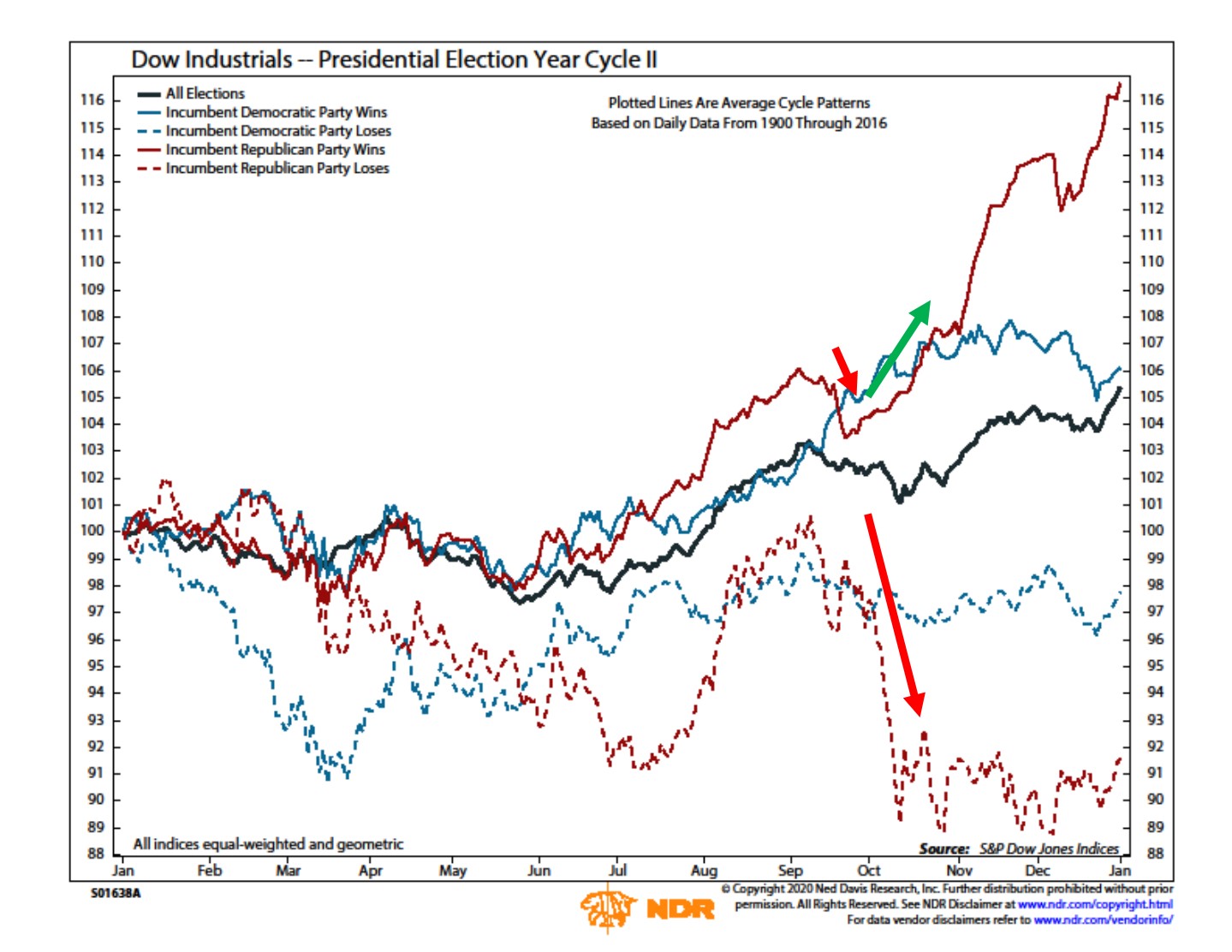

As for a 4th quarter correction, I wouldn’t count on it (unless either party sweeps). Gridlock is historically bullish and that’s what we are likely to get.

