Yesterday the market got hit on all fronts:

1. Covid Cases spiked in FL, TX, CA, AZ.

2. US looked into new tariffs on the EU to level the playing field around Boeing/Airbus competition.

3. The IMF downgraded global growth from -3.0% to -4.9% for 2020.

4. Tri-State (NY, NJ, CT) announced a 14 day quarantine for people traveling from states with case spikes.

5. The Stock Market worried about November elections. Blue administration/potential wave = higher taxes/lower earnings.

The market didn’t take it well as the S&P closed down ~81 points (Dow down ~710).

It reminded me of the song, “When It Rains It Pours” by Country Star Luke Combs. All the worst happens at once to the guy in the song/video. He wakes up with a hangover, gets into an argument with his girlfriend, and she leaves him. Just when it looks like it can’t get any worse for him, his luck changes instantly:

So I went for a drive to clear my mind

Ended up at a Shell on I-65

Then I won a hundred bucks on a scratch-off ticket

Bought two twelve-packs and a tank of gas with it

She swore they were a waste of time, oh, but she was wrong

I was caller number five on a radio station

Won a four-day, three-night beach vacation

Deep sea, senorita, fishing down in Panama

And I ain’t gotta see my ex-future-mother-in-law anymore

Oh Lord, when it rains it pours

Now she was sure real quick to up and apologize

When she heard about my new found luck on that FM dial

And it’s crazy how lately now, it just seems to come in waves

What I thought was gonna be the death of me was my saving grace…

At the point Luke thought his world was over, his luck started to change.

On Tuesday I was on Cheddar TV discussing the structural pessimism embedded in the market – that supports additional gains. Thanks to Brad Smith, Nora Ali and Francesca Conti for having me on. We also dissected the spike in cases by age and locale and the implications of the trend/behavior moving forward. And finally, we discussed the salient economic data as it has been coming in. You can watch it here:

Just as Luke thought that his girlfriend leaving him was going to ruin his life, it turned out to be the inflection point when his luck changed. Similarly, just as most people think that COVID will destroy the economy, it may prove to be the best thing that ever happened for growth moving forward:

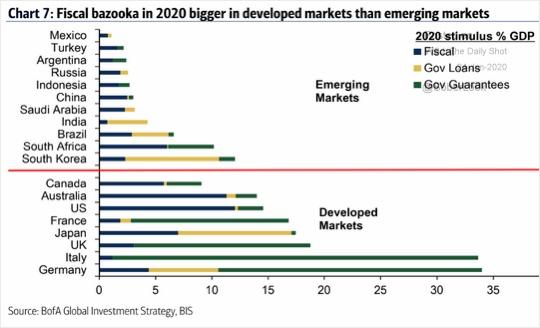

Fiscal Stimulus:

If we did not have the tragedy of COVID, we would not have the benefit of global coordinated fiscal and monetary policy moving forward:

If you remember the narrative of 2019 was that monetary policy was “pushing on a string” and unless policymakers finally started spending, we would have stagnant growth. As you can see from the table above, COVID has jump-started fiscal stimulus to historic levels in just a couple of months.

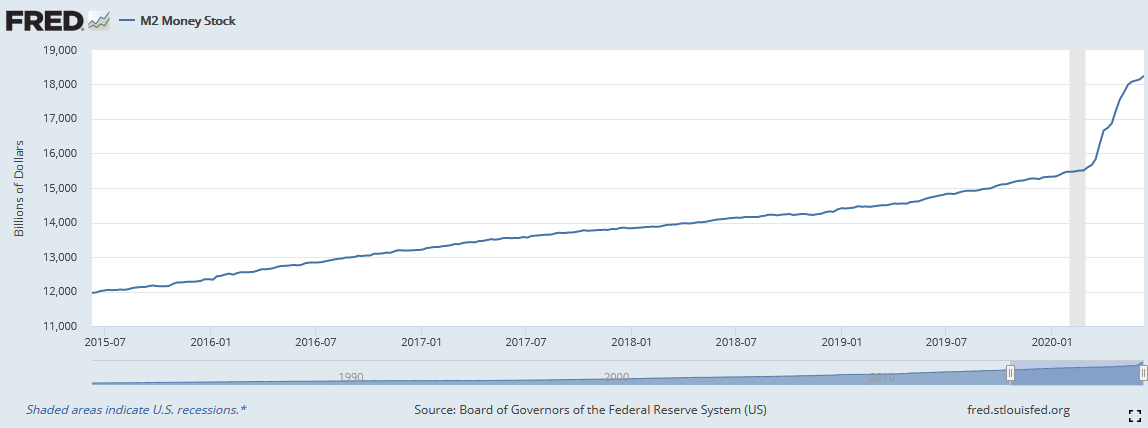

M2 Money Supply and the Multiplier Effect:

During the great financial crisis of 2008-2009 the Fed increased its balance sheet by a little over $3.6T and money supply (M2) increased by ~$6.5T (or near double over the same period).

