Article referenced in podcast above:

Tag: Materials

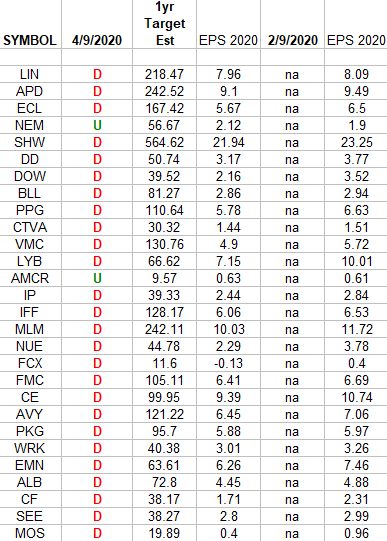

Basic Materials Sector (XLB) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2020 estimates were: 2/9/2020 and today. Continue reading “Basic Materials Sector (XLB) – Earnings Estimates/Revisions”

Be in the know. 15 key reads for Sunday…

- February Expiration Week: S&P 500 Up 12 of Last 14 (Almanac Trader)

- How Mega-Influencer Emily Ratajkowski Turns Obsessive Fans Into A Booming Business (Forbes)

- Top 11 Must See Yachts At The 2020 Miami Yacht Show (Forbes)

- Trump administration eyes 10% middle-class tax cut proposal (Reuters)

- Bloomberg Spent More Than $1 Million On That Barrage Of Instagram Memes (Forbes)

- Chemours Co (NYSE:CC): McIntyre 4Q19 commentary & long thesis (ValueWalk)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Barron’s Picks And Pans: Berkshire Hathaway, Bitcoin, Roku And More ()

- ‘No Time To Die’: Hear Billie Eilish’s New ‘James Bond’ Theme Song and Watch a New Trailer (Men’s Journal)

- 2021 Aston Martin Vantage Roadster Has World’s Fastest Convertible Roof (Maxim)

- Banksy artwork pops up just in time for Valentine’s Day (Mashable)

- Is Trump’s Classical-Architecture Policy Authoritarian? (Manhattan Institute)

- Elon Musk Says He’s About to Deliver the Future of High-Speed Internet (Inc.)

- Coronavirus drug could start production this month: Peter Navarro (Fox Business)

- The Perils of “Survivorship Bias†(Scientific American)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 5

Article referenced in podcast above:

The “‘Great Wall’ of Worry” Stock Market (and Sentiment Results)…

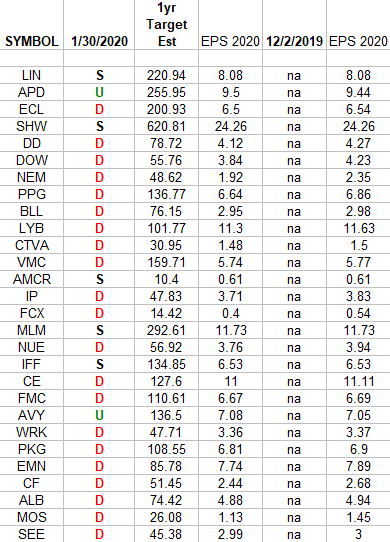

Basic Materials Sector (XLB) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2020 estimates were: 12/2/2019 and today. Continue reading “Basic Materials Sector (XLB) – Earnings Estimates/Revisions”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 13

Article referenced in VideoCast above:

“Are you tired of winning yet?” Stock Market (and Sentiment Results)…

“Are you tired of winning yet?” Stock Market (and Sentiment Results)…

James Branch Cabell, “The optimist claims we live in the best of all possible worlds, and the pessimist fears this is true.”

In many of his campaign rallies, President Trump said, “you’re going to start winning so much that you’re going to beg that I can’t take it anymore!”

Well that was quite a tall order, but regardless of what side of the political spectrum you lie on, Wednesday’s “Phase 1” deal was a big win for the U.S., for China, and the rest of the world. Continue reading ““Are you tired of winning yet?” Stock Market (and Sentiment Results)…”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 11

Article referenced in VideoCast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?

Podcast – Hedge Fund Tips with Tom Hayes – Episode 2

Article referenced in podcast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?

2020 Earnings Estimates: U.S. – DOWN. EUROPE – UP.

Data Source: Factset

2020 Earnings Estimates for the S&P 500 trimmed from 177.77 to 177.64 in the past week. Conversely, the Earnings Estimates for the Euro Stoxx 600 increased by 160bps for 2020 in the past week. Continue reading “2020 Earnings Estimates: U.S. – DOWN. EUROPE – UP.”