The seasonality for weakness is right now. Q4 is when you generally want to be fully invested into year-end. Anything can happen, but that’s what 100 years of data tells us is statistically advantageous.”

As all talented journalists do, she asked the smart follow up question, “then what would you do now?”

I answered,

“If you have some cash, now is a great time to be selectively picking up laggard stocks (Financials, Industrials, Materials, Small Pockets of Energy) that will outperform in the early part of the new cycle. M2 money supply is up ~20% since March. We’ve filled a $1T problem (GDP contraction) with almost $10T of authorized stimulus, aid and liquidity (most of which has not even been used).

We will see GDP growth of >6% in 2021 due to the magnitude and speed of the response to the short term contraction. Don’t fight the Fed… (and valuations are very reasonable in laggard groups – relative to future earnings power).

Tech/Growth stocks outperform when GDP growth is slow (2% or less) because managers have to bid up a small supply of stocks where they can find earnings growth in a slow economy. As we re-open, we will see fast GDP growth (due to the stimulus and M2 growth) and GDP will grow at the fastest pace in decades (OFF A LOW BASE) +6%. This means managers will have a GREATER SUPPLY of companies (with fast earnings growth) to choose from…

This is when Cyclicals have relative outperformance (for the first 4-8+ quarters of a new cycle). Furthermore, S&P Earnings Estimates for 2021 support this thesis: Energy, Consumer Discretionary, Financials and Materials will all grow faster then the S&P 500. Technology will grow at 1/2 the pace (13.8% see below table) of the index (26.2%) – which is why you see this rotation starting and FAANGM getting smashed.”

I will post both articles when they are published in the next week or so.

We are currently in an information Vacuum. The market is trying to find its footing against conflicting forces on a daily basis. When the headlines show progress on the Vaccine front (as we saw yesterday with JNJ becoming the 4th vaccine in Phase 3), money comes out of tech. Generally it moves into cyclicals on news like this, but yesterday EVERYTHING was down.

Conversely, when you see new restrictions/closings, like in the UK over the weekend, money moves back into tech for a day or so (the “stay at home trade”).

Here is the information the market is thirsting for:

VACCINE: We expect an announcement sometime in October or November. With 4 vaccines now in Phase 3, I would not be surprised if we get an announcement ahead of schedule.

EARNINGS: Begin in earnest in the next three weeks.

