The Stealers Wheel classic song “Stuck in the Middle with You,” from 1972, was co-written by the group’s guitarist Gerry Rafferty and keyboard player Joe Egan.

One writer commented (in an obituary for Rafferty) that the song was, “written as a parody of Bob Dylan’s paranoia, it ridiculed a music industry cocktail party,” with the chorus:

“Clowns to the left of me

jokers to the right

here I am, stuck in the middle with you.”

The analogy for today’s stock market being: Clowns (bulls that don’t recognize any risk at all), Jokers (Permabears who have looked only on the negative side), and the “healthy” paranoid that Rafferty was writing about “stuck in the middle with you” – who continue to look at the data and consider both sides (bullish and bearish data) regularly – as the new facts come in.

The catchy pop arrangement struck gold – selling more than a million copies. It later reclaimed fame as a central track in Quentin Tarantino’s 1992 movie Reservoir Dogs.

The Post Chorus elaborates further:

“Well, you started out with nothing

And you’re proud that you’re a self-made man

And your friends, they all come crawling

Slap you on the back and say

Please

Please”

This is a healthy comparison for those who have been long through 2019 and have done exceptionally well, however – in Verse 4, Rafferty warns:

[Verse 4]

“Yeah I don’t know why I came here tonight

I got the feeling that something ain’t right

I’m so scared in case I fall off my chair”

The time to be alert is when everything is going right. Keep checking your thesis and managing your risk. Engage in the healthy “Bob Dylan” paranoia that not only makes you great but keeps you great because you stay on top of the risks versus just coasting.

Listen to Stealers Wheel “Stuck in the Middle with You” here

In our October 24 article, we laid out the “bear case” – aka bricks in the “Wall of Worry” to climb to new highs. We then compared it against the offsetting bullish data:

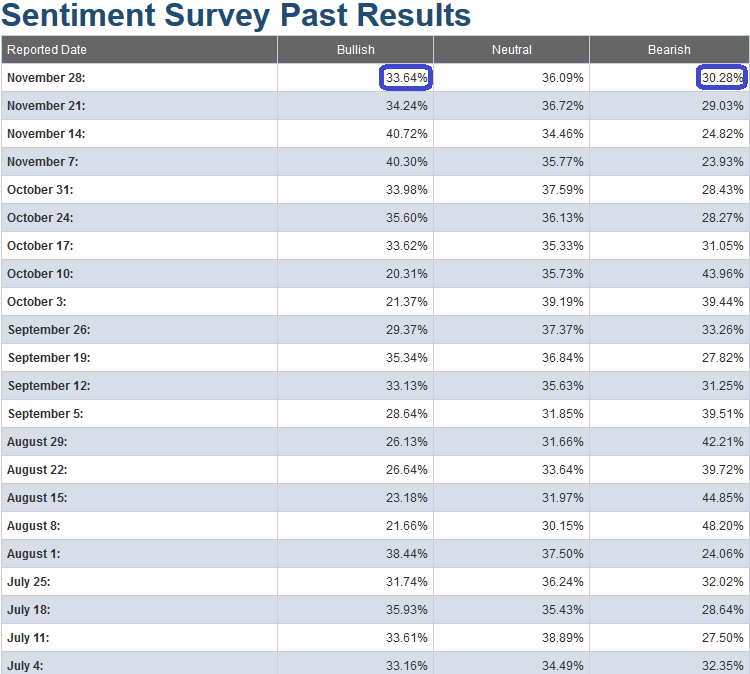

The Kenny Chesney “Everything’s Gonna Be Alright” Stock Market: (AAII Sentiment Survey)

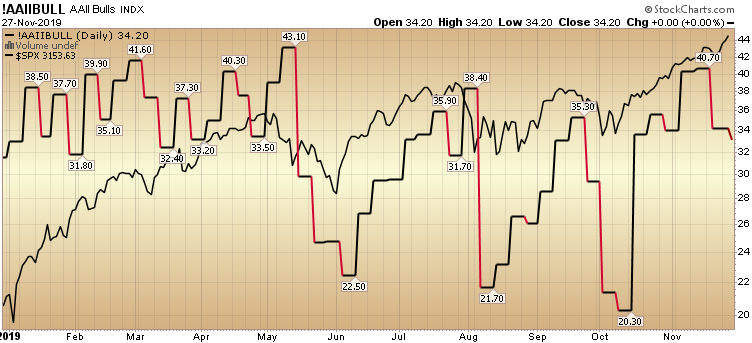

This week’s AAII Sentiment Survey result (Video Explanation) Bullish Percent came in at 33.64%, down from 34.24% last week. Bearish Percent lifted to 30.28% from 29.03% last week. Market participants were in a holding pattern this week.