If that same multiplier effect kicks in this time (the Fed has increased the balance sheet by ~$3T), we could be looking at ~$15T of new money sloshing around the economy in short order.

This is compounded by the fact that the Fed decreased the reserve requirement for banks (normally 10%, now at 0%). At zero, the money supply could increase even more than past instances.

Taking into account the IMF’s new dire prediction of an 8% contraction for the US in 2020 or ~$1.65T, $10-15T is more than enough to offset the short term weakness. When you look further out to 2021, a vaccine comes into play as well as a Fed consensus of +5% GDP growth.

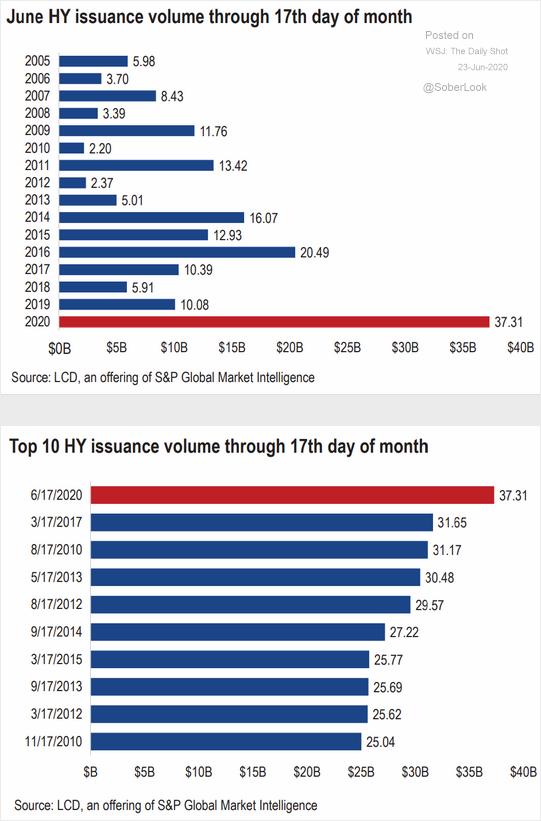

Credit Issuance:

The Fed has also backstopped the credit markets enabling companies to re-liquefy their balance sheets to weather the short term contraction – while demand steadily recovers in coming months.

Both YTD and the month of June show how open the credit markets have been for companies to build a war chest of capital to get them through this short term contraction.

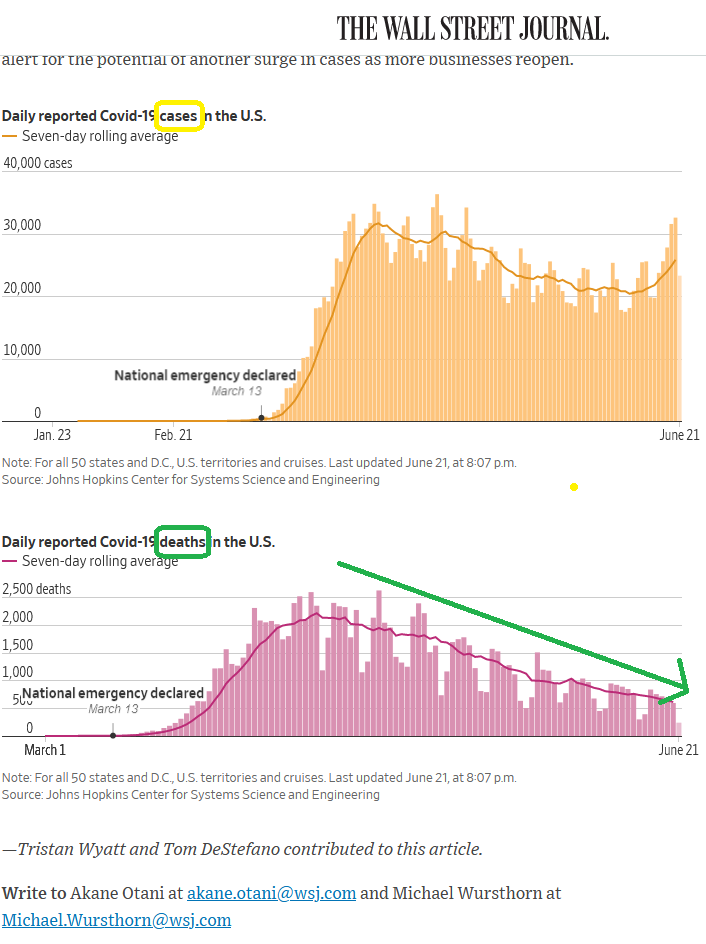

Deaths vs. Cases

So the backstops are there, now the only question is what will happen first? Will we achieve herd immunity or will science win and deliver a silver bullet treatment or vaccine first?

While the cases have spiked up mostly in lower states like TX, FL, AZ, GA, deaths continue to decline nationwide. This is attributable to three factors:

- Doctors and hospitals know more than they did three months ago and are better equipped to save lives with treatment.

- The average age of cases has dropped from mid-60’s to mid-30’s and these cases tend to have better outcomes/recoveries.

- Testing has increased dramatically.

The market was spooked on Wednesday due to the 5 factors listed above, but I believe the heaviest weighting was fear of a second wave and shutdown. The administration and most nationwide leaders are all in accordance that we cannot afford another shutdown. We touched on this fear among institutional money managers in last week’s note:

The Drake “Toosie Slide” Stock Market (and Sentiment Results)…

The states that are getting hit the hardest have not yet experienced what we saw in the epicenter (NY, NJ, CT) so the incentives to wear masks indoors, socially distance and wash hands are not as clear. Meanwhile, because we have been hit so hard in the northeast, everyone is taking action to protect themselves by following the “holy trinity” (masks, hand washing and social distancing) and cases in our region are plummeting.

The same thing will happen in the states that are now having spikes. The threat will become real to people (as it hits loved ones) and they will see how it is in their interest to practice safety in public – so we that can continue to go about our business as normal – until we have a clear treatment or vaccine (likely before the end of the year).

Push/Pull

Will the market continue to look through the short term mini-spikes and bet on science/recovery or do we have to consolidate some of the gains over the summer before resuming the move higher? Ultimately, the liquidity and stimulus will win (and get a boost from science adding a long term solution).

We knew from watching China that we would be able to recover as they did. The southern states getting hit with spikes should also know that they will recover just like the northeast. We remain hopeful that they will learn our lessons and follow protocol quickly – so that they do not have to experience the economic slowdown that our local businesses had to endure through the shutdown.

I commented in the VideoCast last week, if we are at war with an invisible enemy the only way to win is to equip our soldiers.

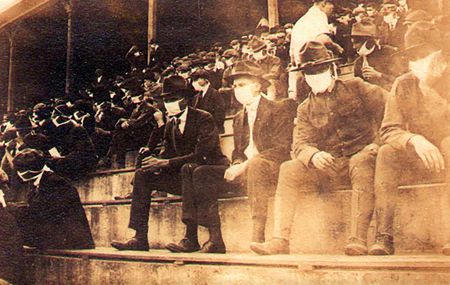

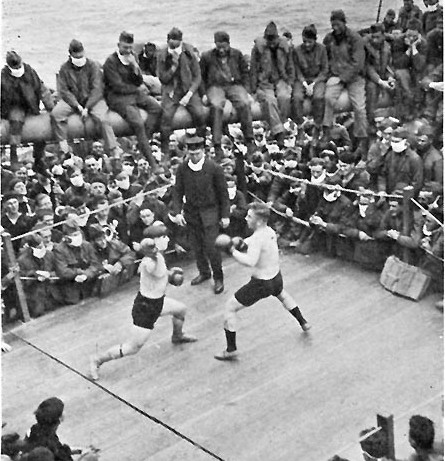

In conventional war it is guns and tanks and planes. With a virus, it is masks in crowded spaces. They did it in 1918 – during the Spanish Flu (both players and fans wore masks) and they made it through:

If you remember from my article on March 19, they also never retested the lows in the stock market after the initial drop:

The Spanish Flu – Coo coo ca choo – Stock Market (and sentiment results)…

So long as we don’t give the virus new hosts, it can’t win. If we want to crush it (the invisible enemy/virus), grow GDP like never before, and put millions back to work in record time, we have to use the weapons we currently have at hand (masks) to starve the virus of hosts. Sooner – rather than later – science will provide our “weapon of mass destruction” against the virus in the form of a treatment or vaccine that crushes the enemy once and for all.

I would not bet against science or liquidity/stimulus in the intermediate term. We will use any opportunity the market serves up to add quality for the intermediate to long term.

Do not be surprised if our luck changes as quickly as it did for Luke Combs in the featured song in this article. Our “scratch-off” ticket will come in the form of science, and everything can change in an instant. Until then, be a Warrior/Patriot and starve this virus with the weapons we have at hand. They are working in the Northeast and will work nationwide when everyone joins the battle.

Now onto the shorter term view for the General Market:

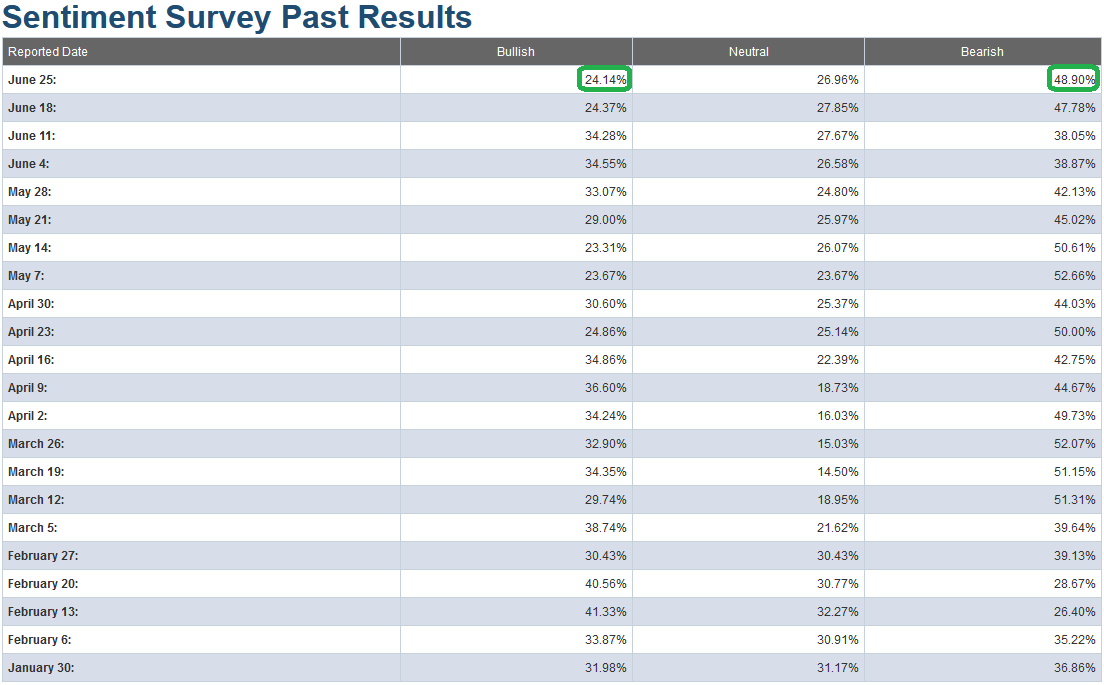

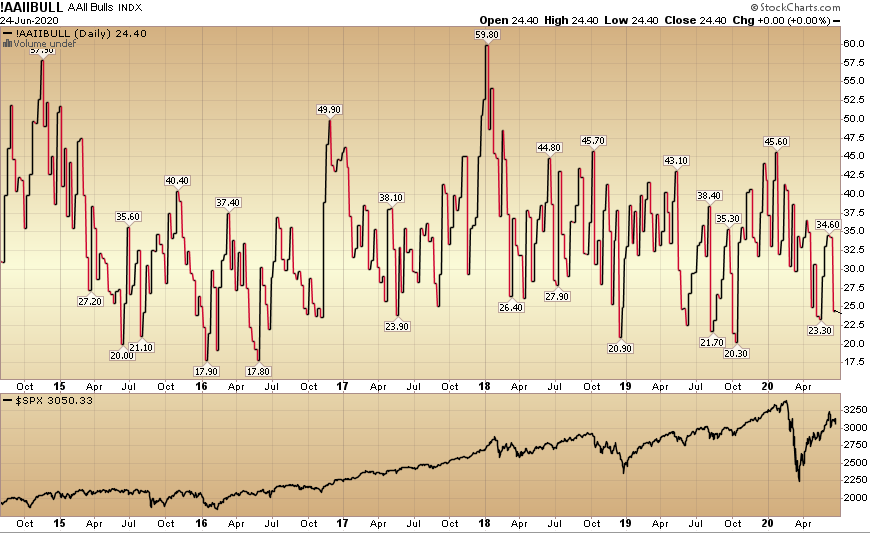

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) compressed even further to 24.14% from 24.37% last week. Bearish Percent also expanded to 48.90% from 47.78% last week. This is a level that historically favors being a buyer versus a seller. See chart below where you can track lows in bullish sentiment to lows in the S&P 500.

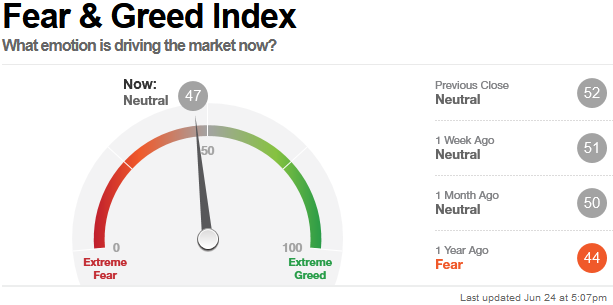

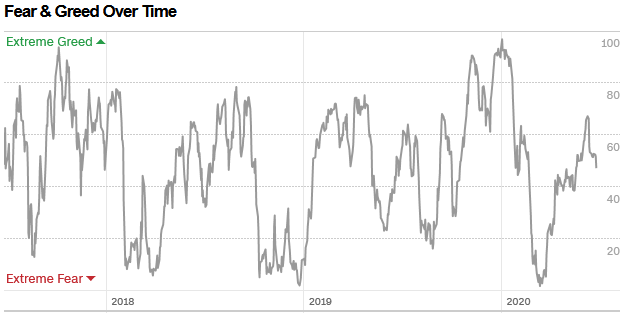

The CNN “Fear and Greed” Index slid back from 51 last week to 47 this week. Despite the market moving up ~40% off the lows, we have still not hit anywhere near an extreme/euphoric level (>80/90) yet. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose from 77.48% equity exposure last week, to 88.25% this week.

Our message for this week:

Two weeks ago I said, “As I have made the case, we will likely get some mini pullbacks (3-9%) and sideways consolidation in coming months, but that does not mean we can’t push a bit higher first (despite being “overbought”).” The next day we got a 6% pullback (sooner and deeper than expected – but in line with the outlook)! Taking all factors into consideration, I still think we could see a push higher here in coming weeks before a more meaningful consolidation.

In part because, despite the fact that this will be the best quarter for equities in 20 years, it is still a hated rally. As we covered last week (Drake Article Above), 1 in 5 individuals sold 100% of their equity holdings at the lows, and institutional managers missed the first 35% of the rally before chasing the last 5%. This is historically a good combination to push people back in.

So what could be the catalyst? Perhaps the bank stress tests that come out after the close tonight and again next week (with further detail). Expectations are very low and everyone is fearing dividend cuts. It will not be a high hurdle to beat expectations and show how well capitalized the banks are – even in the worst case COVID scenario (which the Fed acknowledged this week – did not come to bear).

Banks are a critical bellwether – when it comes to recoveries and confidence – coming out of recessions. As go banks, so goes the recovery. We will know a lot more after the closing bell today and next week. Vice Chairman Randy Quarles alluded to the fact (in a recent speech) that banks’ proactive reduction of buybacks this year has already buttressed capital levels. The question the market needs to know now is, “was it enough?” The second question is, “how will the market react?”

I believe the tests will find that bank capital is sufficient and that dividends will be able to be maintained. However, based on the way the group has been trading – even if they did cut the dividend at this point – most would still yield more than the 10yr Treasury and they are still trading at a discount to book. The market has effectively “sold the rumor” and may simply “buy the news” after any bad (or good) news comes out.

We remain very constructive in the intermediate term and will take advantage of any additional buying opportunities in laggard/cyclical names and banks – should they arise over the summer. In the interim, we will hold what we have and shave only in the event we DO hit levels of euphoria that we have not seen since February.

In the meantime, I wish you and the market a “Luke Combs” style happy outcome – from what has been a tough few months’ fight for the country – against this invisible enemy. We will prevail quickly if we all take the necessary actions to win.