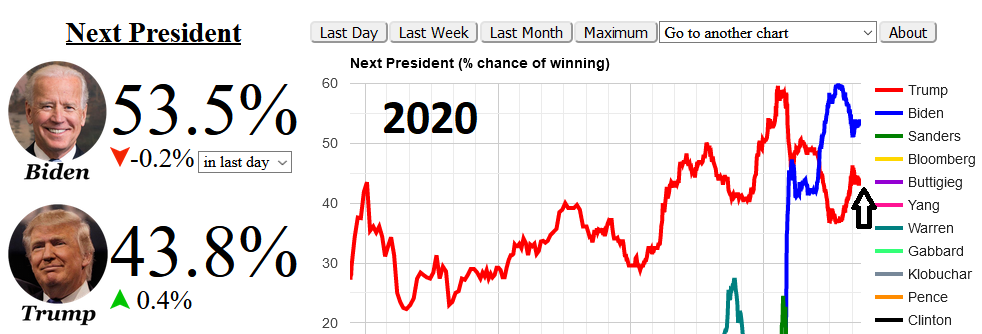

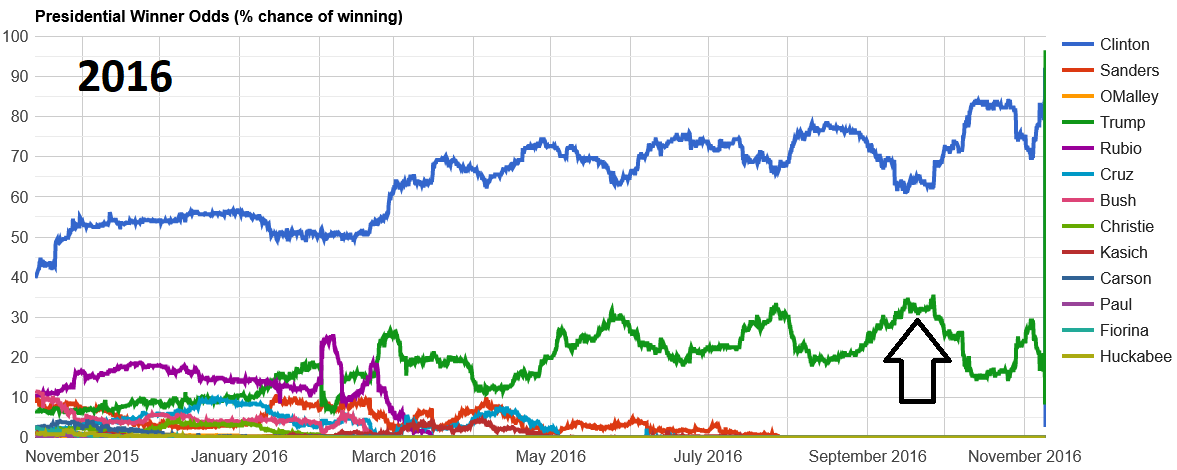

ELECTION: May be a delayed result (if close) due to mail-in ballots. There is no way to tell. While Trump has a 43.8% chance of winning at present (according to ElectionBettingOdds.com), he only had a 33% chance against Clinton in 2016 – at this time in September. Anything can happen and the market does not like uncertainty:

If these managers are correct and the announcement of a credible vaccine would lead to an increase in yields, this would be a boon to banks.

While the Fed has committed to keeping short rates low until 2023, they have dismissed yield curve control – for the time being – and a rise in long rates would help Net Interest Margin (NIM) for banks (the difference between what they pay for capital and what they charge for capital).

Here’s an update on the 2/10 spread – which is in-line with past recoveries of banks:

So in the absence of data on these four fronts Vaccine, Earnings, Election and Stimulus (V.E.E.S.) you have uncertainty. As such, the U.S. Dollar has put in a bottom against the basket of major currencies (after falling ~11.5% from March – August).

Foreign investors buy dollars to purchase US treasuries in an effort to find safety in an information vacuum. Gold has no yield and Japan (Yen) is going through political change of its own – in the short term. The USD is the safe haven of choice until we get new information on these fronts (V.E.E.S). Until then, the USD is likely to have bottomed in the short term.

If you look at USD futures, you will see that “Commercials” have been buying the dollar ahead of this move, while “large traders” have been excessively short. This usually presages a move up in the Dollar as the commercials are the smart money and the traders tend to be late to the party:

Now onto the shorter term view for the General Market:

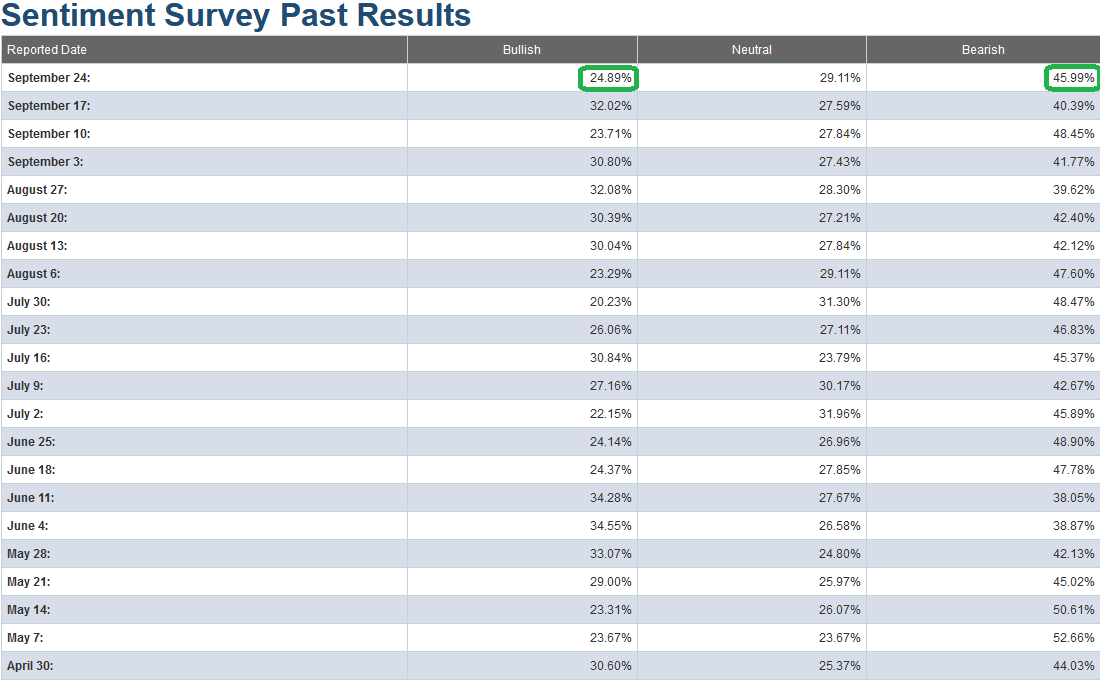

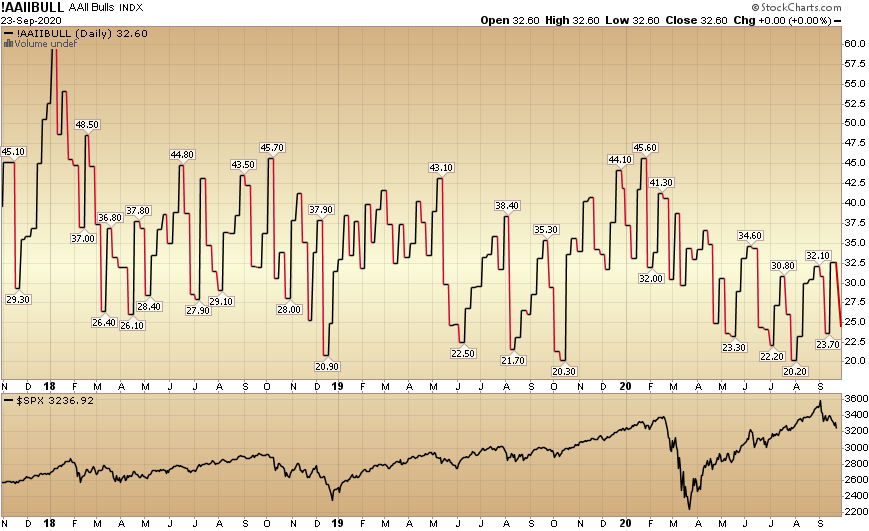

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to to 24.89% from 32.02% last week. Bearish Percent rose to 45.99% from 40.39% last week. We are now closer to a bearish extreme – which historically favors being a buyer versus a seller.

However, with many other indicators in the middle of their range, we need to be extremely selective. This market climate is designed to chop participants up until it finds its footing – based on more information regarding (V.E.E.S.).