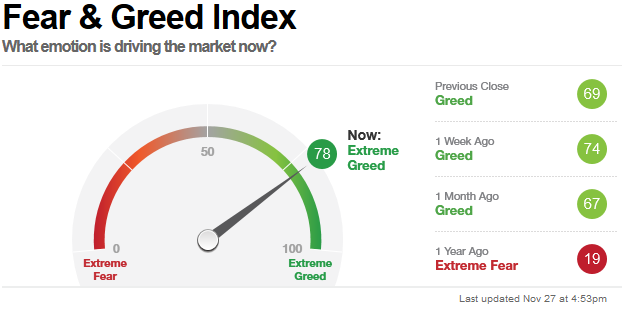

This was inconsistent with the CNN “Fear and Greed” Index – which actually rose 4 points in the past week (from 74 last week to 78 this week).

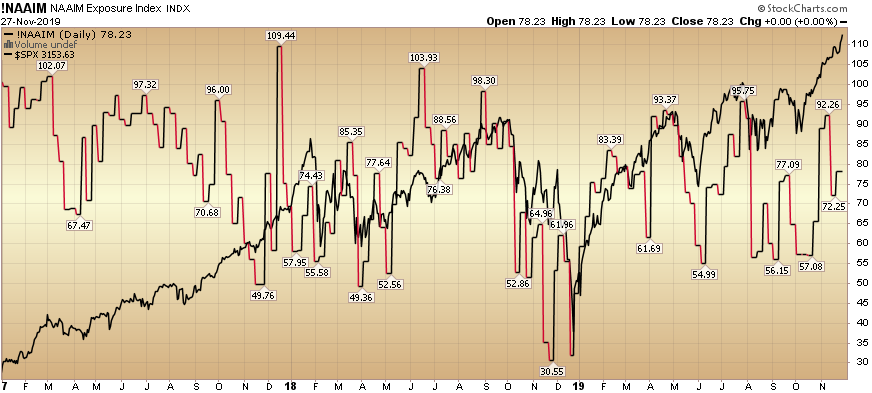

This week the NAAIM (National Association of Active Investment Managers Index) bumped up from 72.25% equity exposure to 78.23%. On last week’s drop (from 92.26 down to 72.25), we noted that “The implication here is that on the next positive “Phase 1” headline, managers will have to doubly scramble to get their exposure up into year-end.” This week’s 6 point bump is a realization of that expectation.

While we have made the case in recent notes that we are bullish intermediate term, we recognized that the short term indicators were “overbought.” This condition could be worked off either in time (sideways grind), or price (short term pullback to shake out the “late money”).

However, we also noted that it is not uncommon to see the short term indicators stay “PINNED” for material amounts of time – particularly when the structure and timing of the market is such that institutions (who were caught offsides) are forced to chase aggressively (similar to Q4 2016 and Q4 2017). To learn more about “PINNING” review this article – which explained the concept in detail:

The Katy Perry “Hot ‘N Cold” Stock Market (and Sentiment Results)

Our antidote to manage the short term risk was to trim some portion of the runners (stocks that have had huge runs off of the August/September lows) while simultaneously and opportunistically adding in those stocks/sectors that money had just begun rotating into.

In September we made the push for Biotech when it was down and out with the political noise. The sector is up 24.32% off the bottom after the article came out:

In late October we made the case for the Exploration and Production Sector over the intermediate term.

Snake OIL? How Portfolio Managers View Exploration & Production Stocks…

While the sector is up just a hair in the few weeks since we wrote the note, we updated the earnings estimates data this week (which points to a 24.59% jump in earnings for the sector in 2020).

Either the price of the sector is wrong (too low), or the estimates are too high. I’m betting on both, and even so – I believe there are prolific pockets of opportunity in the space that will play out in coming months – just as was the case with Biotech when price was subdued due to the political noise of August and September (despite rising estimates):

Exploration & Production Sector (XOP): 24.59% Growth for 2020 (Earnings Estimates)

The sooner the Phase 1 deal with China is inked, the sooner we can count on 2020 Earnings Estimates stabilizing, and possibly increasing in certain pockets (Energy would be a beneficiary) – depending on the magnitude of the deal. We are currently holding strong at 9.9% earnings growth for 2020, but each day that passes without a deal will lead to modest erosion.

On the flip side, no one is expecting the possibility of estimates rising – which is well within the realm of possibility following a Phase 1 completion – as greater visibility yields increased investment and a resumption of “animal spirits.”