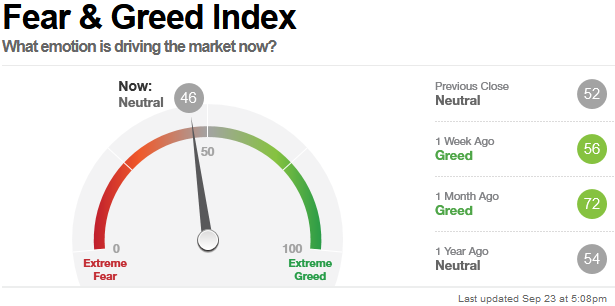

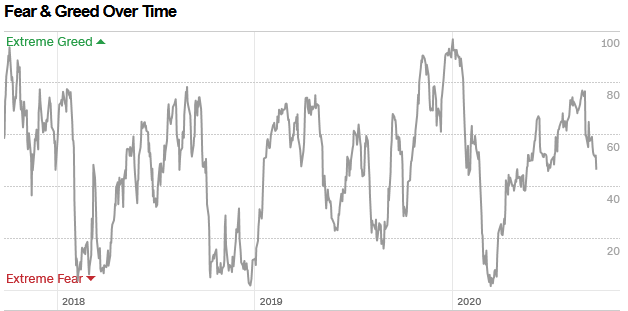

The CNN “Fear and Greed” Index slid from 56 last week to 46 this week. Fear has crept in, but not at an extreme level. This indicator is in the middle of the range. You can learn how this indicator is calculated and how it works here: (Video Explanation)

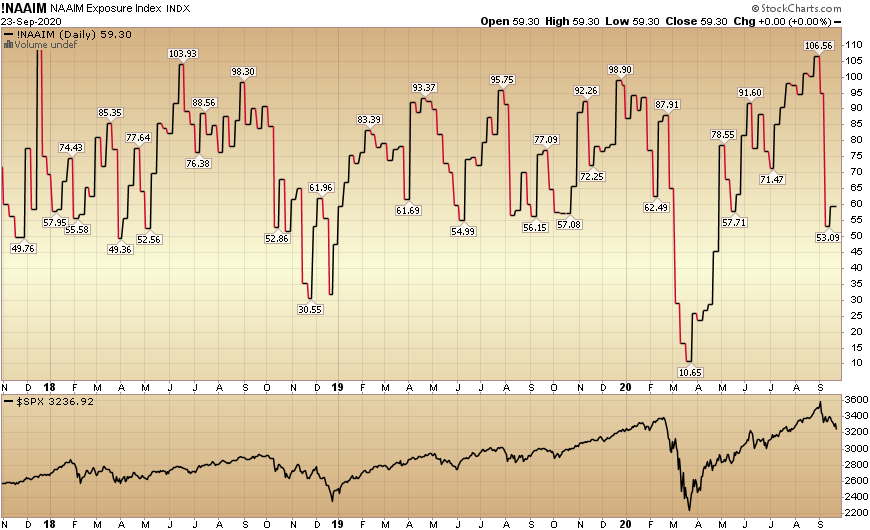

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) bounced from 53.09% equity exposure last week, to 59.30% this week.

Our message for this week:

As I have repeated for a few weeks, the catalyst for change (a continuation of the move into Cyclicals) will likely come from science at this point. Don’t bet against science. Not only do we have 4 vaccines in Phase 3, but we are seeing progress on treatments as well (Lilly and Regeneron’s monoclonal antibody treatments).

The market is starting to ease into the “re-opening” trade (Cyclicals) – in anticipation of the imminent vaccine approval. We saw this with Industrials, Materials, Transports and Financials outperforming Tech so far in September.

Given the legacy overweight to tech, my sense is there is still some more to work out in the coming week(s) for some of the overvalued pockets of tech/saas, etc. The “pain trade” is likely still down for some of the “over-owned” names.

However, I do not think we are in for a major wholesale crash. There’s enough money ($4.4T cash on the sidelines) that has yet to broaden their exposure and get positioned for the “re-opening” trade move into cyclicals/value.

These economically sensitive names outperform in the early/high economic growth stages of a new cycle – which we have started in Q3. We will continue to take advantage on any short-term weakness – as when the re-opening trade flips on in earnest – it will be abrupt and meaningful for those who were correctly positioned…

But for now, “Patience Danielson!” And always remember how the “leg sweep” was resolved in the end: